Key Points

- The best-laid plans often go awry.

- In retirement, a plan gone awry could be disastrous.

- Using comprehensive financial and retirement planning software, there are ways to prepare for and mitigate unexpected events that could derail a retirement plan.

You can spend a lot of time putting together a financial plan for yourself, making sure you have all the details exactly as you see them playing out. But in real life, unexpected stuff happens. In economics and finance especially, you simply can't forecast everything with 100% accuracy.

This means that stress testing a plan is absolutely imperative. By stress testing, we essentially mean throwing the unexpected at a plan--particularly on the negative side, as most people would love to have some positive surprises--and seeing what happens.

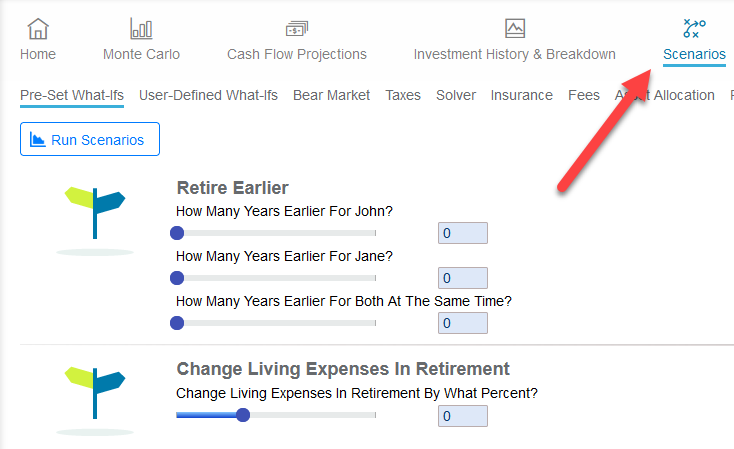

By definition, we don't know what unexpected things will happen. But in WealthTrace, we have a number of ways to model unexpected things that might happen, or that have happened in the past, in our Scenarios section.

Here are a few things to try in that section. (Scenarios are available to subscribers of the Advanced, Deluxe, and Advisor versions of our retirement planning software.)

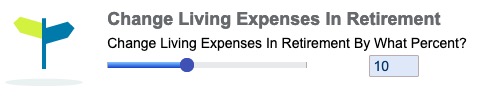

Change Living Expenses In Retirement

We'll start with an easy one. You should have a decent idea of what you expect to spend in retirement. This is a core piece of any successful retirement plan.

But what if you're off by a bit, or more than a bit? It can certainly happen. One thing you can do is add some unexpected one-time expenses to a plan in case an emergency comes up. But a more broad-brush approach is to simply increase spending by a flat percentage and see what happens to the plan.

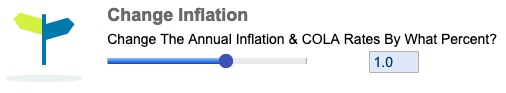

Change Inflation

Inflation has rightly been on everyone's minds lately, including ours. Inflation can really do a number on a retirement plan.

WealthTrace allows you to model modifying (or likely increasing, in our current environment) inflation on its own, or in parallel with annual returns. In both cases, the plan's probability of funding all of its goals will decrease. However, the drop will be less severe in the latter case, as most companies will be able to pass along price increases to customers over time, so their profits (and their stock prices) should not get hit too badly.

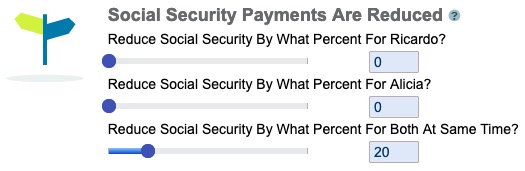

Reduce Social Security Payments

Will Social Security be there in its entirety when you start taking it? Probably. But 'probably' isn't 'definitely,' so it could make sense to run some scenarios where your benefits are given a haircut. If you have lots of other sources of income, such as investment accounts, it may not matter that much. But for those dependent on Social Security when the time comes, a cut could make a difference to their standard of living.

You can also read our article about how to run scenarios on delaying Social Security benefits.

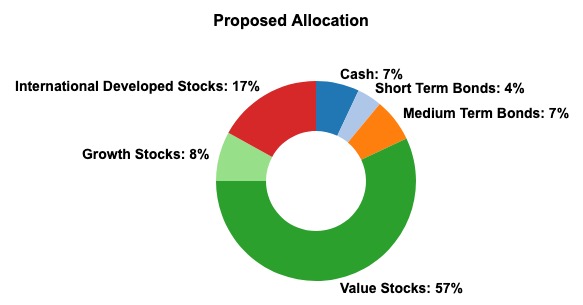

Change Asset Allocation

Sometimes the biggest problem with a retirement plan isn't that the person/couple hasn't saved enough, or that they're planning on spending an unreasonable amount of money each year. It's that they don't have their asset classes right. Oftentimes retirees, or people headed into retirement, haven't moved their assets into a more conservative allocation, leaving them exposed to bear market havoc. WealthTrace allows you to test out some allocations and see what the effects on a plan would be.

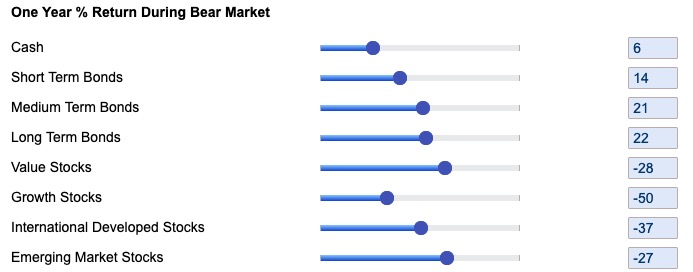

Bear Market Simulation

Speaking of bear markets: Is your plan ready for one? With yield curves flattening and briefly inverting in recent weeks, we could be looking at one in the not too distant future. In our Bear Market Scenario section, you can simulate a 2001, 2008, or 2020 bear market, and see what it would do to your plan. You can also modify the settings and create a 'custom' bear market, as no two bear markets are exactly alike.

To learn more about bear market scenarios in WealthTrace you can read a more detailed article we wrote about modeling a bear market with a market rebound.

Be Prepared

We can't see into the future, but we can learn from the past. 'Set it and forget it' is unfortunately not an option when it comes to a retirement plan. It pays to look at your plan from different angles and try to make a mess of it with unexpected negative events, and prepare accordingly.

Do you want to run what-if scenarios to see how various changes will impact your retirement portfolio? Sign up for a free trial of WealthTrace today and start running your own retirement planning scenarios.