Key Points:

- Market volatility isn't all bad, especially if retirement is a long way off.

- If retirement is near or if you're already retired, the less of it, the better.

- There are ways to protect your portfolio against the effects of big market swings.

What can you do to protect your retirement plan from market volatility?

We have written before about volatility, specifically having to do with what a bear market could do to a retirement plan. This time, we're taking a different tack: exploring ways to diversify a portfolio such that market swings won't affect it quite as much.

First things first, though. As a recent post suggests, if you've got a 30-or-so-year time horizon until retirement, this column probably isn't for you. In your case, stock market volatility is your friend. You're likely going to be a net buyer of stocks over that time period. That means you want lower stock prices. Further, if you want to build wealth, it is far more likely (based partially on 100+ years of market history, but also on common sense) that you'll want to be invested almost entirely in equities than in any other asset class. So even if a lot of near-term projections indicate stocks won't do nearly as well as they have recently, just stay the course. It will probably work to your advantage.

For those at or near retirement, however, the story is quite different.

Sequence Of Returns Can Matter

A big part of the reason for the difference has to do with sequence of asset class returns in retirement. Sequence-of-returns risk, for the purposes of this discussion, refers to the risk of low or (especially) negative returns early in retirement. You can read more about it here (warning: math ahead!), but to take an extreme and simple example, say you retire with a 30-year time horizon. You plan on about a 3% withdrawal rate from your equity-heavy portfolio. If a 2008- or 1973-style bear market hits early on in your plan, you could be in trouble: Your portfolio might drop 50% in value right when you're starting to take money out of it. If such an event were to happen later in retirement, the chances of it sending you out in search of a paycheck again would be much smaller.

That's sequence-of-returns risk. We can run 20-, 30-, or 40-year market-return simulations, but those long-term numbers won't mean much if in real life you happen to be one of the unlucky investors caught in a market downdraft at the beginning of the simulation.

What Can Be Done?

The first job of a retirement plan is to not run out of money. It is the single most important thing. So how do we make that happen?

Use the right tools for the job. You've probably heard of Monte Carlo simulations. Some people don't like Monte Carlo because it mostly relies on the past just as so many other tools we use to forecast the future. We understand that concern, but we still like it as one of the tools in the toolbox. Using Monte Carlo along with other retirement planning scenarios helps present a fully comprehensive look at retirement.

We particularly like it if we use it with a Laplace distribution. You can read about Laplace here (warning: even more math ahead!). In a nutshell, Laplace handles the simulation of extreme market moves better than a normal returns distribution. And, in recent years, we have had more extreme moves than we would expect from a normal distribution.

The article linked to above says it best in making the case that what was once a normal return distribution no longer is:

In the last 67 years, the S&P has had two days with returns between +5.5% and +5.6%. The normal distribution estimates the probability of one event of that magnitude as 0.0001 in 67 years--in other words, we should expect a move near +5.5% once in 670,000 years on average--and in reality, we’ve had two of them in 67 years! From a risk analysis standpoint, this is analogous to building your house above the 670,000-year flood line and being flooded out twice in the last 67 years.

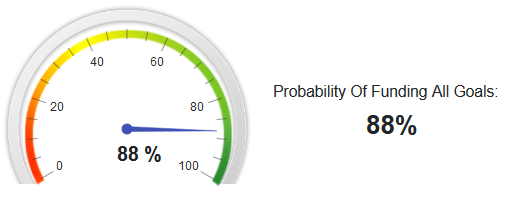

To get a sense of the difference when running Monte Carlo using a normal distribution vs. Laplace, I took a 55 year old couple with $600,000 invested, all in IRAs. They are 60% in value stocks and 40% in medium term treasury bonds. When I used a normal distribution I found an 88% that they never run out of money.

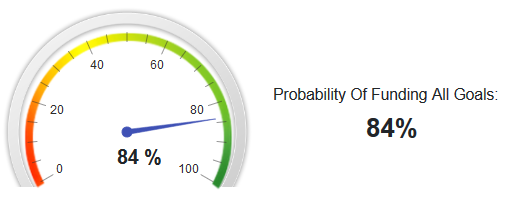

I then switched to the Laplace distribution and the probability of plan success dropped to 84%.

This is not surprising given that higher volatility or higher probabilities of extreme events almost always lower the Monte Carlo value.

Dividends, year in and year out. Longtime readers will know our stance on dividend-paying stocks: Own them, especially in retirement. If you pick a diversified bunch of them (and you can do so fairly easily), extreme market events won't matter as much to you. That's because many dividend-paying stocks will keep up with their payouts regardless of what happens to their stocks; some have increased dividends annually for 40 consecutive years or more.

Yes, companies can falter or fail, and stocks can even go to zero, but a diversified portfolio of dividend payers can largely protect against that.

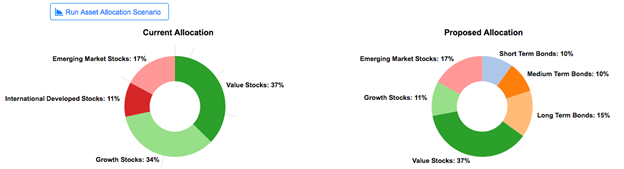

Some diversification required. We're not necessarily fans of the own-your-age-in-bonds rule. The proper percentage in any asset class is going to depend on a person's risk tolerance and other factors. But putting some portion into bonds is probably a good idea.

WealthTrace can show you what a change in asset classes might mean for the probability of success of a plan.

This goes back to the sequence-of-returns risk issue above. It's worth considering what happens to bonds (or what has happened to bonds) when the stock market goes south. (In short: They might go down a bit, or they might even increase in value, but they likely won't suffer the same losses that stocks do, giving you some downside protection.)

Then it becomes a matter of striking a balance based on your risk tolerance and calculations of what you need to live on in case of a big downturn. You might sacrifice peace of mind being exclusively (or almost exclusively) in stocks. On the other hand, you will almost surely sacrifice growth in your assets' value over time by putting a portion of those assets in fixed income investments.

Start With Knowledge

Market volatility might hide for a while, but it always returns in some form. Shielding yourself from it in (or as you head into) retirement, at least to some degree, starts with knowing what you own, and knowing how modifying what you own could help

Are you optimally invested for retirement? Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.