Key Points

- Not one company in the S&P 500 cut its dividend in the first quarter of 2018.

- The S&P 500 had another record dividend payout in the first quarter.

- Dividend payers historically do better in tougher economic times.

In the first quarter of 2018 not one single company in the S&P 500 cut its dividend. This is the first time this has ever happened. At this rate, 2018 will post its seventh straight record in terms of dividend payouts for companies.

Over 935 companies increased their dividend yields in Q1 of 2018. This is a 7.6% increase compared to Q1 2017. The total dollar amount of dividend payouts is also up over 4% year over year.

The S&P 500 has so far this year seen a 5.5% increase in its dividend payments compared to last year.

If we only include companies that pay a dividend, their average dividend yield is now 2.5%. That is an increase from the 2.4% we saw in the fourth quarter of last year. For the overall S&P 500 (including stocks that don’t pay a dividend) the dividend yield is now 1.9%.

Dividend Growth Is Usually A Sign Of Health

I have written many times about looking for companies that show solid dividend growth over time. It’s even better if these companies have shown that they will not cut their dividends during a recession.

CEOs can talk and talk all they want about how their company is doing, and earnings don’t always reflect how well a company is really doing. But dividend payouts are where the rubber meets the road. If dividends keep increasing, it shows that the company has the ability to keep their strong payouts going for their investors.

Dividends And Historical Returns

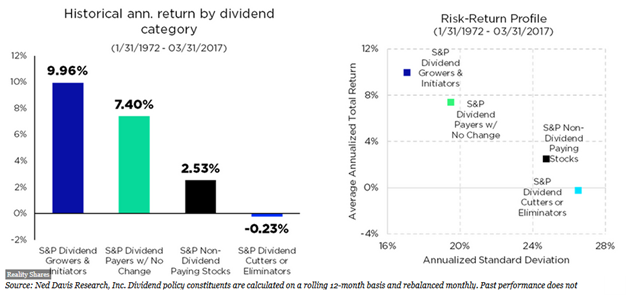

Since 1930, dividends have accounted for approximately 43% of the S&P 500’s total return. Perhaps more astonishing is that during periods of slow economic growth, dividends have accounted for over 75% of the total return.

This shows how the right dividend payers can stabilize a portfolio over time, which in turn can help increase one’s chances of never running out money in retirement.

This shows how the right dividend payers can stabilize a portfolio over time, which in turn can help increase one’s chances of never running out money in retirement.

Retire With Less Stress Using The Best Dividend Payers

Using our WealthTrace planning software I ran through some scenarios using updated dividend information. I ran analysis using our portfolio of 20 of the best dividend champions, which includes Procter & Gamble (PG), Exxon (XOM), Wal-Mart (WMT), Coca-Cola (KO), and Altria (MO).

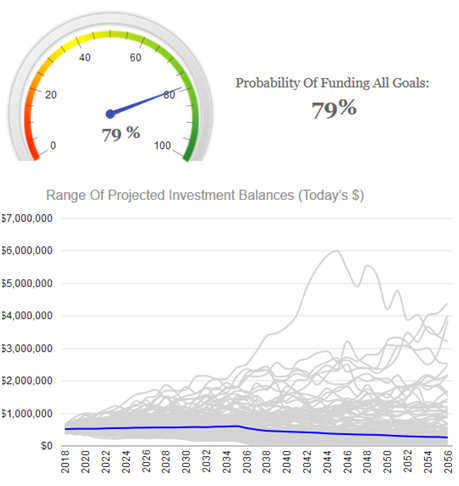

I first looked at a couple that is 45 years old and has $400,000 invested in the S&P 500 index. All of their money is in an IRA. They plan on spending $50,000 per year in retirement and will retire when they’re 62. I ran their results through our Monte Carlo analysis, which runs 1,000 different scenarios on their assets, and came up with the following probability of them never running out of money.

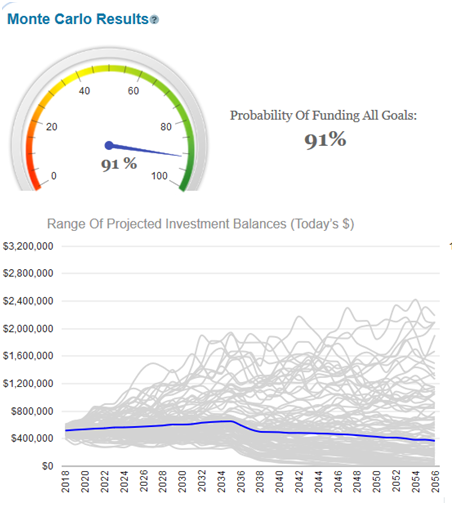

This isn’t a bad result for them, but we would like to see their Monte Carlo results close to 90%. So I took half of their money and placed it into our portfolio of dividend champions. Their new Monte Carlo results look much better:

Because dividend payers are much less volatile and they provide a more stable stream of income through time, it’s not too surprising that this couple does better under this scenario.

Stable Dividends Can Mean No Withdrawal Of Principal

It’s pretty simple: If you don’t withdraw from your principal, you won’t run out of money in retirement. So the key is to generate enough income to cover expenses every year (or at least the majority of years) so that your principal is not touched. It is much more difficult these days to do this since interest rates are so low, but with dividends increasing at a rapid clip, we can still find a steady income stream using the best dividend champions that are out there.