The power of growing dividends over time continues to be underestimated by many investors. Many are concerned with another decade of slow growth and low to negative equity returns. However, one way to prepare for another decade of slow economic growth is to invest in dividend paying stocks that have shown they can weather tough economic times and not slash their dividends while it happens.

One such company is Merck (MRK). One big, and justifiable, knock on Merck from dividend investors was that they had not increased their dividend in seven years. Thankfully that just recently changed as their dividend payment was boosted by nearly 11% in 2011.

| Merck: |

| Div Yield | 1 Yr Div

Growth Rate | Annualized 3 Yr Div

Growth Rate |

| 3.7% | 10.5% | 3.5% |

| Annualized 5 Yr Div

Growth Rate | Payout Ratio | Last Year in Which

Div Did Not Increase |

| 2.1% | 75% | 2010 |

*Profile (Taken from Yahoo Finance)

Merck & Co., Inc. provides various health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. The company provides human health pharmaceutical products, such as therapeutic and preventive agents for the treatment of human disorders in the areas of cardiovascular, diabetes and obesity, respiratory, immunology infectious diseases, neurosciences and ophthalmology, oncology, vaccines, and women's health and endocrine.

Merck is an interesting case study in how dividend investors will fare if the company starts increasing their dividend at a consistent rate like they always had prior to 2004.

It is not necessarily obvious how investors will fare if they hold onto Merck for the next 10 years, receiving not only the dividend, but a growing dividend over time. It’s important to analyze scenarios for such a company where we look at the dividend yield and growing dividends.

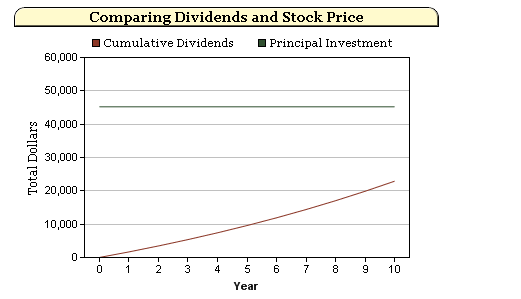

I ran the following scenario on our publicly available calculator called Total Returns- Dividends vs. Price Appreciation. Let’s take a look at how Merck will fare if their dividend grows by 3% over the next 10 years.

| Inputs: |

| Investment | Dividend Yield | Growth of

Dividend (Annual) |

| $73,000 | 3.7% | 3% |

| Outputs: |

| Total Return | Annual Return | FV Dividends | FV Investment |

| 51% | 4.2% | $22,901 | $45,200 |

An annual return of over 4.2% when the stock price isn’t too bad considering only a 3% annual growth rate in their dividend. The relatively high starting dividend yield for Merck is what makes this possible. I also included the future value of the dividend income stream compared to the future value of the initial investment. The dividends accumulated to more than $22,000 over the 10 year period. Looked at another way, the price of this stock could fall by almost 50% during this period and the investor would still break even. Now let’s take a look at what happens if Merck increases their dividend by an average of 6% over the 10 year time frame.

| Total Return | Annual Return | FV Dividends | FV Investment |

| 59% | 4.7% | $26,554 | $45,200 |

The annual return jumps to 4.7% even with no growth in the stock price. The key here is the growing dividend payments over time. That is the beauty of high dividend paying stocks over time. The initial investment becomes less and less important.

Dividend growth stocks can help a retirement plan immensely, especially vs. low-yielding treasury bonds. I plugged in the 4.2% total return figure I found in our first example into our retirement planner in place of the ten treasury bonds that were in the portfolio before.

I found that if a typical 55 year old couple with $400,000 in assets, with half invested in treasuries, moves 50% of their funds from treasuries to dividend payers that give them a 4.2% return, over ten years they will have increased the time that their funds last in retirement by over 9 years.

I believe that investing in Merck today for the long run will pay off only if they continue to grow their dividend over time. Scenarios such as the ones I’ve run here can help investors understand the power of dividends over time, especially when those dividends are growing.