Key Points:

- The age to take Required Minimum Distributions (RMDs) would go up to 72 from 70 ½.

- The maximum age for IRA contributions would be completely repealed.

- There would be more uses for 529 plans.

Believe it or not, we might have a bipartisan bill pass through Congress that would likely signed by the president. This one involves saving for retirement. It is becoming widely recognized that most people are not prepared to retire at a reasonable age. In fact, many people in this country will have to work pretty much their entire lives.

There are two main reasons why we are in what has been referred to as a retirement crisis. One is simply that people have not saved enough money for retirement. If we only include people who have anything saved for retirement, the median retirement savings for the age bracket of 55-64 is $120,000. If we include people who have nothing at all saved, the median savings is an astonishingly low $17,000.

The other problem many people are having when it comes to planning for retirement is too much debt. The main culprit for the large increase in debt over the past twenty years is student loans. In the United States, people older than 50 now owe more than $250 billion in student loan debt. This is up from only $36 billion just 14 years ago. The main problem with student loan debt is that it cannot be discharged in bankruptcy, unlike any other type of debt. So most people are stuck with the loan payments forever. And if a borrower simply stops paying the debt, the federal government can take it out of his or her tax refunds and Social Security benefits.

What The New Bill Includes

While this retirement bill does not address the biggest issues with debt, it does address some of the issues with saving for retirement as well as the impact of Required Minimum Distributions (RMDs). This bill includes:

- A variety of changes which would encourage small businesses to give private retirement benefits to their employees.

- Changes that allow small businesses to group together to offer 401(k) plans.

- Creation of a tax credit for companies that set up 401(k) plans where employees are automatically enrolled.

- The maximum age for IRA contributions (currently at 70 ½) would be eliminated completely.

- Quite possibly the biggest change: The age where Required Minimum Distributions (RMDs) begin would be increased from 70 ½ to 72.

- 529 plans could be tapped for home schooling and to help pay off student loans.

IRA Contributions

Some might think that eliminating the maximum age for IRA contributions won’t matter much since RMDs would kick in at age 72 anyway. I confess that I’m not sure if this would have much of an impact, so I put together a case study retirement plan in the WealthTrace Financial & Retirement Planner.

I looked at a couple that is currently 60 years old. They have $200,000 saved in their taxable brokerage account, with half in treasury bonds and half in an S&P 500 index fund. They also have $1 million saved in an IRA with the same asset allocation. They plan on retiring at age 65 and they will spend $75,000 per year in retirement.

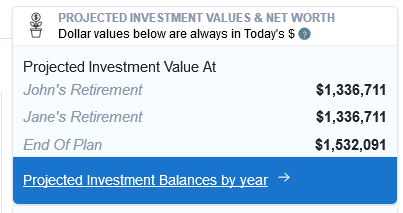

If this new law passes, they will be able to move $7,000 each year from their taxable account into their IRA and receive a tax deduction for it. The question is, will this even help them? I first ran their plan where they move money into an IRA until age 70 ½. Their results are below.

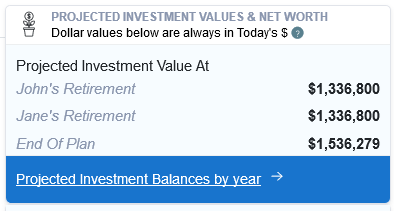

This couple will have about $1.4 million at the end of their life expectancy. So what happens if they can now contribute to their IRA forever? In this example, I have them moving money from their taxable account to their IRA until they are 85.

As you can see, they are barely better off with this strategy of moving money to their IRA each year. Why? Because their RMDs kick in at age 72 and they have to pay their full federal and state income tax rates on the entire withdrawal, not just the gains. This change for IRAs likely only benefits those who plan on working through their 70s and are currently in a higher tax bracket than they will be once they finally stop working.

Required Minimum Distribution Age

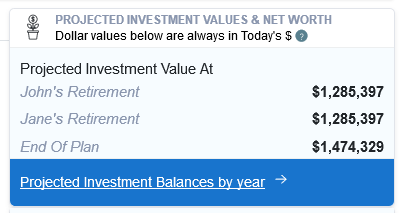

I believe this will have the biggest impact on retirement plans. By pushing out the age where RMDs begin, retirees should see their IRAs and 401(k) plans last longer. To test this, I used the same couple in my previous example. I first ran their plan where RMDs begin at age 70 ½, which is the current law.

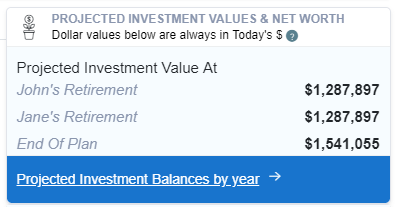

I then moved the RMD start age to age 72.

No surprise, the amount they have left at the end of their plan increased. This is of course due to the fact that they get to defer taxes on the RMDs for another year and a half.

Congress Won’t Save Retirees

Although some of the changes in this new bill are helpful, they don’t even come close to solving the problem of not enough savings and too much debt for over half the country. These are major, systemic problems that won’t be solved easily. The solutions to these issues are best left for another time and probably another place where political discussions make more sense. Regardless, the tried and true methods of “save early and often” and staying out of debt are still the best ways to ensure a stress-free retirement.