Key Points:

Where are you in your financial journey?

If you’re reading this article, you’re probably further along than most people. You’re thinking about your finances; you’re doing some reading and research. This is a good thing.

Maybe you’re looking at your finances and thinking about ways to get your debt or spending under control. Or perhaps debt isn’t the issue. You’re saving and investing, but it feels like a game you’re playing where you don’t know the rules. How much do I invest? This fund? That fund? What should I even be looking at before committing money to an investment?

We’ve written about some of the tools that are out there, and how it’s easier than ever to track spending and investments. Let’s get more specific and compare a few of the services by name: Mint, Personal Capital, and WealthTrace.

One Thing In Common

All three of these services do account aggregation. Essentially, account aggregation means the ability to track all of your financial accounts in one place.

Account aggregation is powerful stuff. It can help you track your spending to a budget; get a handle on where your money is being spent; track contributions to investments and income or distributions from those investments; and much else.

There are a few important differences between the services, though.

Minty Fresh

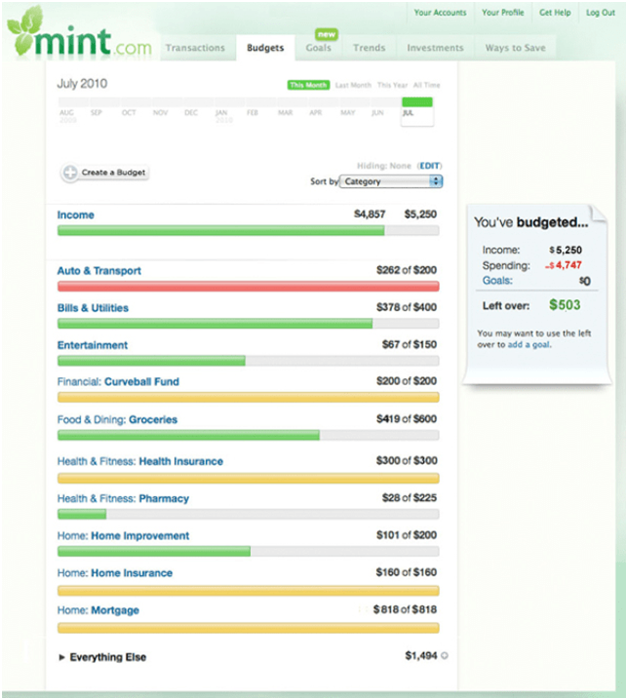

If you’re more focused on debt management, it might be best to start with Mint. Mint can help get you into good habits and make you more financially goal oriented. Your budget is front of mind with Mint, making it easier to get into good habits and stick with them.

Along those same lines, Mint also allows you to set up goals, such as paying down a credit card by a certain time, or saving up for a big vacation. You can track your progress toward these goals using the program.

Finally, unlike the other services, Mint actually allows you to pay bills through its portal. This won’t be a big deal if you have automatic payments set up that pay bills via a credit card or bank account. But if you’re the type that likes to pay bills yourself, Mint’s service can come in handy, as you can pay practically all of your bills in one place.

Take It Personally

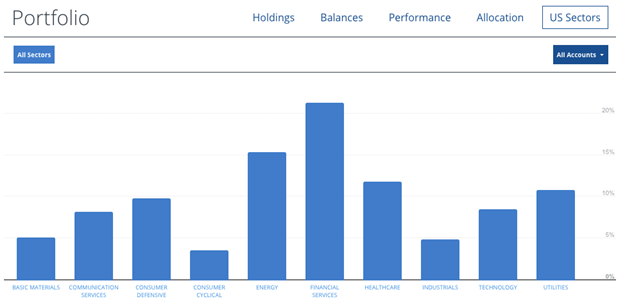

A one-sentence attempt to describe the difference between Mint and Personal Capital might read something like, “Mint is more budget oriented, while Personal Capital is more investment oriented.”

There’s more to it than that, and it’s definitely a generalization, but it’s an accurate one. While both services allow you to track your investments, Personal Capital delves a bit deeper into the investment side of things, allowing you to look at asset allocation, account performance, and investment fees, among much else.

Personal Capital will also allow you to run some rudimentary projections on whether you are on track for retirement. That part of the service is only meant to be a starting place for a plan, though. This is partially because Personal Capital’s business model is to get you onto their planning and advice platform, for which they charge an asset-based fee. (The rest of the service, like Mint’s, is free.)

Don’t Forget The Most Important Part

So budgeting and investment tracking are covered. What’s missing?

Plenty, actually. For a lot of people, part of the point of tracking this information is to find out what it will take to get to retirement--and how long it might take. You can figure this out and manage it yourself, too.

To do so, you’ll need a program like WealthTrace that can handle the following:

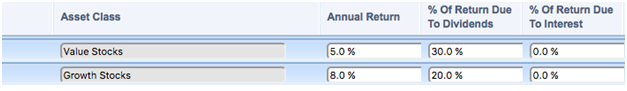

Projecting asset class returns. What kind of returns can you expect from your investment accounts going forward? WealthTrace can help you find out.

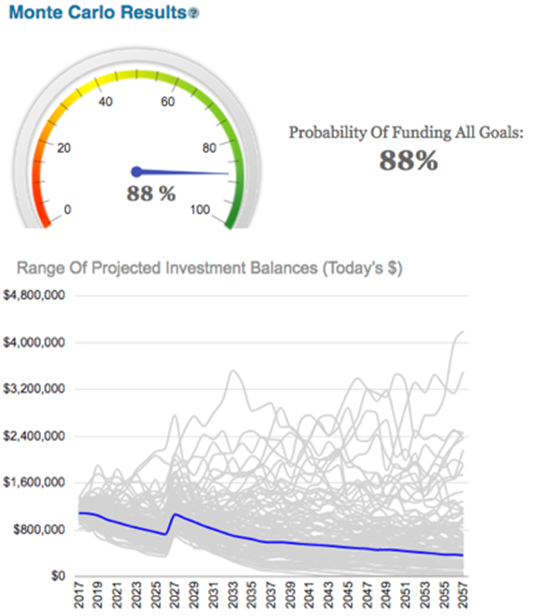

Stress testing. Stock markets are volatile. The closer you get to retirement, the more important that volatility becomes. You’ll want to be prepared for it--and know how to minimize it if it makes sense to do so. A program like WealthTrace takes those investment accounts you’ve been tracking in Personal Capital (and which you can track in WealthTrace too, by the way) and runs a Monte Carlo analysis on them (more on what Monte Carlo is and its importance here).

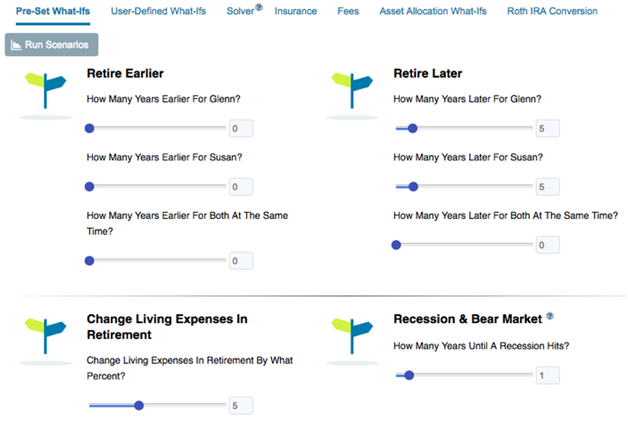

Another way to stress test a portfolio is through scenario analysis. Stuff happens; you want to know how it affects you if and when it does.

What if you decide to retire earlier than planned, or later? What if a recession hits in a few years--would that knock your portfolio off course? What if your living expenses are higher than expected in retirement? WealthTrace can help with these what-ifs--and many others too.

If you’ve gone as far as being good about budgeting, managing your debt, and tracking your investments and other financial accounts using one of the online tools out there, that’s great. But don’t stop there. Take it into the home stretch: Planning for retirement and beyond. For that, you’ll want a program like WealthTrace that can do some forecasting for you.

WealthTrace is the whole package: Financial planning software that is as powerful as an advisor would require, but easy enough for individual investors to use. Click here to sign up for a trial subscription.