Key Points

- The phrase 'rules are made to be broken' applies in personal finance like nowhere else.

- Dialing down your exposure to stock market volatility as you get older still makes sense, but possibly not to the degree you expect.

- Getting your asset allocation mix right in retirement is key to a successful retirement plan. Use the WealthTrace Financial & Retirement Planner to find your optimal asset allocation both before and during retirement.

Are you familiar with the Rule of 100?

There are lots of such rules in finance, though they're often not so much rules as they are suggestions. The 4% Rule comes to mind.

That's because everybody's situation is different. Rules generally apply to everyone. But in finance, they almost never do.

However, it is often the case that, as we get older and approach retirement, our risk tolerance changes. Specifically, we become more risk averse. So it makes sense that investors will generally dial down their exposure to riskier assets the older they get.

But these rules/suggestions evolve over time too. The aforementioned Rule of 100 says that to get your optimal asset allocation by age you subtract your age from 100, and the result should be the percentage you put into stocks. (The remainder should be in less volatile assets, such as cash or bonds.) So if you are 70 years old, this rule says you should be 30% in stocks and 70% in bonds or cash.

But life expectancies have risen since that rule was invented, so now it's more like the Rule of 105 or the Rule of 110. If you live longer, you might need the additional performance that stocks provide.

Similarly, the 4% Rule, which has to do with the maximum percentage of your assets you can draw down on in retirement and not run out of money, has been modified in recent years. You now see the 3% Rule mentioned more often, or an even lower number.

As financial asset research has become its own discipline, opinions about what makes the most sense change over time. Another example: It used to be that you would rarely hear any expert advocating for much exposure to the stock market later in life. But now, it's a lot more common. That's partially because we now have more sophisticated ways of looking at the data, but it's also because yields on fixed income assets have been declining for decades (until recently). With income on those less risky assets dropping, it makes sense that investors would stick with the riskier ones.

The Portfolio Makeover

Let's see how this might play out in practice using WealthTrace’s retirement planning software.

Our couple for the purposes of this exercise is 46 years old. They're not saving anything currently, but they have managed to amass $2 million in savings and investments. They hope to retire at 65, and plan to spend around $90,000 annually in retirement.

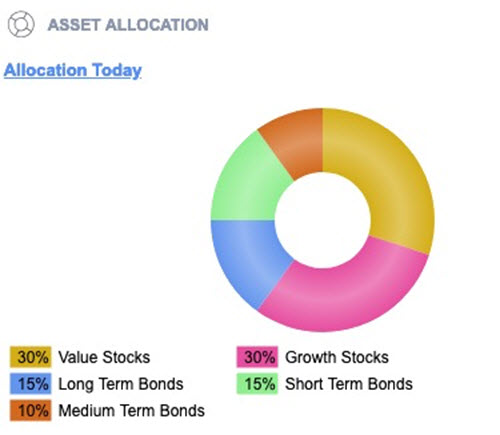

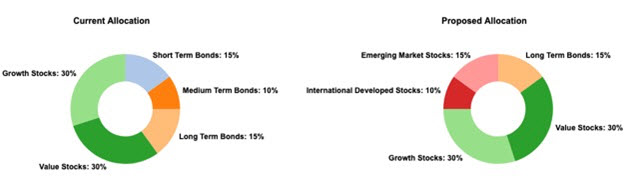

The couple is fairly risk averse, so they have more in bonds than most people probably would at this age, with a 60% stock / 40% bond allocation:

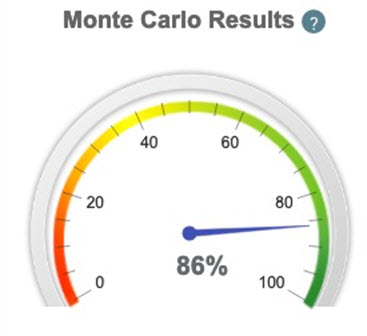

Even so, they're in pretty good shape, with an 86% chance of hitting all of their retirement goals:

Feeling confident about the direction they're headed, they want to know what would happen if they went to 100% fixed income right about when they retire. WealthTrace can run that for them.

Unfortunately, the results point to disaster in that case, with Monte Carlo retirement simulations registering a mere 58% chance of full plan success. There are a number of reasons for this, but the fact that some fixed-income assets are projected to return below inflation surely has a lot to do with it.

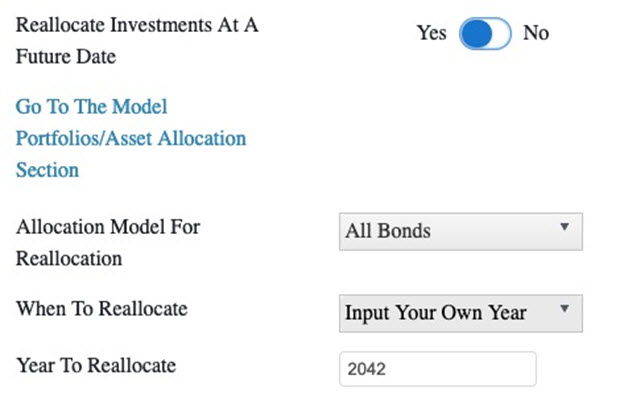

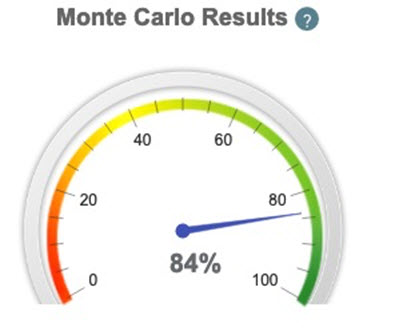

So they start tweaking their allocations a bit. First, they see what happens by going to 60% bonds and 40% stocks in 2042, when they turn 66, inverting their current allocation. That move works out pretty well for them:

That's virtually no change in their chance of success while taking a bunch of volatility off the table at the same time.

Then they try going from 60/40 stock/bond currently, to 60/40 bond/stock twenty years from now, and then to 100% bonds in 2047, when they turn 71. The WealthTrace retirement planner allows them to reallocate a second time.

But in that case, the Monte Carlo result drops to 68%. Ouch. That's too low to take a chance on.

In the end, they decide to go with a 70/30 bond/stock split in 2047. That puts them at a more comfortable 83% number. If they can find a way to save a mere $6,000 a year between now and retirement (up from $0 now), they can get that figure closer to 90%.

It's an iterative process, which WealthTrace's Asset Allocation Scenarios tool can also help with. For example, if our risk-averse couple could be convinced to go more aggressive now, while they're in their 40s, they could then go with a larger portion of fixed income in 20 years, or more likely even earlier than that.

Evolution

We have not taken into account what Social Security would do to the plan, or even larger contributions to their investment accounts, and a number of other things. With a large enough amount of money and a modest spending level, of course, an investor could be in all bonds. Or all cash. A mattress full of cash, even.

We have not taken into account what Social Security would do to the plan, or even larger contributions to their investment accounts, and a number of other things. With a large enough amount of money and a modest spending level, of course, an investor could be in all bonds. Or all cash. A mattress full of cash, even.

But most people aren't in those enviable shoes. The rest of us will most likely need some equity exposure later in life--and a decent amount of it at that. That may not be what you've learned about investing in retirement, but these rules, if we can still call them that, evolve over time. Retirement planning software like WealthTrace can help you keep up with the changes.

Do you know if your assets are optimally allocated? Sign up for a free trial of WealthTrace to run asset allocation scenarios and Monte Carlo analysis on your retirement plan.