Key Points:

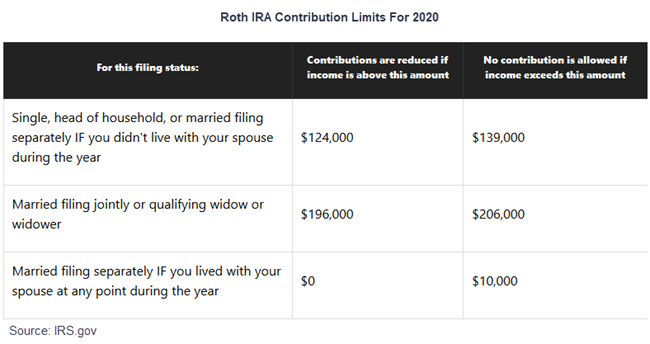

- If your income is too high, you cannot directly contribute to a Roth IRA.

- A backdoor Roth IRA contribution can save you thousands of dollars over time vs. saving to a regular taxable account.

- Watch out for the pro rata rule. It can greatly reduce the benefit of a backdoor Roth IRA contribution.

For those who make above a certain level of income, contributing to a Roth IRA directly is not an option due to income limits on who can contribute.

For those who bump up against this limit on Roth IRA contributions, there is an indirect way to contribute. This is called a backdoor Roth IRA contribution.

For those who bump up against this limit on Roth IRA contributions, there is an indirect way to contribute. This is called a backdoor Roth IRA contribution.

A backdoor Roth IRA is completely legal and most online brokers have systems set up to handle it. There is also no income restriction on this strategy. Here is how it works: Basically, you contribute money to a traditional IRA and then immediately convert it to a Roth IRA. The money in the Roth now gets to grow tax-free and when you withdraw the money in retirement, you won’t pay any taxes at all on the withdrawal.

How Big Is The Benefit?

To get a feel for how big the monetary benefit one might get from a backdoor Roth IRA is, I put together a sample plan in the WealthTrace Financial & Retirement Planner. I set up a plan for a 50 year old couple that makes a combined $250,000 a year. Due to their income, they are not eligible for a Roth IRA contribution. They also both have a 401(k) plan at work, so they are not eligible for a traditional IRA contribution either. They have no money at all in non-Roth IRAs, which is important as I will discuss later.

This is a good example of a couple that will benefit from a backdoor Roth IRA. They are currently maxing out their 401(k) contributions, which is the smart move in terms of how to save for retirement. But they have an extra $15,000 they are saving into a taxable brokerage account.

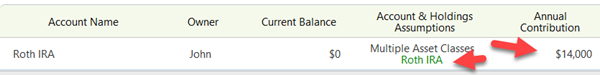

The good news for this couple is that they can use $14,000 of that $15,000 in extra savings for a backdoor Roth IRA contribution. Each spouse can contribute $7,000 in 2020 to the Roth IRA (they get $1,000 in catch-up contributions since they are 50 years old).

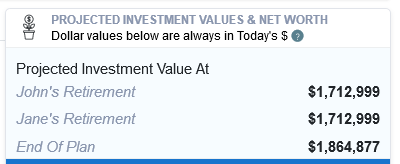

Currently they are saving the $15,000 into a taxable brokerage account that is 80% in an S&P 500 index fund and 20% in a Treasury bond index fund. They have $400,000 saved in their 401(k) plans and they want to retire when they are 67 years old. Their plan is to spend $80,000 a year in retirement. Their projected investment values at retirement and at the end of their life expectancy are below:

Now what if they took $14,000 of their annual taxable savings and instead used a backdoor Roth IRA?

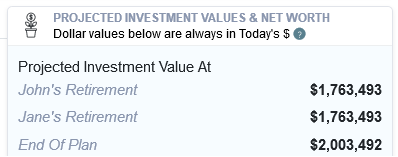

The results for this scenario are below:

This couple would have about $60,000 more at retirement and nearly $150,000 more at the end of their life expectancy by simply changing from saving to their taxable account to using a backdoor Roth IRA account.

The Pro Rata Rule

There is one potential major sticking point for a lot of people who have traditional, SEP, or rollover IRAs. This is the pro rata rule. This rule requires you to add up all of your non-Roth IRAs when calculating how much tax you might owe on the conversion.

In the previous example, if you had no money in an IRA, you would owe no taxes on the backdoor Roth conversion. But, if you have, say, $50,000 in a rollover IRA, you would indeed owe taxes on the conversion. This is because of the pro rata rule where the IRS looks at your rollover as coming partly from the new contribution, which is from post-tax dollars, and the current IRA, which is all pre-tax dollars.

In the example where the couple put $14,000 in to the Roth IRA, the amount of that contribution that would be deemed a taxable rollover event would be 50,000/(50,000+14,000) = 78%. So 78% of their backdoor Roth contribution would be taxable at their income tax rate. In effect, 78% of their contribution is a regular Roth IRA conversion. This severely limits the benefit of the backdoor Roth strategy for them.

Prepare For Retirement Early

Don’t be surprised if strategies like the backdoor Roth IRA are curtailed in the future. We already saw changes to inherited IRA rules last year that caught most people by surprise. The best way to prepare for retirement is to save early and often to a 401(k) plan or IRA. Maintain a diversified portfolio, take more risk when you’re young, and reallocate to less risk as you get older. Also, don’t overpay for mutual funds and Exchange Traded Funds (ETFs). These tried and true methods have worked for millions of people and they can work for you as well.