When I look for dividend paying stocks for the long run, a few of the characteristics I like to see are a reasonable dividend yield of at least 2.5%, a low payout ratio, low debt, and a strong dividend growth rate over the past five years. Although Microsoft has normally not been looked at for its dividends, it’s time investors being thinking differently about this company. With a 2.6% dividend yield, a 20% annual dividend growth rate over the past five years, a payout ratio of only 26%, and very little debt, Microsoft is poised to return strong dividends for years to come.

MSFT Profile*:

Microsoft Corporation develops, licenses, and supports a range of software products and services for various computing devices worldwide. The company’s Windows & Windows Live Division segment offers PC operating system that primarily includes Windows 7 and Windows Vista operating systems; Windows live suite of applications and Web services; and Microsoft PC hardware products.

*Profile taken from Yahoo Finance.

| MSFT: |

| Div Yield | 1 Yr Div

Growth Rate | Annualized 5 Yr Div

Growth Rate |

| 2.6% | 25% | 20% |

| Payout Ratio | Debt to Equity |

| 26% | 20% |

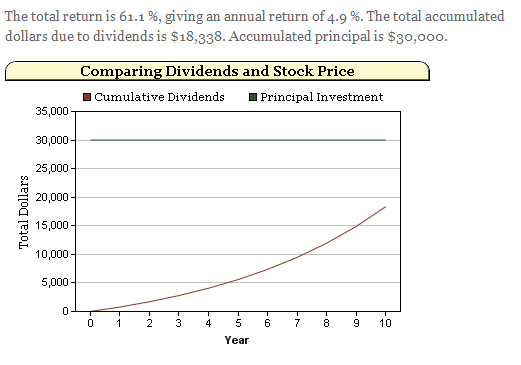

Although a dividend yield of 2.6% may not seem too sexy compared to other dividend payers who are paying out 5% or more, we have to take into account the rapid growth rate in dividends that Microsoft has been paying. It’s important to analyze scenarios for such a company where we look at both the dividend yield and growing dividends. I ran the following scenario on our publicly available calculator called Total Returns- Dividends Vs. Price Appreciation. If we buy 1,000 shares today, apply a dividend growth rate of 15% over the next 10 years, reinvest dividends, and assume the price of the stock does not change, we get the following:

| Inputs: |

| Investment | Dividend Yield | Growth of

Dividend (Annual) |

| $30,000 | 2.6% | 15% |

| Outputs: |

| Total Return | Annual Return | FV Dividends | FV Investment |

| 61% | 4.9% | $18,338 | $30,000 |

The annual total return, even if the stock price doesn’t budge, would be nearly 5%.

What if an investor holds Microsoft for 20 years in a retirement portfolio and collects the dividends over this time frame without any increase in the stock price? For this scenario I assumed a dividend growth rate of 15% for the first 10 years and then 10% for the next 10 years.

| Outputs: |

| Total Return | Annual Return | FV Dividends | FV Investment |

| 280% | 6.9% | $84,041 | $30,000 |

An annual return of 6.9% with no increase in the stock price is not too bad. It simply shows the power of growing dividends over time.

Dividend growth stocks can help a retirement plan immensely, especially vs. low-yielding treasury bonds. I plugged in the 4.9% total return figure I found in our first example into our retirement planner in place of the ten treasury bonds that were in the portfolio before.

I found that if a typical 55 year old couple with $400,000 in assets moves 50% of their funds from treasuries to dividend payers that give them a 4.9% return, over ten years they will have increased the time that their funds last in retirement by over ten years.

I believe that investing in Microsoft today for the long run will pay off due to their growing dividends. Scenarios such as the ones I’ve run here can help investors understand the power of dividends over time, especially when those dividends are growing.