Key Points:

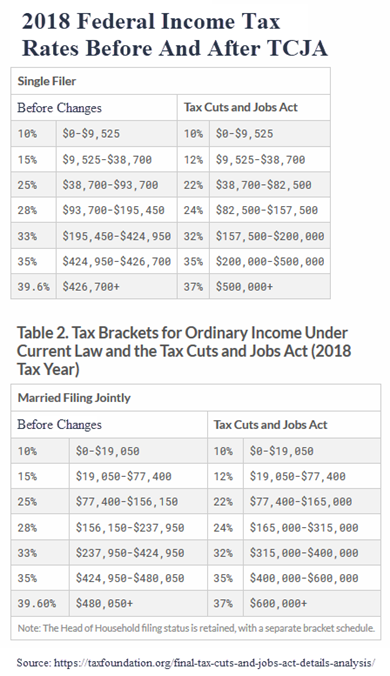

- At the end of 2025, federal income tax rates are scheduled to go back to where they were before the Tax Cuts and Jobs Act (TCJA) of 2017.

- Many expect Congress to extend the tax cuts, at least for lower brackets, but nothing is guaranteed.

- If tax rates are set to increase, Roth IRA conversions today would make more sense for many people.

The sweeping tax law enacted in December, 2017 made several major changes to the federal income tax code. The biggest change was a decrease in income tax rates for most tax brackets. But there were several other changes as well, including a doubling of the standard deduction, elimination of the personal exemption, a doubling of the child tax credit, a limit on local and state tax deductions, and a 20% tax deduction on pass-through income for many small businesses.

All of the changes listed above will expire on or before January 1str, 2026 unless Congress moves to extend them. Add this to the list of things that people planning for retirement cannot predict with any degree of certainty. Many of us already have to run what-if scenarios on the possibility of Social Security benefits being cut in the future. Now we need to run federal tax what-if scenarios as well.

What Happens If All Federal Tax Rates Revert Back

Let’s start with the extreme example of all tax rates going back to where they were before the tax law changes. I created a retirement plan for a couple that is 50 years old. They plan on retiring at age 60. Currently they have $1 million in 401(k) plans, $300,000 in taxable investment accounts, and their income is a combined $200,000 a year. They save a combined $20,000 a year into their 401(k) plans. In retirement they project they will spend $70,000 per year.

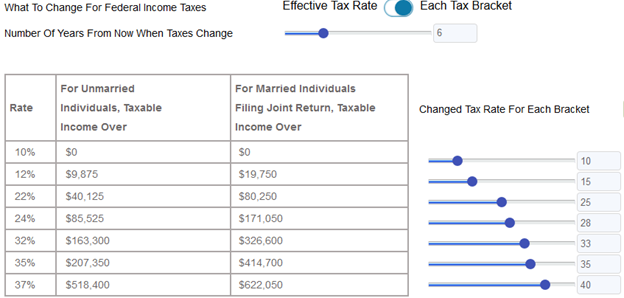

Using the WealthTrace Financial & Retirement Planner I ran a scenario where federal income tax rates go back to where they were in 2017. Note that because the tax bracket ranges changed a bit, the tax scenarios run here do not exactly match the tax code of 2017. But it’s very close and will give us an idea of the impact we should expect to see.

I also reverted back the doubling of the standard deduction and reinstated the personal exemption amount. For this couple, this means their deductions decline by about $4,000.

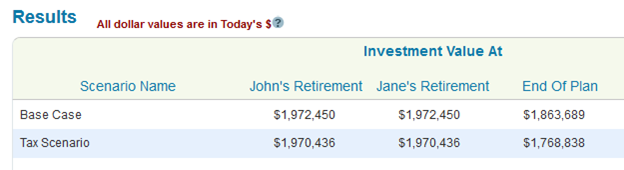

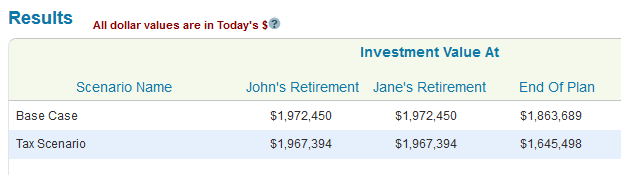

The results from this scenario are below:

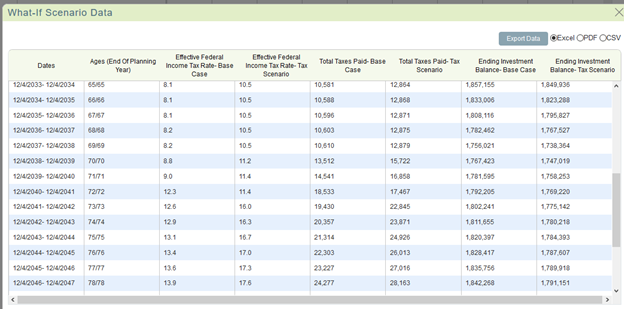

You can also compare projected tax rates and investment balances from the base case and the tax scenario through time.

For this couple, the tax hit is about $95,000 over their lifetime. Most of the increased tax bite for them comes from the taxes on their Required Minimum Distributions (RMDs) after they turn 70 ½.

The change for them certainly isn’t devastating. Their Monte Carlo probability of funding all of their goals only dropped from 96% to 95%.

Taxes Could Go Even Higher

With elections looming in 2020, we are seeing promises to raise taxes even higher than they were before the recent tax law changes. In addition to a potential wealth tax, some presidential candidates want to increase the top marginal tax rate to 50% or more. Bernie Sanders has a plan to increase income taxes for nearly every bracket while increasing the top tax rate to 54.2%. The brackets would change, but most people that currently pay federal income taxes would see a tax increase.

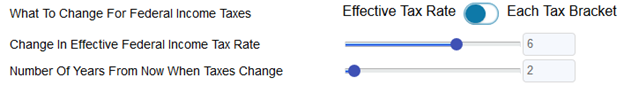

I modeled this as best I could and estimated that this couple’s average effective federal income tax rate would increase by about 6% under the Sanders plan.

The Sanders tax plan would knock over $200,000 from their ending wealth and it reduces their probability of success to 93%. For wealthier individuals, the increased tax bite would be even more severe.

Roth IRA Conversions Could Make More Sense

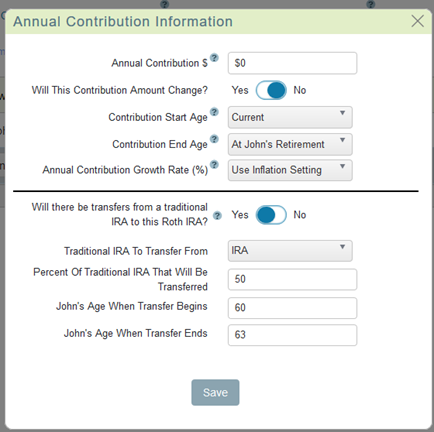

Let’s say we have a couple that is convinced that taxes are going up soon. In fact, they believe that their effective federal income tax rate will indeed rise by 6% four years from now. This means their RMDs in retirement will be taxed much more heavily than they initially expected. It also means a Roth IRA conversion might make more sense for them.

This couple has the same parameters as the previous couple except they are currently 60 years old and already retired. Instead of having 401(k) plans, they have traditional IRAs. I looked at their plan where they convert half of their traditional IRA to a Roth IRA. They do this in their low tax years from age 60 to 63 before the new tax law goes into effect. The key is to convert the IRAs before any taxes increase due to tax law changes. In this example I assume taxes increase in four years.

With the Roth conversion, their ending wealth in the higher tax scenario decreases by about $85,000. If they don’t do the Roth conversion, their ending wealth goes down by about $150,000 due to higher taxes.

If there is no change in the federal tax code, I found that the Roth conversion only helps them by about $7,000 overall. So the future change in taxes means that a Roth conversion today for this couple makes much more sense. This is because they can pay taxes now at the much lower federal income tax rate compared to how much they will pay later when RMDs kick in and their tax rates are much higher due to the change in the tax code.

Prepare As Best You Can

It is frustrating to not know what our tax rates will be in the future because it makes retirement planning that much more difficult. But at least we can run some what-if scenarios to see the best way to prepare for potentially higher taxes later on. For those who are convinced tax rates will go up in the future, a Roth IRA conversion could make more sense than ever.

Do you want to see how your investments and retirement plan would hold up under a variety of what-if tax scenarios? Sign up for a free trial of WealthTrace to find out.