Key Points

- Phased retirement--rather than traditional, stop-work-entirely-at-a-certain-date retirement--is a common way to ease into retirement.

- FIRE (Financial Independence, Retire Early) is arguably a phased retirement under another name.

- Whatever you want to call it, there are certain elements of a plan to think about at each phase.

Different Types Of Retirement

FIRE (Financial Independence, Retire Early) is all the rage these days. We've written about it a few times ourselves. As with most trends, FIRE has garnered something of a backlash, or at least a bit of pushback. Could bailing on full-time employment if you might have 50 or more years to live be a bad idea? Say it can't be so!

We'd like to issue a reminder that a phased retirement, which includes some part-time work for a period of time, is still a possibility for a lot of people, and probably makes more sense than FIRE for, well, nearly everyone.

And anyway, FIRE basically is phased retirement for a lot of its practitioners once you look closely. One spouse might still work full time while the other works part time, for example. Or both of them might work part time, and plan to indefinitely. If things go well (with the stock market, with ad sales and commissions generated by the inevitable referral links on their web sites), maybe one of them will stop working entirely. And then once the kids are out of the house, maybe both of them will be really retired in the more traditional sense of the word.

Phases Of Retirement

Whether you plan to retire early or ease into retirement some other way, setting up a successful phased retirement requires some careful consideration of a number of factors. Here are some things to think about in the various stages of a typical phased retirement.

Phase one: One person goes part time, while the other stays full time. Once one person goes part time, salary income will of course drop (unless that "side hustle" you've been dreaming about really takes off).

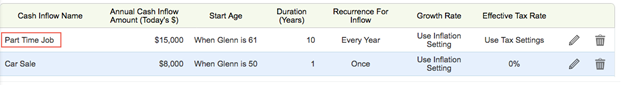

What will your part-time income look like? How long do you expect to work part time? WealthTrace will help you see what effect part-time work will have on your plan.

Possibly some expenses will go down. For example, if the formerly full-time person had a long commute previously, fuel and auto maintenance costs might be less than before.

But by and large, expenses will probably stay the same even as income declines, and any family considering this path will want to keep that in mind.

Phase two: Both people are part time. This might be the most critical phase of all. The obvious part is that salary income will be down substantially from where it was before, and you might need to replace if from some other source. But there's a lot more to consider than just that.

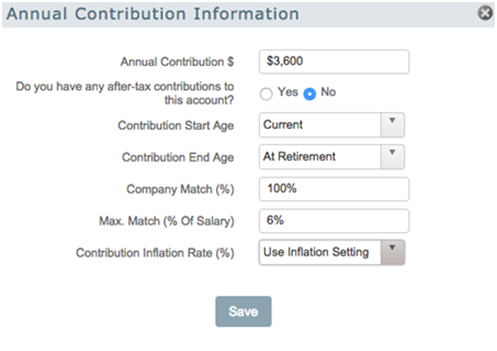

First, those automatic contributions to 401(k)s that you have been dutifully maxing out contributions to (right?), along with the free money the employer gives you as a match, will go away.

WealthTrace can help you model your 401(k) contributions, including the employer's matching contributions--and what will happen when those stop. Learn more.

You will want to consider how to replace those savings (or even if you will be able to). You won't be able to get the matching employer contributions anymore, of course. But if you have maxed out your tax-deferred IRA contributions (which top out at a far lower amount than 401(k) account maximums), can you bump up your contributions elsewhere? Is there a 529 plan that could be further funded, or maybe a health savings account? There are ways to squirrel away money on a tax-deferred basis, and you'll want to get to know them.

Arguably the biggest wildcard of all for retirees, health care costs, will also suddenly loom large at this stage (because the remaining spouse that had employer-sponsored health insurance no longer will). Figuring out what Affordable Care Act subsidies your family might qualify for will be critical to coming up with an estimate.

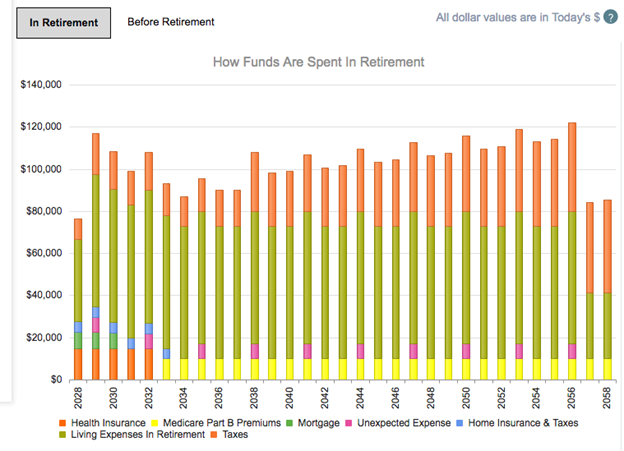

Don't sweep health insurance costs during early retirement under the rug, as they're a major, important expense. WealthTrace can help.

Phase three: One person works part-time, one is fully retired. Presumably, if you're at this stage, you're now pretty confident that you've got costs where you need them to be.

One thing to do at this stage is to think harder about taxes. You might have a good handle on what your income taxes will look like over time. But property taxes can be somewhat stealthy and grow faster than general inflation in a lot of locales. Is yours one of them? Will it make sense to pay ever-higher property taxes down the road, especially if the kids are out of the local schools? There's a lot more to the decision to pick up and move than just property taxes, but it is something to start thinking about here.

Where does it all go? WealthTrace can help you find out.

The Normal Rules Still (Mostly) Apply

The phased approach means you will probably be able to save money in some ways. You might be able to get by with one car, for example. That's great, but for the most part, a lot of expenses you would have considered before, you'll still need to consider now. Those might include:

- Long-term care insurance

- Elderly parent care

- College and wedding expenses for children

- Random, unexpected expenses

That's not to be discouraging--far from it. As is the case with a more standard retirement plan, the key is to sit down and run the numbers.

What are your retirement goals? What kind of return to expect from your investments? What might taxes and inflation do to your savings? Sign up for a free trial of WealthTrace to find out if your retirement plans are on track.