Key Points

- Beware free retirement calculators. They're incomplete at best, inaccurate at worst.

- Complete, affordable options for online retirement planners are out there.

- You can't expect a few clicks and check boxes to give you an accurate assessment of whether you are set for retirement or not.

There are a lot of free retirement planners--actually, the better word is "calculators"--out there. We say calculators because they're often little more than a way to enter in a few assumptions and a button.

That may suit our ever-shortening attention spans, but it doesn't suit something as important--and, frankly, as complex--as retirement planning. There's just too much the freebies miss.

AARP's calculator, which comes up toward the top of a Google search, was last updated in 2016. Vanguard--whom we have a lot of respect for--has a retirement income calculator that is just too stripped down to be of use to a lot of people, and anyway is mainly there to get you to become a Vanguard customer.

So what makes for an actually useful retirement planner?

Updated Investment Information

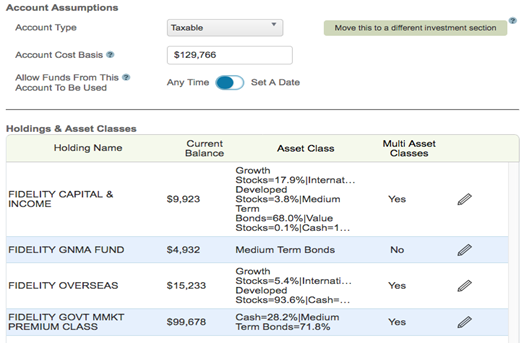

Let's start with your actual, live investment account data, updated regularly. A free calculator is at best a snapshot in time, whereas a program like ours will keep track of your investment accounts' performance and holdings over longer periods. If your mutual funds and ETFs change up their portfolio holdings, their anticipated performance (based on the asset classes they hold) will be automatically handled in WealthTrace.

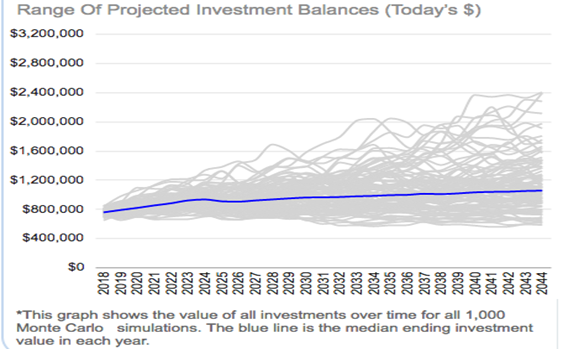

How about taking probability into account using a Monte Carlo simulation? Nobody can predict the future precisely, but a Monte Carlo analysis can run through a whole bunch of scenarios and present you with a probability of an event--such as the success of a retirement plan--occurring. WealthTrace will give you this information.

Something seemingly as trivial as required minimum distributions (RMDs) can make a huge difference to a plan, yet very few of the free calculators even mention them, let alone calculate them for you accurately. WealthTrace can estimate what those RMDs will look like, how they will be taxed, and how they will be used (or not used, in which case they might flow back into a taxable account).

And speaking of taxes: You guessed it, most calculators aren't even going to give taxes a passing glance. This is perhaps the most concerning part of trying to put a plan together using free tools--especially now, after huge changes in tax laws. WealthTrace always reflects the most up-to-date tax laws, and even takes cost bases into account.

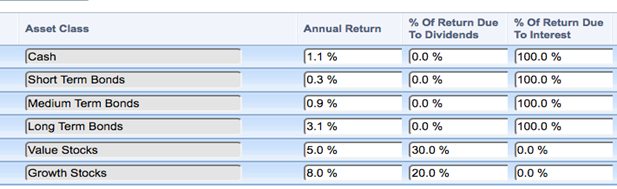

Not all total returns are created equal. What if you've structured your portfolio to generate qualified dividends so you don't have to take much in capital gains? Or what if you lean toward the conservative side and want interest income exclusively? WealthTrace can take all of that into account, and handle the taxes accordingly.

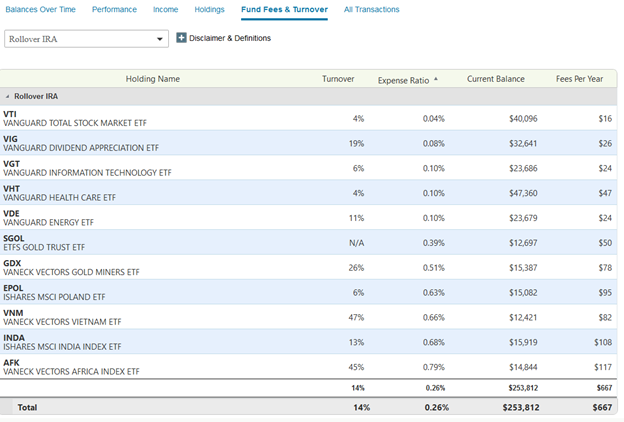

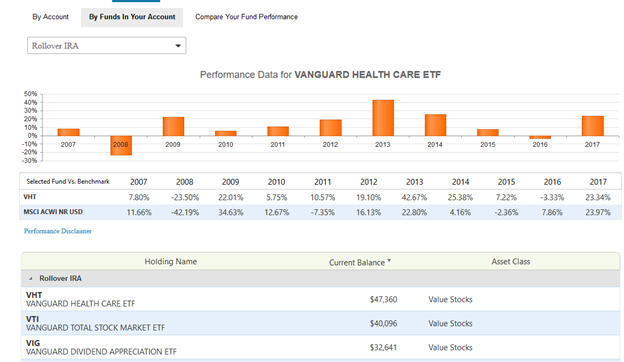

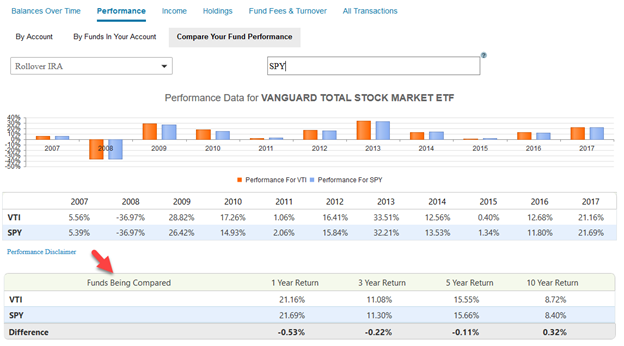

Viewing Your Fund Fees & Fund Performance

Sadly, many investors have no idea how much they are paying each year for the mutual funds and ETFs. It’s not always easy to find the expense ratio of your funds, but we have made it easy for you. We collected the fee information for every mutual fund and ETF in the world and show you how much you are paying each year for the funds you own.

Do you want to see how your funds are performing through time? You can easily view historical performance for all of your funds. Want to see how your funds are performing vs. another fund? You can do that too.

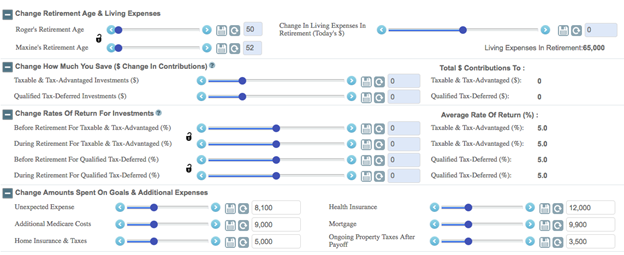

Running Scenarios

Two words might sum up why free is not the best option: What if?

After all, you're not usually locked into any one way of making retirement work. A good planner--we're talking about both a live human planner and an online planner--will give you multiple options and scenarios, each usually with their pros and cons, to consider when putting a plan together.

And this is where a program's ability to handle the very real complexities of personal finance comes into focus.

Take a deep breath before having a look at the next image:

There are lots of options here. Change your retirement age, living expenses, assumed return rates, assumed savings rates, and so on.

Does that make you anxious? If so, don't go running to that AARP one-page calculator and hope for the best. The truth is that if you're not comfortable working with the ability to change multiple assumptions at once, you might want to work with a professional planner. But the truth is also that it's not as intimidating as it might look, and that there's a lot of power here--power that used to be the domain of professionals alone, but that is now available to individuals as well.

Back to the what-if question. What if you're already retired and want to see how things are shaping up for you? Many calculators can't even handle this--they force you to put your retirement date into the future.

Last but not least, who are you gonna call? That is, what if you have questions? WealthTrace comes with support--email, phone, live chat--in case you get stuck.

Are you on the path to early retirement? The WealthTrace Financial & Retirement Planner can help you find out. Start a 14-day free trial now.