Key Points

- Paying a financial advisor an annual percent of your assets can cost you more than a million dollars over time.

- New models, such as hourly financial planning help, have arisen that can save you a ton of money and give you expert help when you need it.

You may have seen articles in the financial press recently about the rise of index-fund investing and the demise of active management (stock picking). This is actually nothing new. Investing has been evolving this way for many years, and is in large part a welcome development: Over time, most active management does not beat the indexes, and is expensive to boot. Low-cost indexing is the way to go for most investors.

But this narrative raises a big question for investors who work with financial advisors. If low-cost index funds beat the stock market most of the time, why pay an advisor a fee based on how much you have invested with them (an asset-based management fee)?

When you buy a cable or satellite TV package, you're (almost surely) paying for channels you never watch. That is what has led to the so-called cord-cutting movement. More TV viewers are being selective and budget-conscious, hoping to pay only for what they watch.

The same general concept applies to financial planning. There's no need to pay for services you're not using. By investing in low-cost index funds, you're removing a large portion of what you might normally pay an advisor for. (We have previously written about low-cost investment options for a retirement plan, including index funds, target-date funds, and dividend-paying stocks.)

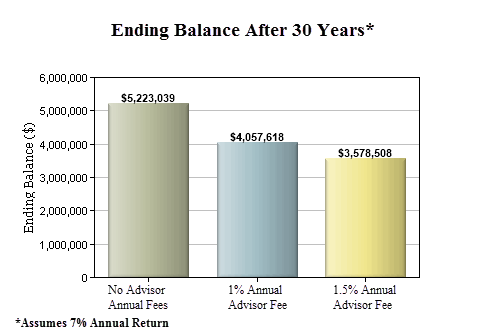

How Much You Can Save By Going Hourly

Take a look at the chart below. This shows you how much a financial advisor will cost you over 30 years if start out with $500,000 saved and contribute $15,000 a year. The balance of your portfolio can shrink by as much as $1.6 million if you go from no advisor annual fee to a fee of 1.5%.

Let's now take a look at how the hourly model can save you a ton of money while still giving you the help you need. A client with $500,000 in assets might pay an advisor 1% of assets, or $5,000, each year for the advisor's services. Converted to a rate of $200 an hour (which an hourly advisor might charge), that's 25 hours' worth of services per year.

But if you're paying an advisor who charges by the hour, you'll almost certainly not need anywhere near 25 hours' worth of services per year. Let's say it's more like 10 hours per year, or $2,000. That's $3,000 more in your pocket annually (or, better yet, in your IRA).

In addition, when you're paying by the hour, your advisor's incentives are better aligned with your goals. You're paying for your advisor's expertise, and your advisor is less likely to be getting paid by a mutual fund company to sell you a product.

You're also more likely to get one-on-one access and the advisor's undivided attention for the hours you pay for. With an asset-based fee, you're paying regardless.

With the investment portion largely handled (aside from some asset allocation decisions and an assessment of your tolerance for risk), what sorts of things might you talk to an advisor about for that 10 hours per year? Here are just a few possibilities:

- Can I retire early? (Or, what do I need to do to retire early?)

- How would planning to work part-time for some years early in "retirement" affect my retirement date?

- Should I pay off my mortgage?

- Is long-term care insurance a good idea?

- Should I take my pension as a lump sum, or as an annual payout?

- When should I begin taking Social Security payments?

- From which accounts should I draw down first in retirement?

- Should I convert a portion of my traditional IRA to a Roth IRA?

- What effect would selling my home and moving into a smaller home have on my retirement plans?

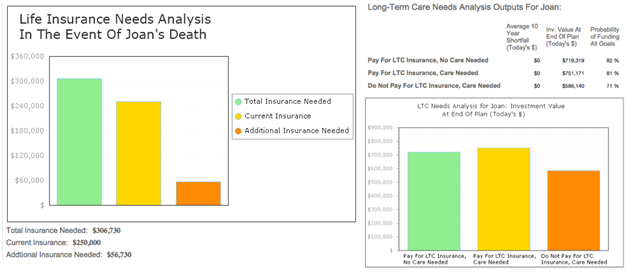

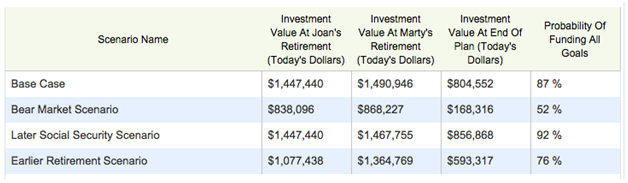

A financial planner paid by the hour can review with you some of the more technical aspects of retirement planning, such as life insurance and long-term care insurance needs (top image), or stress testing a plan with what-if scenarios (bottom image). With WealthTrace you can have access to your own financial plan and get hourly expert planning help and coaching.

A financial planner paid by the hour can review with you some of the more technical aspects of retirement planning, such as life insurance and long-term care insurance needs (top image), or stress testing a plan with what-if scenarios (bottom image). With WealthTrace you can have access to your own financial plan and get hourly expert planning help and coaching.

In the age of index mutual fund fees that can run as low $500 annually for a $1 million portfolio, it only makes sense to eschew big asset-based advisor fees, and pay hourly for expert advice on the harder-to-understand aspects of a retirement plan. As with anything else, shouldn't you pay for what you need, and get what you pay for?