Key Points

- If you don’t take enough risk when you’re young, you might not be able to retire when you want.

- If you take too much risk when you’re older, you can be hurt badly by a serious market downturn.

- Diversification still works and is most important when you’re older.

Most of us know that we should take more investment risk when we’re younger and less investment risk as we get older, especially as we begin to use our retirement investments to pay for expenses. But there are still a lot of people who are nearly 100% in stocks even in retirement.

There are at least two reasons why people are weighted more heavily in stocks than they were, say 20 years ago. First, bond yields are much lower than they were 20 years ago. This is a direct result of Federal Reserve policy where they lowered interest rates in the hopes that more people would move money into the stock market. This policy certainly had its desired effect as the S&P 500 is up nearly 300% since March, 2009.

The large gains in the stock market over the past 10 years have also given people a sense that stocks always do well over a long enough time period, especially after a market collapse like we saw in 2008 and 2009.

The Risks Of Being Too Conservative

It is well known by many investors that the longer the time horizon for investments, the more risk one can and should take. Why is this? There are actually two reasons. First, there is reversion to the mean. It’s similar to weather. Over one week we might see temperatures 10 degrees below normal and rain every day. But over a few months, this rarely happens as both temperature and precipitation begin to move more towards their average values. The same thing applies in shooting percentages in basketball, scores in golf, and in the stock market.

Because of mean reversion for stock returns, pretty much every financial advisor tells their clients to take more risk in their younger years. A 30 year old usually has over 25 to 30 years before he or she will need money from retirement accounts and the U.S. stock market has never underperformed bonds during any 25 year time frame.

To see how important it is to take more risk in the younger years, I ran a retirement plan for a 35 year old couple in our WealthTrace Planner. This couple currently has $50,000 saved to their IRAs and saves $15,000 a year. They will retire at age 65 and spend $70,000 a year in retirement. I set their portfolio up so that they are invested 100% in stocks returning 7% per year until they retire. Once they retire they will move to 50% stocks and 50% bonds.

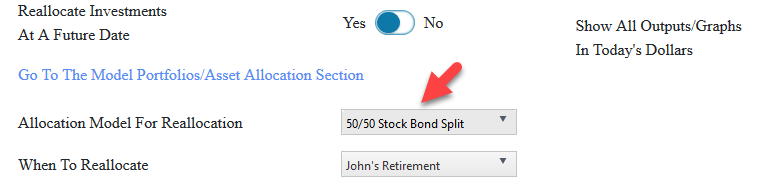

Using WealthTrace you can reallocate to a model portfolio in the future. You can modify and create your own model portfolios.

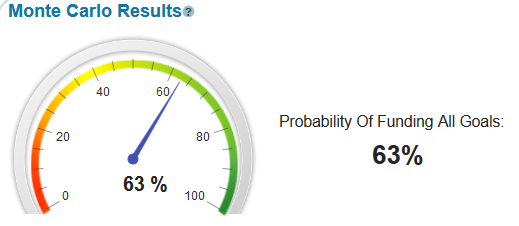

I ran their plan through Monte Carlo analysis and found the following:

This shows that they have an 89% chance of never running out of money in retirement. But what if they are extremely conservative while they are young and invest their retirement money 75% in bonds and only 25% in stocks?

Their chances of not running out of money plummet all the way to 63%. Monte Carlo takes into account mean reversion over time, which is why it shows that it is much better for this couple to take more risk when they are young.

The Risks Of Overweighting Stocks When You’re Older

The flip side of being too conservative when young is taking too much risk when you’re older. I have been surprised by how many people I have seen invested 90% or more in stocks when they’re in their 60s. Let’s take a look at just such a scenario.

I set up a plan for a couple that is 65 years old and spends $75,000 a year in retirement. They currently have $600,000 in their IRAs, all invested in stocks. Their life expectancy is set to age 85.

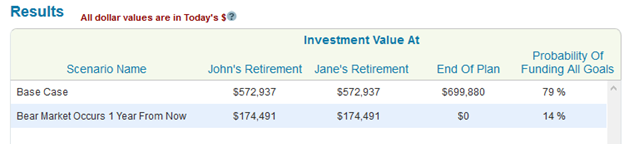

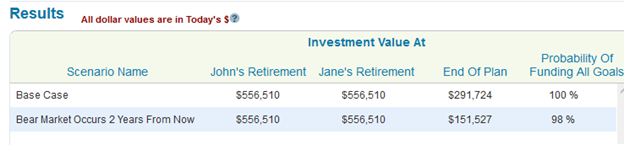

I ran Monte Carlo analysis and our Bear Market what-if scenario for this couple. The results are below:

Their chances of never running out of money are 79% in the base case. If we see a bear market in stocks like we had in 2008/2009, their probability of never running out of money drops all the way to 14%.

Their chances of never running out of money are 79% in the base case. If we see a bear market in stocks like we had in 2008/2009, their probability of never running out of money drops all the way to 14%.

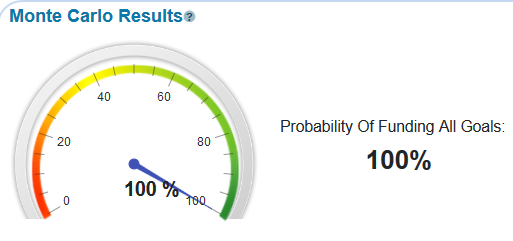

Now what if we move them to a more conservative 50/50 mix between stocks and bonds?

Their Monte Carlo probability goes up all the way to 100%. I admit I was a bit surprised it went up that much, but it does show the value of diversification when you’re older. Possibly even more valuable is the Bear Market scenario result. When they were invested only in stocks, they had only a 14% chance of not running out of money. By simply moving to a 50/50 split between stocks and bonds, their chances of not running out of money are still a very solid 98% even if a serious bear market hits.

Keep Track Of Your Asset Allocation

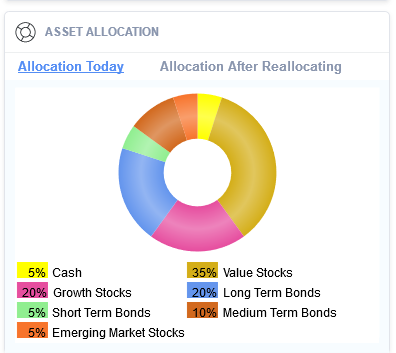

It is important to know what your overall asset allocation is using all of your investments combined. Using WealthTrace you can always view you updated asset allocation every day.

One great way to ensure you are not taking too much risk in your retirement accounts is to utilize target date funds, which rebalance automatically based on your age and when you plan to retire. If you do not have access to these types of funds, you should check on your asset allocation at least quarterly. If you’re younger you want to make sure you do not let too much build up in bonds and you basically shouldn’t have any money in cash in your retirement portfolio. If you’re retired you should check your stock vs. bond allocations as stock balances will increase more over time due to their higher returns.

Do you want to see how your investments and retirement plan would hold up under various scenarios? Sign up for a free trial of WealthTrace to find out.