Key Points

- The Federal Reserve is raising interest rates in an effort to stamp out inflation.

- This means it's time to take a closer look at assumptions about bond returns--and probably increase them.

- But higher interest rates on bonds won't matter much if inflation stays high.

Inflation is top of mind for just about everyone right now. One way investors are combating it is via Series I Savings Bonds. Like most bonds, these earn interest, the rate of which is largely determined by inflation. As of this writing, the rate is 9.62%. That rate will be applied to the six months following purchase, and then is reset for the remaining six months.

The problem with I bonds is that you can only buy $10,000 worth each calendar year. (A lesser problem is that you have to buy them directly from the US Treasury, and they can't be transferred to your brokerage.) But we bring them up because they're a bright spot in what has been a pretty dismal fixed-income landscape.

Bonds are known to be the conservative investor's haven. In a low-interest-rate environment like the one we've mostly seen now for decades, performance has been sleepy at best and it has been very difficult for retirees to live off the interest generated from bonds.

That's kind of the point of bonds as investments, of course: While you won't generally see giant returns with bonds, you won't normally see big drops either. In WealthTrace’s retirement planning software, default returns on bonds, based on historical (backward-looking) total return data, range from 0.9% on the short end of the duration scale to 3.2% on the long end. Sign up for a free trial of WealthTrace to run your own retirement planning scenarios, including changing inflation rates and bond yields over time.

With inflation raging and (relatedly) interest rates finally increasing, all bets are off. Vanguard's Total Bond Market ETF is down more than 10% for the year to date, unprecedented in its history. High inflation is also having a negative impact on stocks.

And now, for a whole host of reasons including rising inflation, the yield curve is inverted by some measures, like the 10-year/2-year treasury yield spread. This means that some shorter-term bonds are paying better yields than longer-term ones. That's out of the ordinary, and often the harbinger of a recession.

Regardless of whether a recession is imminent or not, it's fair to say that the fixed income landscape has changed, and that past assumptions about what bonds will return might need some modification. WealthTrace can help you incorporate those changes into your plan, and help determine what they might mean.

Inflation and Interest Rates

A number of things drive bond yields, but one of those things is inflation--especially expectations for where inflation will go. When interest rates rise, which they normally do when inflation is increasing, longer-duration bonds (and bond funds) do poorly. This is essentially because new bonds can and will be issued at higher interest rates in such an environment, making existing bonds less valuable.

It makes sense to apply higher bond returns than those we've come to expect in recent years. So let's try a before/after in WealthTrace and see how it looks.

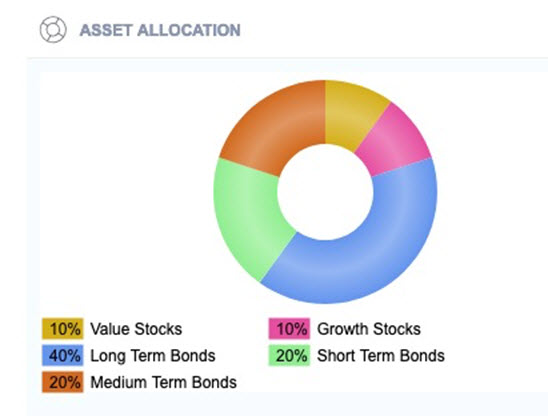

Consider a retired couple in their 60s with around $2 million in investments and $90,000 in annual spending. They consider themselves risk averse, and that's borne out in their asset allocation:

Using WealthTrace, import your investments so you can see your overall asset allocation.

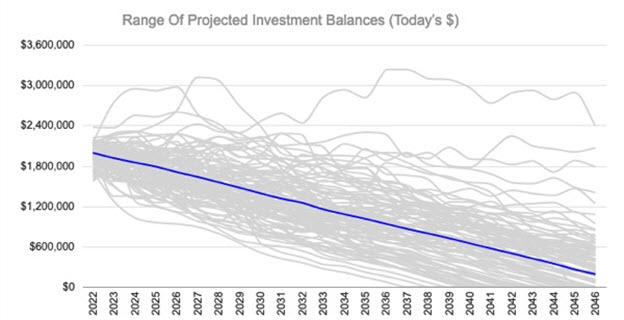

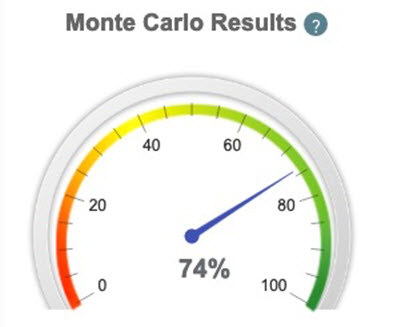

A portfolio with 80% allocated to bonds is extremely conservative, even for retirees (or at least retirees of this age). Using WealthTrace's standard total return assumptions for bonds, Monte Carlo results show them as having only a 74% probability of meeting all of their retirement goals and not running out of money--and that's with a 2.5% inflation rate. At 2.8% inflation, it's 68%, and at 3%, it's an unacceptable 64%.

That's not looking too great for our risk-averse couple, is it? Inflation will probably continue to come down, but there's no guarantee of that, and anyway it could be a while before we get to a rate of inflation that we used to consider normal. What if it's 4% for a while, or 5%? Based on what we see in those results above, with inflation assumptions well below where inflation is now, their returns--and their retirement--could be decimated. Even at 3%, the graph of their projected investment balance over time is rather alarming to look at.

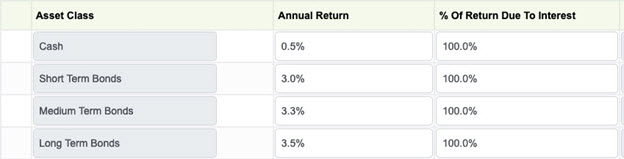

The good news is that, as we mentioned above, bond interest rates should also rise if inflation holds steady. In WealthTrace, we can make modifications to those rates.

By default in WealthTrace, based on historical return figures, short-term bonds are assumed to return 0.9%; medium-term bonds are at 2.1%; and long-term bonds are at 3.2%.

But that's not what bond yields look like at the moment, so we'll change them in the program. For simplicity's sake, we'll use current U.S. treasury bill and bond yields, and put 3-month bills at 3%, medium-term bonds at 3.3%, and long-term bonds at 3.5%. (In reality, there's a pretty wide range of returns at the medium-term level, with two-year bonds anomalously returning 50 basis points more than 10-year bonds, but we'll keep things simple here.)

After modifying the total return assumptions of those bonds to reflect current conditions . . .

. . . things do look a lot better for them:

But that's using a flat 3% inflation rate--far lower than what it is currently, and higher than the 2% rate the Federal Reserve normally targets. Especially in times like these, an inflation rate that is assumed to vary over time is more appropriate.

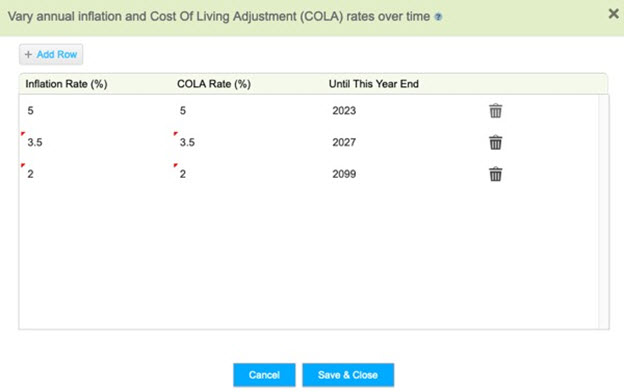

WealthTrace allows you to enter inflation (and cost of living adjustment) rates that vary over time. So if we assume that, instead, we're at 5% inflation through the end of 2023, then 3.5% through 2027, and then back to 2% after that . . .

WealthTrace allows you to vary the inflation rate over time.

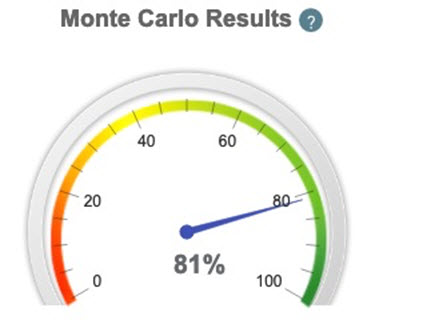

. . . things are starting to look better:

If we can pry our couple's grip from that 80% bond allocation and convince them to make it more like 70% bonds and 30% equities, we could get that Monte Carlo number to more like 90%.

Rising Rates Can Help

Would that we could all get nearly 10% returns, risk free, on all of our investments like with I Bonds. On a real basis, meaning on an inflation adjusted basis, that would currently only be around 3% or 4%, but still tough to beat given the other fixed-income alternatives out there.

The larger point, though, is that rising interest rates are no reason to panic, and in fact might benefit retirees if they stay high. It means returns on less risky assets might finally come back to a level that retirees can use--as long as inflation can be put back in its place.

WealthTrace allows you to run multiple scenarios on your retirement plan, including changing inflation rates over time. Sign up for a free trial of WealthTrace to run your own comprehensive and accurate retirement plan.