When you're early in your working years, or even not so early, it can be tough to conceptualize how retirement might happen. You might have a vague idea that, if you have a large chunk of money, then you won't need to worry much about budgeting or spending or how you'll manage to pay the bills without a job. But otherwise, retirement might seem inconceivable at best, or unattainable at worst.

But it usually starts to become clearer as you approach retirement age range. You start to look at the assets you have (hopefully) accumulated, and start to pay more attention to what you're spending (if you're not budget-minded already), and it starts to come into focus.

Let's try to sharpen that focus a bit. Here's a list of things to do if you anticipate retiring five years out or less. Running through these items should help you determine if you're really ready for retirement.

What Will Your Costs Be?

The first thing to do is to start tracking your spending if you're not doing so already.

Like eating your vegetables or flossing, you know this is something you should already be doing. If you are doing so, great (and same for the flossing!). If not, well, then you're probably not ready to retire.

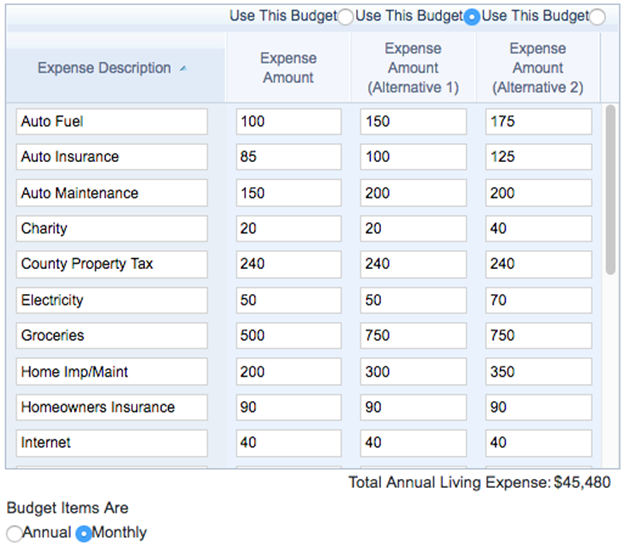

WealthTrace can help you get your retirement budget together.

WealthTrace can help you get your retirement budget together.

Any discussion of how much you need saved for retirement has to start with how much you're going to spend in retirement. At the risk of stating the obvious, you have to live within your means in retirement the same way you do when you have employment income.

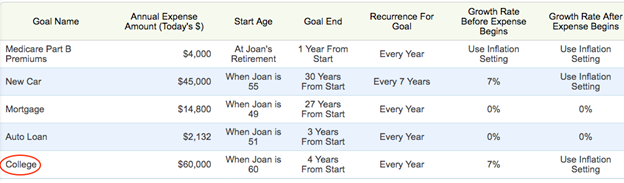

It's also worth taking some time to really think about what major expenses might pop up in retirement. Overlooking such expenses might not derail a plan entirely, but could force you to unexpectedly rethink your spending. "Unexpectedly" is not a word you want to hear in conjunction with retirement.

Such major expenses could include:

Cars. Do you buy tend to buy it used and drive it until it's dead, or do you get a brand-new car every three years? Either way, you'll want to make a realistic assumption about what you'll be spending on vehicles, and how often. (Don't forget to net out the trade-in value, at least in the latter case.)

Medical Expenses. We'll need more medical care as we get older; that's not exactly a news flash. So it's Medicare to the rescue, right?

Not exactly. Although you'll at least be partially covered by Medicare if you have paid into it, you'll likely have additional costs, either through other Medicare options (like Part B), another form of private health insurance, or out of pocket.

College. Not for you, but for your kids, or maybe your grandkids. If you plan to cover a portion of someone's college expenses, even if it's a long way off, be sure to budget for it.

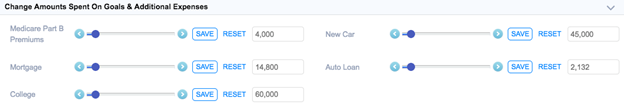

Tracking one-time expenses--or expenses that will only last a specific period of time--is easy to do in WealthTrace.

And So On. Do you like extravagant vacations--or, rather, will you want to take extravagant vacations? Might you be paying for a wedding? Add these to the list--any big expense you can think of that might be coming down the pike. If, after putting your retirement plan through its paces, you find that you're coming up short, you can take out any major expenses that you might not be able to afford. Again, the word "unexpected" is not one you want to hear in retirement--unless it's in conjunction with the word "surplus" or "windfall" or something like that.

In fact, consider budgeting for the unexpected. By definition, that's not entirely possible, but throwing in an "Unexpected Expense" line item (to cover, say, a big medical deductible payment, or a broken water main, or a hundred other things we could list here that would only just begin to cover the things that could happen out of the blue) that occurs every couple of years or so wouldn't be a bad idea.

With WealthTrace, you're able to prioritize your goals and expenses--and see what the effect would be of modifying their projected cost.

There could be some good news amidst tallying up all of the big-ticket items you'll be looking at once you're retired. Some costs you have grown accustomed to should disappear or decline. Most people probably will spend less on transportation costs, for example, because they're no longer commuting. Less gas, less auto maintenance, fewer commuter train tickets. Maybe you can become a one-car household. What about your mortgage--is that on its way out too? Kids moving out of your house might not coincide exactly with your retirement date, but the disappearance of this and other substantial expenses should be taken into account.

What's In Your Wallet?

Next up are your investment assets and what they might reasonably be expected to produce in income.

We won't list every possible kind of investment asset here, and anyway you should know what you own. But there are some details about your investment accounts that you'll want to have handy, or be thinking about.

Cost Basis. This is mainly important for taxable investment accounts and Roth IRAs. How you'll be taxed on the accounts' realized capital gains will partly depend on this information. Your broker(s) should be able to provide you with the cost bases on your accounts. If you use the WealthTrace planning software and link your accounts, the cost basis will come in automatically.

Holdings Today. In what asset classes are you invested? If you link your accounts in WealthTrace via our partnership with Yodlee, we'll handle this for you. Otherwise, you can tell us what your asset classes look like.

Asset class information is critical in helping to predict what your investments' total returns might look like. There are lots of sources of information on how asset classes perform; we factor our own estimates into WealthTrace, but you can modify them.

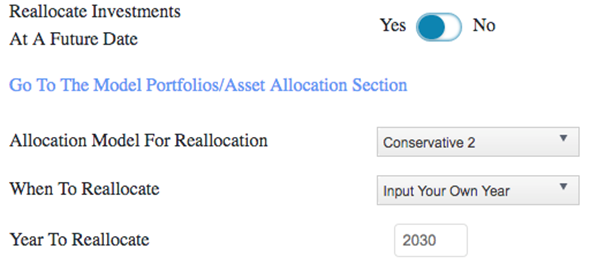

Holdings Later. You'll probably want to go to a more conservative asset allocation as you get older. What will that do to projected returns and the success of your plan?

WealthTrace can run your assets through a reallocation and help you determine if it would be helpful to your plan.

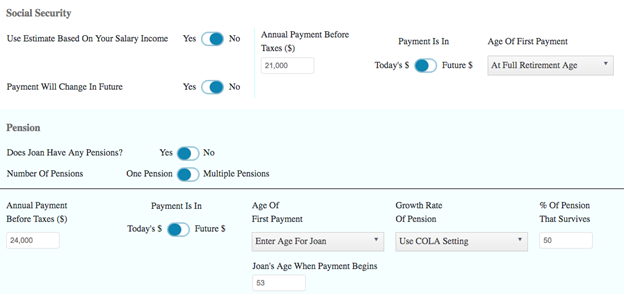

Cash Generators. What other sources of income do you anticipate that aren't investments? For most people, this will be inheritances, Social Security benefits, and pensions. You'll definitely want to include these, but be conservative (that is, shoot low) with your estimates. You can even give your projected Social Security benefits a haircut if you're concerned Social Security might not be entirely there for you when the time comes to take your benefits.

While we're on the topic: Having a pension or Social Security benefits that can be expected to pay you a certain amount of money each year is every bit as good as a portfolio of investments, or maybe even better. A retiree with a good pension should generally need a far smaller portfolio than a retiree without one. A $30,000 pension, for example, is arguably the same as having a $600,000 portfolio yielding 5% (though without the ability to tap the principal, of course).

Put The Puzzle Together

At this point, you have the data you need to create a plan, and a couple of options for putting the whole thing together.

One way is to manually tally up inflows and outflows and make sure you're within the guidelines of the conventional benchmarks for spending in retirement. Those benchmarks might be the 4% rule, the 3% rule (which has more or less replaced the 4% rule in recent years), the income replacement rate (which has been discredited in recent years), or whether you have saved X times your salary at age 30, 40, 50, and so on.

See any issues here? What were once thought to be rules turn out to be temporary. You might target one of these benchmarks and then find that, due to factors beyond your control (such as persistently low interest rates), you can't rely on it any longer.

The other way of tracking it is to set it up in a program like WealthTrace.

You can guess which one we'd recommend. That way, all you need are the facts. WealthTrace can handle the rest and tell you whether you're on track to retire.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.