Key Points:

- Taking too much risk in retirement can lead to major problems when the market has a severe downturn.

- Not taking enough risk when young means leaving a lot of money on the table.

- Taking appropriate risk plus diversifying is extremely important to any retirement plan.

When times are good we see a lot of people take more risk as they chase returns. When the market has a major downturn we tend to see more people sell stocks and go into cash and bonds. Many times this is closing the barn door after the horses are already out. The best strategy is to make sure you have the appropriate amount of risk and diversification before the markets go up and down.

Taking Too Much Risk

After the 2008/2009 recession and severe market downturn, the stock market rocketed back up as the S&P 500 index increased by over 330% during the next ten years. During this time many investors felt like if they weren’t in stocks, they were certainly missing out. Even many people in retirement and in their 70s were 80% in stocks or more.

To see how taking too much risk can impact a retirement plan I looked at an admittedly extreme example of a 75 year old couple that is 90% in stocks and 10% in bonds. They are already retired and spend $85,000 per year. They have $700,000 in an IRA and a combined $40,000 a year in Social Security benefits.

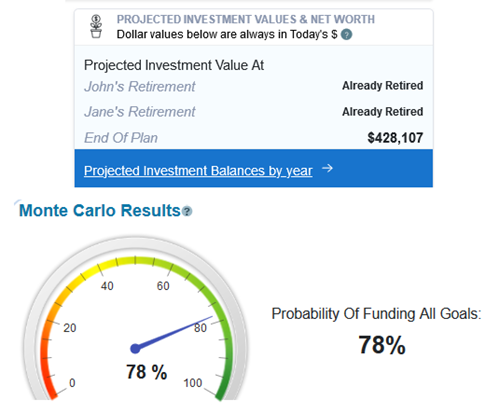

I ran the projections on their plan in the WealthTrace retirement planning software and found that they are projected to have a little over $400,000 at the end of their life expectancy, which is set to 85 years old. Their Monte Carlo probability of never running out of money was 78%.

I also ran some bear market scenarios where we see the stock and bond markets perform like they did during the recessions of 2001 and 2008/2009. The results are below.

| Investment Value At Age 85 ($) | Monte Carlo Probability Of Success |

| Base Case | 362,000 | 78% |

| 2001 Bear Market | 0 | 36% |

| 2008/2009 Bear Market | 0 | 22% |

A severe market downturn would be devastating for this couple. They would run out of money before age 85 and their probability of meeting all of their spending goals plummets. This couple is clearly taking too much stock market risk.

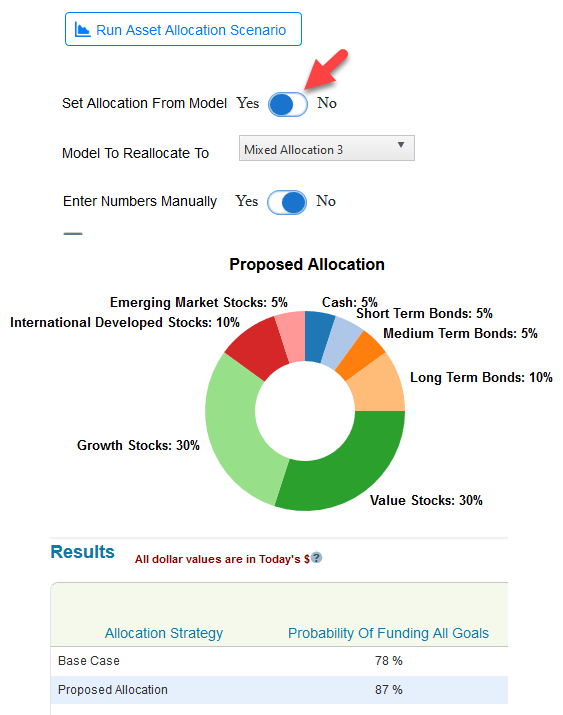

I used the WealthTrace Asset Allocation scenarios section to see how much better off this couple would be with a more diversified and less risky portfolio.

I set their new allocation using a pre-defined model portfolio. This model is 75% in stocks and the rest in bonds and cash. It is also well diversified among several asset classes. As you can see, this helps their plan quite a bit as the Monte Carlo probability increased from 78% to 87%.

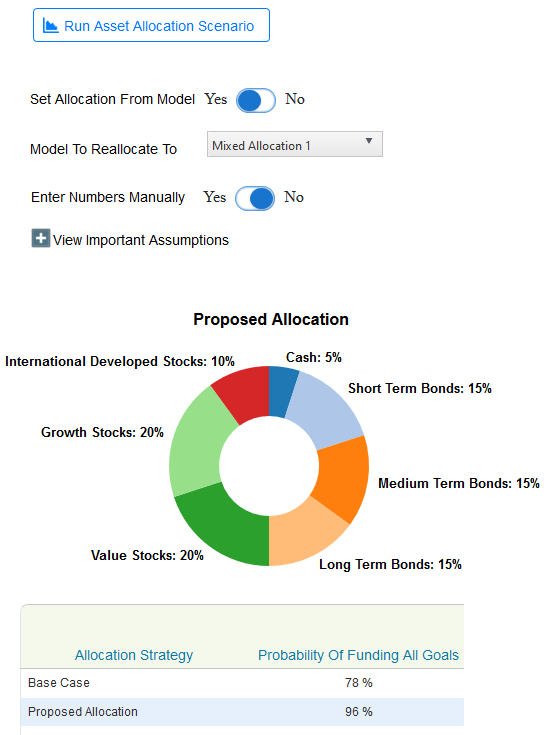

I then changed the model to an even more conservative 50/50 split between stocks and bonds, which is more appropriate for a couple that is 75 years old. The results were even better.

This asset allocation is clearly more optimal for them. They get to take less risk and their chances of running out of money in retirement are only 4%.

Being Too Conservative

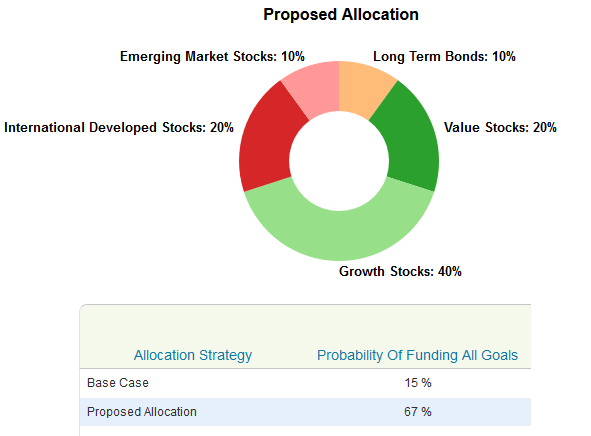

The flip side of taking too much risk when older is being too conservative when young. Again, I will take an extreme example to make my point. Let’s look at a 30 year old couple that is saving a combined $40,000 to 401(k) plans and already has $50,000 saved. They plan on retiring when they are 62 years old and will spend $85,000 a year. They are very risk-averse and are only 20% in stocks while investing 80% in bonds.

I found that this couple is projected to run out of money when they are 80 years old. Their Monte Carlo probability is a paltry 15%. These poor results are undoubtedly due to the fact that they do not have enough money invested in stocks. They have 32 years before they will touch their retirement money. It makes total sense for them to be invested heavily in stocks to reap the higher returns over bonds, which always occurs over a long enough time horizon.

Once again I used the Asset Allocation scenarios section in WealthTrace. I moved them to a 90/10 stock bond split.

This is a very large jump in their probability of plan success and shows the value of taking more risk when you’re younger.

Changing Risk As You Get Older

As we get older we should be reducing our risk level. Target date funds have become wildly popular for retirement portfolios because they automatically reduce the percent in stocks and increase the percent in bonds as the investor gets older.

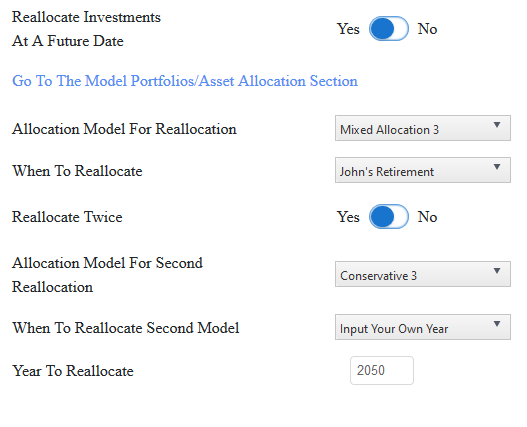

In WealthTrace this can be replicated by reallocating at a certain age. As you can see in the screenshot below, you can reallocate two times in the future.

In this example, they reallocate twice in the future, with the final reallocation being the most conservative portfolio.

In this example, they reallocate twice in the future, with the final reallocation being the most conservative portfolio.

Take Risk Early, Don’t Get Greedy Later

It is so important to save early and take risk early. Let the magic of compounding work for you. But as you get older, a severe market downturn can be disastrous if you are not diversified enough and/or if you are taking too much risk in your retirement portfolio. The easiest way to make sure your level of risk is appropriate is to invest in target date funds in your IRA or 401(k) plan. Let them do the rebalancing and reallocation for you as you get older.