Key Points

- Case studies are usually pretty specific, but can be a starting point to see if you're on the right track to retire if you have $4 million saved.

- There are many factors that affect everyone's retirement plans, but inflation is suddenly near the top of the list, and needs to be reckoned with.

- Varying multiple factors in a plan using financial planning software for retirement can give you a sense of what the high-impact points are.

Is $4 million enough to retire? It depends on many factors that we will discuss. No two retirement plans are alike, but case studies can still be very powerful. We run our case studies in Wealthtrace’s financial planning software for consumers. You can sign up for a free trial and run your own retirement projections just like we did here. We have run through quite a few case studies before, including for couples retiring on $1 million, $2 million, and $3 million.

Is $4 Million Enough to Retire With at Age 60?

This time around we'll use for our case study a 59-year-old couple looking to retire at age 60. They have asked the question, can I retire with $4 million comfortably?

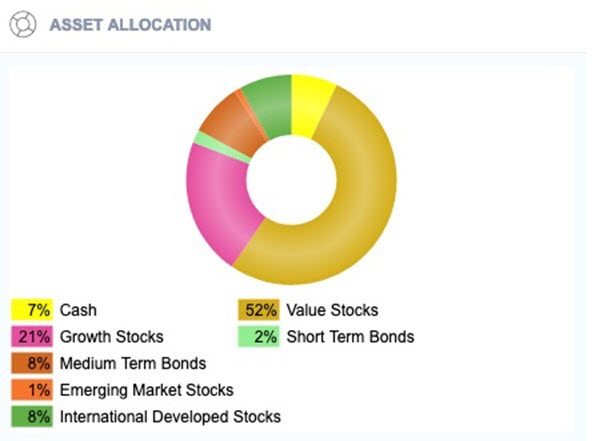

Their investment assets are well diversified across various stock types. They have a bit of cash, but very little in bonds--only about 10%. Their base-case spending-in-retirement figure is $100,000 annually, with additional annual expenses peppering the plan here and there: An unexpected expense of $5K every other year, $15K of Affordable Care Act insurance expenses between now and when they turn 65, $10K of Medicare supplemental after that, and $10K in annual mortgage payments for the next five years.

Their base-case total return estimate of 4.5% is very low, especially given their exposure to equities. There are a couple of reasons for this. First, they understandably want to be conservative in their estimates. Second, they have broken the dividend component out of their total return estimates and put it under Additional Cash Inflows, leaving interest and capital gains as the remaining total return components. Normally, dividends would be included in total return estimates, so once they're removed, the figure drops.

The couple is confident that their value stock investments will generate consistent dividends, and that those dividends will grow just a bit faster than inflation. So why break those dividends out of total returns? In this case, the couple plans to cover a lot of their living expenses in retirement using dividends. Separating them like this allows the couple to more easily make changes to the projected dollar amount of the dividends, or the growth rate of the dividends, in testing out some what-ifs. WealthTrace can easily handle this for them.

We may start to see inflation ease, but of course there's no guarantee of that. So we'll spend some time on that piece of this plan. Inflation is enemy number one for retirees, reducing purchasing power. Modeling persistently high inflation is important for anybody looking at retiring soon and it can have a big impact on whether or not a couple can retire with $4 million.

Retirement Projections: Retire with $4 Million

Here's what their assets look like currently.

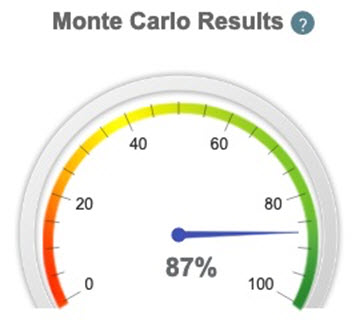

That's a pretty stock-heavy allocation for people headed toward retirement. Even so, their Monte Carlo retirement simulation results, which shows the probability of never running out money, look pretty good:

WealthTrace's financial planning software for individuals gives accurate Monte Carlo results.

This Monte Carlo result is pretty good considering they have more than 30 years to go and their average annual return assumption is so low. The amount they've been able to save, plus their estimated dividend income, are what's mainly keeping them afloat here.

You can also see various probabilities of success for this couple given a variety of annual spending amounts below.

| Annual Living Expenses | Probability of Never

Running out of Money |

| $80,000 | 100% |

| $90,000 | 93% |

| $100,000 | 87% |

| $110,000 | 82% |

| $120,000 | 75% |

| $130,000 | 65% |

| $140,000 | 56% |

| $150,000 | 44% |

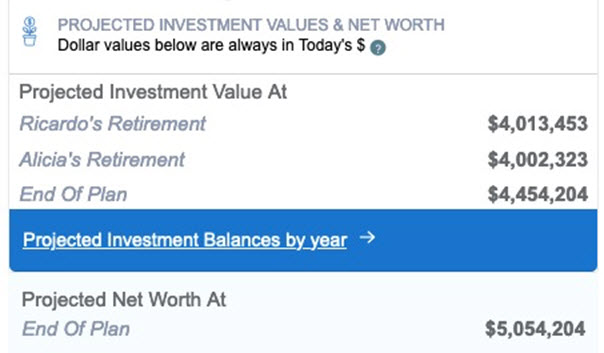

And on a straight-line basis assuming year-in, year-out returns with no bumps along the way, everything looks great. In fact, by that measure, the value of their investments actually inches up over time.

Projected results using WealthTrace's financial planning software for retirement.

Projected results using WealthTrace's financial planning software for retirement.

Poking Holes and Pulling Levers

But we can't just take those things as gospel. The stakes are too high. We need to do our best to poke some holes in the plan, or at least see what changes to inputs will do to the outputs. We'll vary not just inflation but living expenses, total returns, and retirement age. Plus, we'll throw a bad bear market at them and see what happens.

| Retirement Age | Living Expenses | Annual Return | Inflation | Other Changes | Probability of Success |

| 60 (both) | $100,000 | 4.5% | 2.25% | N/A | 90% |

| 60 (both) | $100,000 | 6% | 2.25% | | 95% |

| 60 (both) | $90,000 | 4.5% | 2.25% | | 94% |

| 60 (both) | $100,000 | 4.5% | 2.25% | 2001-style bear market in 2 years | 76% |

| 60 (both) | $100,000 | 4.5%, then 3% in 5 years | 2.25% | Reallocate to 60% bonds/40% stocks in 5 years | 96% |

| 60 (both) | $100,000 | 4.5% | 3.5% | | 77% |

| 63 (both) | $100,000 | 4.5% | 2.25% | | 92% |

This table shows what happens when we start pulling some levers, with changes to the base case highlighted in red and/or appearing in the "Other Changes" column. Boosting their annual return figure to a reasonable 6% annually has a very positive effect, as does increasing their retirement age. Reallocating to a big slug of bonds in five years, which reduces the total return estimate by about 30%, somewhat paradoxically increases the probability of the success of the plan. That's because the potential volatility of the returns drops substantially.

But let's look at what a couple of adverse effects do to the plan. First up: A bear market like what we had in 2001. That crushes the plan, due largely to their big allocation in stocks--making the case for that reallocation mentioned in the previous paragraph.

Just as bad is bumping inflation up to 3.5%. We've already used an above-target rate of 2.25% as our base case. The Federal Open Market Committee's target is 2%, and we haven't been near that in quite a while. Regardless, this case study shows pretty clearly how bad inflation can be for a retirement plan.

How to Retire on $4 Million Without Stress

There's more we could do, too, like changing two or more factors in the plan at once. If we wanted to see that probability number at 100%, for example, we might push their retirement out a few years and increase their annual return number. (Actually, we ran that, with retirement pushed out to 63, and it put them at a very comfortable 96% probability of plan success.)

Lessons Learned

In this case study, it's pretty clear that inflation is a big wildcard, and that guaranteed--or close to guaranteed--income streams like their dividends are tough to beat. Also, a bear market can really do a number on a portfolio that's top-heavy with stocks. Do all of those factors apply to you? Some probably do more than others, but all are worth having a close look at.

Do you know want to know if you can retire stress-free with $4 million? Sign up for a free trial of WealthTrace and use our financial planning software for retirement to find out if your retirement plans are on track.