Key Points

- Taking some risks with your portfolio can lead to higher returns over time.

- "Over time" is important; in the short run, high risk can do damage to a portfolio--and a retirement plan.

- Emerging markets investments have a place in most portfolios. The question is how much.

The horrific viral outbreak in China, which as of this writing shows no signs of abating, has us thinking about investing in emerging markets in general, and what the appropriate strategy for doing so should be.

Disaster can strike anywhere, of course. But emerging-markets countries are simply more prone to events that can shake investor confidence. Currency crises, political crises, protests, strikes--the list is lengthy. In return for putting up with that risk, though, you get exposure to some of the fastest-growing markets in the world.

Historically, that rapid growth has meant high returns for investors--but not year in and year out by any stretch (and certainly not in recent years). For example, an ETF set up to track the FTSE Emerging Markets All Cap index (Vanguard FTSE Emerging Markets ETF, ticker VWO) was up about 20% last year, after being down about 15% in 2018 and up 31% in 2017. In fact, total returns--whether in positive territory or negative--have been in the double digits in eight of the past 10 calendar years. Many of those calendar years have been in the high teens or more. Up, down, up, down--though, over longer periods, more up than down.

Too Much of a Good Thing

As with any other investment you might make, you have to ask yourself: Are you comfortable with this level of volatility?

A younger investor should be. That's because a younger investor should be buying stocks--or, more likely, funds--on a regular basis via retirement accounts such as 401(k)s and IRAs. This leads to some dollar-cost averaging, where, yes, the investor might be buying at market crests, but also during market corrections or crashes. As long as they stay the course and not panic during the downturns, they'll probably come out far ahead in the long run.

An older investor, on the other hand, will probably need to tread carefully in emerging markets and other volatile corners of the capital markets.

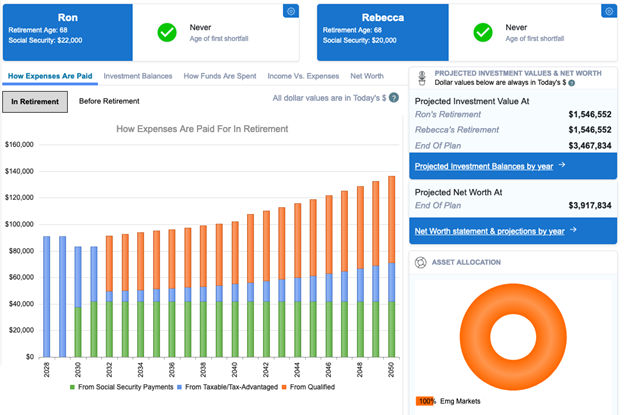

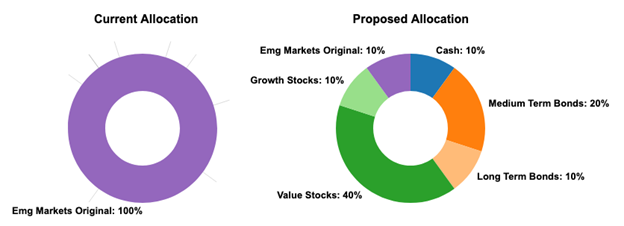

Let's take a look at an extreme case of a couple who decides to invest it all in emerging markets. Our hypothetical couple has about eight years to retirement when they turn 68, $1 million in investment assets, and a goal of spending around $60,000 per year in retirement. They expect to start taking Social Security at age 70.

At first glance, they appear to be in great shape. That million dollars could be worth close to $4 million at the end of their lives, and WealthTrace shows them never having any shortfalls:

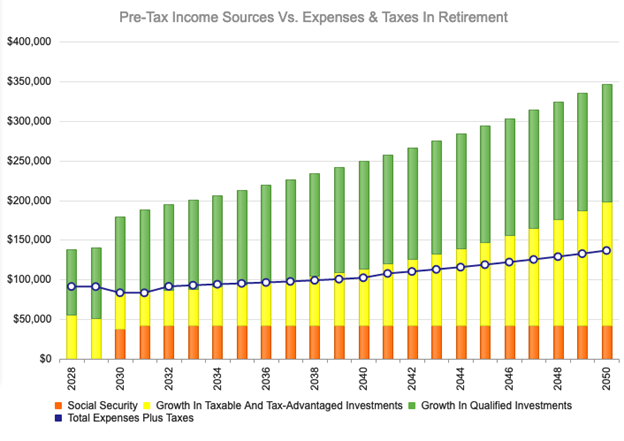

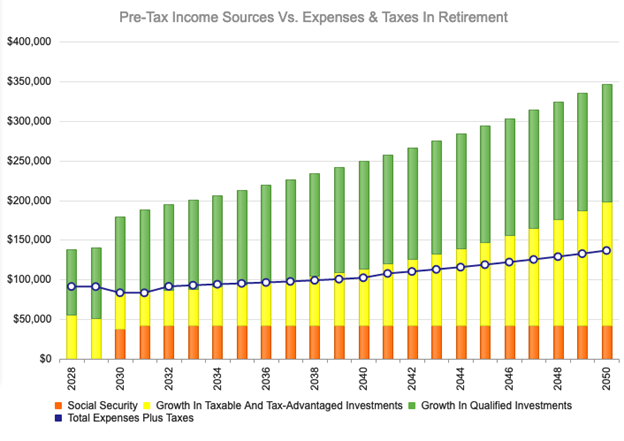

In addition to that comforting upward slope showing income growing over time, their expenses (show here as the blue line with the white dots) appear to be well covered by their investments and Social Security:

In addition to that comforting upward slope showing income growing over time, their expenses (show here as the blue line with the white dots) appear to be well covered by their investments and Social Security:

Does that mean, then, that the key to a successful retirement plan is to pile into China (mostly) and other emerging-markets countries? Is it just that easy?

It is not. We're bumping into the limitations of projecting returns on a straight-line basis. The graphs above assume year-in and year-out returns of 9.5% annually--because historically, over time, that's what emerging market returns have looked like on average.

The "on average" part is what's important here. As we mentioned above, the volatility of emerging market returns can be extreme; nothing about them can be counted on every year--except unexpected and volatile returns.

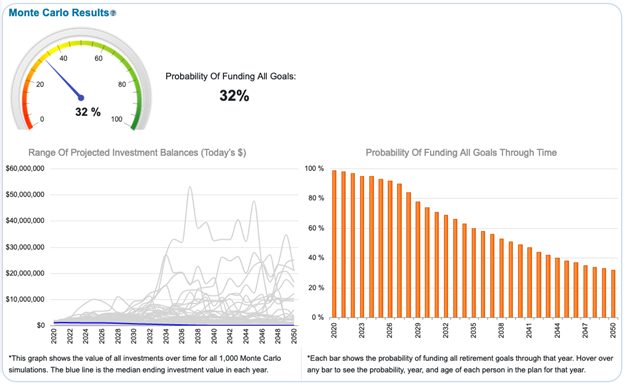

To take that volatility into account, we need to look at another tool WealthTrace provides: Monte Carlo simulations. You can read more about Monte Carlo here, but in a nutshell, it's a way to run a whole lot (a thousand, in our case) of scenarios based on historical performance of the asset classes and their correlation to one another. In this particular case, correlation isn't very relevant, since the couple is only invested in the one asset class.

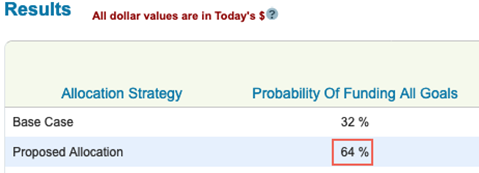

When we take a look at the Monte Carlo simulation, things look dramatically different than the straight-line numbers:

Suddenly we've gone from "no shortfall" to "wait, there's only a 32% chance that I'll be able to fund all of my retirement goals?"

This is the effect of extreme volatility. Time is on your side when you are invested in volatile assets; you can mostly count on that 9.5% annual average return if you have 30 or 40 years to go before clocking out for the last time. But if you have only eight years like our couple here, it's a very different story. Notice in the above graph that they do have a slim chance of hitting a whopping $50 million balance in their portfolio about halfway through the plan. That should be thought of as a lottery ticket, though--the chances of hitting it are really, really slim. There's just too great a risk that you'll get a year or two of negative 15% returns--or worse--and ruin your whole plan.

If we put them in a more traditional allocation, things look a lot better with their chances of success doubling, though the plan will still need some additional work:

In Moderation

Are we finally at or near the end of a great domestic bull market? Nobody knows for sure, of course. If you have largely been invested in the US the past several years, congratulations. It's probably time to do a bit of rebalancing if you haven't done so already, and to check whether you're comfortable with your asset allocation. You may find that you don't want as many of your eggs in the red-white-and-blue basket, and want to venture abroad. But before doing so, consider your age, goals, and tolerance for risk, and proceed accordingly.

How will your investments and retirement plan hold up under various scenarios? Sign up for a free trial of WealthTrace to find out.