Key Points:

- We have modern ways of putting together and reviewing a retirement plan, but the inputs are the same as always. You can use WealthTrace to figure out how much you need to save to have a successful retirement plan.

- We can’t predict the future, but we can simulate a lot of things that could happen.

- Stress testing a plan is a good way to get you thinking about must-haves and nice-to-haves in retirement.

When it comes to retirement planning, there’s really not that much new under the sun.

There are ways to make planning more efficient and transparent. You’ll even hear about new investment products and strategies on occasion. Scratch the surface, though, and it’s usually just a new wrapper on an old item. ETFs, for example, are great and useful, but essentially serve the same purpose as mutual funds (for investors, that is--it’s a different story for traders). Another example is so-called bucket investing strategies, which have been around a while but are getting a lot of ink these days. In the end, though, these strategies have more to do with investor psychology than anything else: Shuffle the money and assets around any way that you like, but you still need to save and invest like you always did.

The future is still the future, too: Unpredictable. As has always been the case, you still don’t know exactly how your investments will perform. You also don’t know what unexpected events might pop up in your life that could throw you off course. We do have some ways of seeing what the effect would be of throwing certain wrenches in the works, but we can never know exactly what will happen.

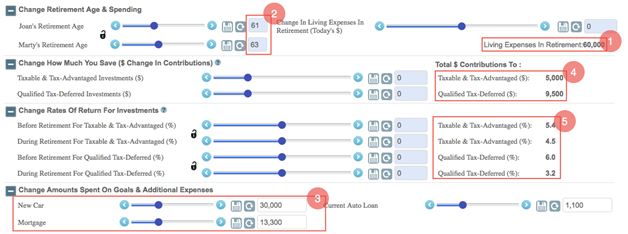

Here are the basic inputs of a successful retirement plan. These inputs have not changed since retirement planning was invented--even as programs like WealthTrace have improved how we look at and process the information.

1. Spending. Spending in retirement isn’t an overlooked item, exactly, but it’s often underappreciated as an important factor in making a retirement plan work. People talk about “their number,” referring to how much they think they need to have saved at retirement. But the number they should usually start with is their anticipated spending.

2. Retirement date. Moving your retirement date--or your spouse’s, or both--can make a big difference to a plan.

3. Goals. We’re talking about goals that cost money here, like college expenses for grandkids, or second homes. Goals are obviously very much tied in with spending, but less day-to-day and more one-and-done.

4. Saving. How much are you socking away, and in what kinds of investments? Do you have tax-deferred accounts going? The more years you are from retiring, the more these things will matter.

5. Rates of investment return. What are you invested in? This will determine what kinds of returns you might expect on your investments.

In the image above, we have couple in their early 50s hoping to retire in 10 years or so. They have about $1.2 million in invested assets.

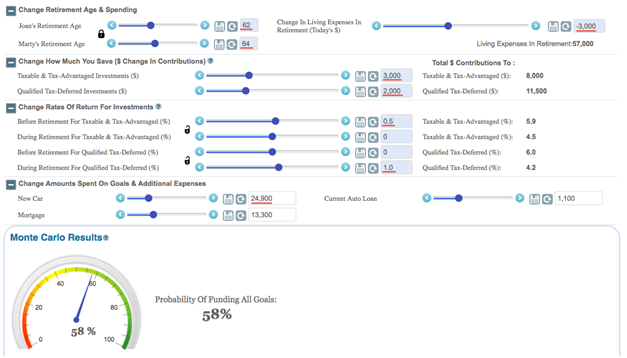

If we put their plan through a Monte Carlo simulation as is, they only have a 33% probability of meeting all of their goals. But if we start moving the inputs around a bit, things improve considerably for them. Notice how we are increasing the amount they save, which is how we figure out just how much one needs to save in order to have a successful plan.

We made these changes to the plan (noted in red underline) by adjusting the sliders:

- Bumped up their retirement ages

- Reduced their living expenses

- Increased their contributions to savings

- Increased rates of return on their investments slightly

- Lowered their new-car expense (which they’re set to purchase every seven years)

A 58% probability is still too low. At this point, after making all of these broad-brush changes and still getting such a low probability rating, we’d probably want to revisit some of these inputs in detail, starting with our investment account asset allocation (toward the end of this post). But it’s great to be able to see what changes cause the largest effects, all here on one page.

Disaster Simulation

There’s one more major thing to consider. The closer you are to retirement, the higher the chances are that a bear market could wreak havoc on your retirement plan. Every bear market is different, but with WealthTrace, you can simulate what would happen to your plan if a 2008-like downturn happened to your portfolio. The change in a person’s wealth can be dramatic during a major recession.

In this case . . . ouch. We may need to have a closer look at our plan.

Past Is Only Partially Prologue

We never know exactly what is coming down the pike. But we can run simulations based on things we have seen before--and plenty of things we haven’t seen. The more rigorous you are about your testing, the clearer the difference will likely be between must-haves and nice-to-haves in retirement.

There is a lot more to a successful retirement plan than just hitting your number. WealthTrace covers all the bases. Learn more.