Key Points

- Stocks are volatile again and are down nearly 6% from their peak this year.

- Diversifying between stocks and bonds can reduce the impact of a recession.

- The older one is, the more important diversification can be.

Stock market volatility and big market downturns are back. With many predicting an imminent recession along with fears of a trade war with China spiraling out of control, the S&P 500 is down nearly 6% from its peak in late July.

As stocks have fallen, treasury yields have plummeted. The inverse relationship between stock and treasury bond returns has held steady for decades, especially during recessions.

Diversification Still Works

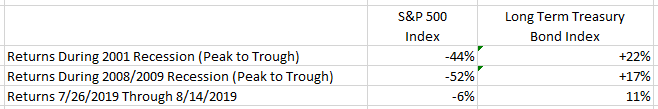

As we can see in the table below, there is a significant inverse relationship between treasury bonds and stocks when the stock market is not doing well.

The main reason that treasuries do well when stocks don’t is that the market usually predicts that the Federal Reserve will lower interest rates to fight off a recession or an impending recession. Another reason is what is called “flight to safety”, which means a lot of investors are moving their money out of stocks and into less volatile, much safer treasury bonds.

How Much Diversification Is Needed?

There are many rules of thumb for how diversified a portfolio should be, such as taking 100 minus your age to determine what percent your portfolio should be in stocks. This isn’t a bad place to start, but it definitely does not work for all people. There can be many other factors that will determine a person’s asset allocation.

One factor to consider besides age is when you will need the money. The longer the time horizon for using the money in a particular account, the more risk one can take. Also, if a person has a large pension and/or Social Security benefits that will cover most of all of their retirement expenses, it’s possible they will never need to withdraw from their retirement portfolio.

If a person never needs to withdraw from his or her portfolio in retirement, they can definitely take more risk. But most people, even those with $1 million or $2 million saved up will end up withdrawing funds from their investments to pay for retirement expenses.

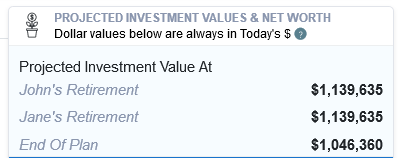

So let’s take a look at what diversification does for a 55 couple that has $1 million saved in their 401(k) plans. They plan on retiring at age 60 and will spend $60,000 a year in retirement.

Currently they have a mix of 90% stocks and 10% long-term treasury bonds. Their weighted average rate of return is assumed to be 6.5%. Using the WealthTrace Retirement planner and straight line projections, everything looks good for them as you can see below.

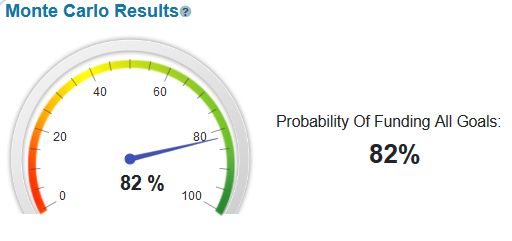

I then ran Monte Carlo analysis on their portfolio, which uses 1,000 scenarios and looks at past returns, volatility, and correlations for the investments they own. Using this analysis, we see that they have an 82% chance of never running out of money.

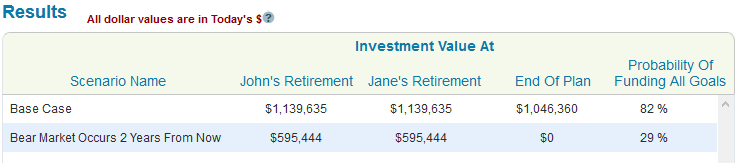

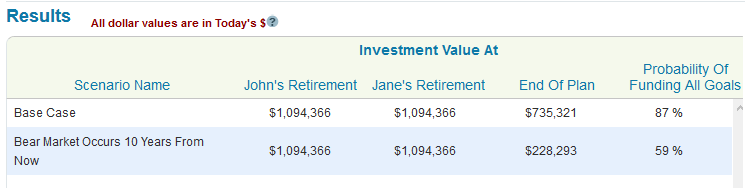

I also ran a bear market scenario and assumed there will be a recession in two years comparable to the recession in 2008/2009.

This is where things really get ugly for them. If we have a major recession in two years, this couple will very likely run out of money in retirement. In this scenario they only have a 29% chance of meeting all of their retirement spending goals.

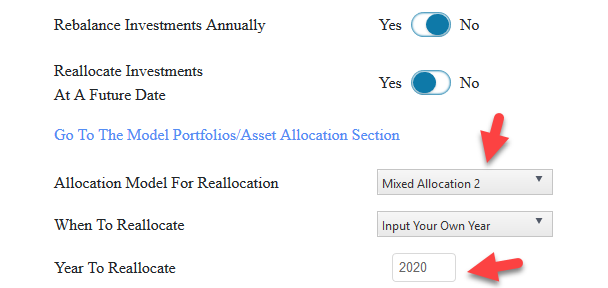

So what happens if they change their asset allocation to a more conservative 60/40 split between stocks and bonds? I used the ‘Reallocate’ setting in WealthTrace to reallocate their investments to a 60/40 mix in one year.

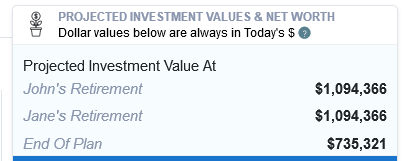

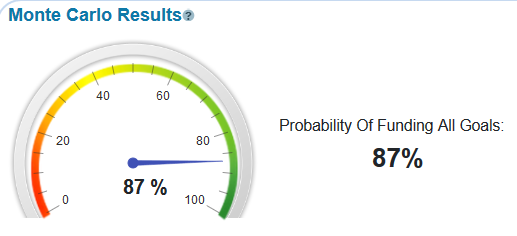

I found the following results:

As you can see, using straight line projections, the amount of money they have at the end of their plan goes down by about $300,000. This is to be expected since they now have more bonds in their portfolio. But what we are really interested in is their probability of success and how their plan holds up under a recession. Using these criteria, they are much better off with a more balanced portfolio. Their probability of never running out of money goes up to 87% and their results in a bear market are much better than before.

Keep in mind that this is a 55 year old couple. If this couple was younger, they surely would see much different results. Younger people should be taking more risk in their retirement portfolios since their time horizon is so much longer. They should then become more conservative as they get closer to retirement.

Diversify Among Different Types Of Stocks And Across The World

Diversification isn’t just for stocks vs. bonds. It is important to diversify among different types of stocks. There are small company stocks, large company stocks, value, and growth among many other classifications. The key is to get the correlation as far below 1.0 as possible. It is also wise to diversify away from the United States. There are many ETFs that can give one exposure to many other countries, both for stocks and bonds.

Don’t Wait Too Long

Diversification is a tried and true way to reduce risk while maintaining a return that will be good enough to retire on. The older one gets, the more important it is to diversify. Don’t wait until the next recession and bear market are on top of us before figuring out that diversification is the best way to protect a retirement portfolio.

Do you want to see the value of diversifying your retirement portfolio? Sign up for a free trial of WealthTrace to find out.