Key Points:

- In many ways, a financial plan for a couple is the same as a financial plan for an individual.

- There are, however, plenty of differences that couples need to reckon with.

- The calculations surrounding death and taxes warrant the use of a retirement calculator built to handle them.

Is it trickier to make a retirement plan for a couple than it is to make one for an individual?

Let’s start with the basic components of a retirement plan. You need to:

- Save a certain amount of money.

- Have a good idea of what you will be spending in retirement.

- Have some sense what one-time expenses and goals could be on the horizon.

- Know what income sources you can count on in retirement.

All of that is going to apply regardless of whether the plan is for a couple or not.

When it comes to planning specifically for a couple, though, there are a few calculations that can get tricky. But if you use the right software and have accurate inputs, you can get it right--and have a more accurate plan as a result.

The First of Two Certainties In Life

It’s relatively easy to figure out income, saving, and spending figures. Dealing with taxes, though, is another story.

There’s a reason you probably use a CPA or tax software to help you with taxes: They’re complicated. And they change from year to year.

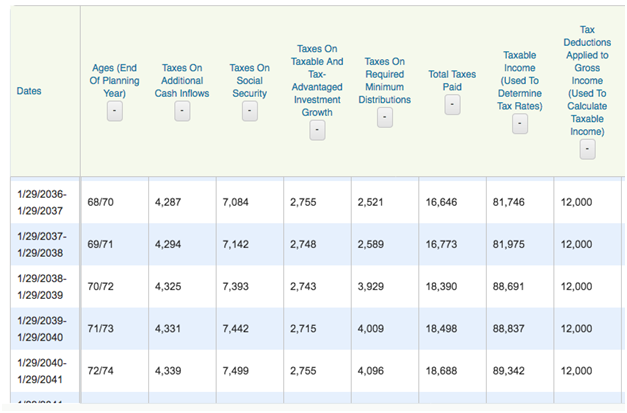

We don’t need to get into the details of tax law here. Suffice it to say that taxes matter a lot when it comes to retirement planning. “Married filing jointly” versus “Single;” accounting for cost basis on investment accounts; tax rates that vary depending on the source of the income--all of these things and lots else factor into getting a retirement plan that is reasonably accurate.

You could just make a rough estimate of what your taxes might look like, but why do that if you don’t have to? WealthTrace uses up-to-date tax tables to give you the most accurate estimate of taxes possible. Learn more.

The Second of Two Certainties In Life

Nobody wants to think about it much, but the death of one of the plan participants can have a huge effect on the plan’s outcome.

The future is of course uncertain. But most people can make at least educated guesses about life expectancy. A large age difference between the plan participants or serious health issues with one participant should be accounted for in a plan.

What are we referring to here, exactly? A few things:

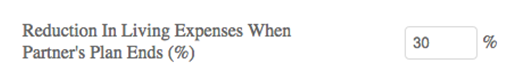

The reduction of living expenses for the survivor. If one spouse or partner passes away, living expenses will almost surely drop. The question is by how much. That reduction in costs should be accounted for in a plan.

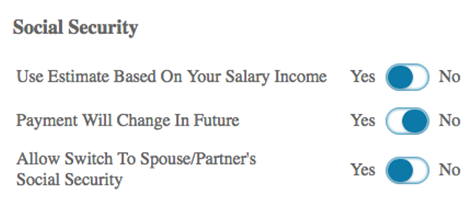

Social Security survivor benefits. Each plan participant will likely be eligible to receive Social Security benefits if they paid in over the years. Broadly speaking, the larger Social Security benefit continues after the death of one of the plan participants, even if the larger benefit belonged to the deceased. Taking this into account can be a big deal.

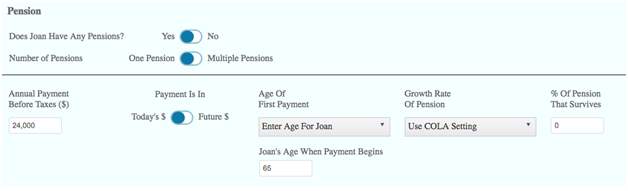

Pension survivor benefits. Some pensions are structured with full or partial benefits to the survivor, while others are not.

Details matter: If your retirement income depends on the pension on one of the plan participants, and that person passes away, what happens? Does the pension continue to be paid out? WealthTrace can help you account for this. Learn more.

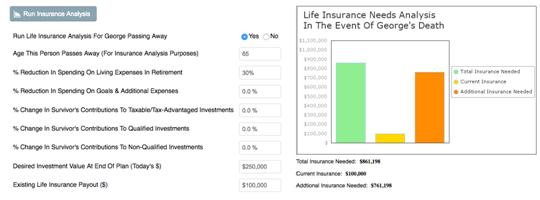

Life insurance needs. Depending on your tolerance for risk and where you are in your investing timeline, you might be considering life insurance. If the main breadwinner passes away unexpectedly, how will the survivor cover expenses? Life insurance is one common way.

There are plenty enough vagaries in any sort of forecasting. It just makes sense to do whatever you can to reduce errors or uncertainty, especially with something as important as a retirement plan. For couples, using a retirement planner like WealthTrace that is always updated with the latest tax laws can lead to greater piece of mind when looking 10, 20, or 30 years out.

WealthTrace is the whole package: Financial planning software that is as powerful as an advisor would require, but easy enough for individual investors to use. Click here to sign up for a trial subscription.