Key Points

- Financial empowerment is the feeling that you are in control of your financial and retirement situation.

- Financial empowerment is not necessarily about your wealth or level of income.

- Financial education is one of the key components to feeling empowered about your finances.

Financial Empowerment: What it is and is not

Financial empowerment is really a feeling and not a number. It’s the feeling that you are in control of your finances, your financial situation, and you feel on track to retire with confidence.

It may come as a surprise that there are many people with high incomes and wealth who do not feel financially empowered. It doesn’t matter if you have $2 million, $3 million, or even $10 million. It’s not the amount of money that matters. It’s really about knowledge and knowing what you need to do to get your finances in order.

There are many people with below average incomes who feel financially empowered. People can earn a very good living, but not understand how much they need to save for retirement or how they should be investing their money. On the flip side, there are plenty of people who are lower-income that understand exactly what they need to do to reach their financial goals.

Financial empowerment isn’t about how much money you have. It’s about starting down a path to financial literacy and wellness, feeling confident about your finances and ready for unplanned events in life. With financial empowerment comes the ability to tackle challenging financial times with self-assurance.

Why Are Some People Financially Empowered and Others are not?

Most people that have a sense of financial empowerment have educated themselves about personal finance. There are many resources online that are free and millions of people have taken advantage of this to gain financial literacy.

Many people that feel financially empowered also feel like they have their arms around their retirement situation. They have either hired a financial planner to build a retirement plan for them or they have built their own retirement plan. Instead of relying on antiquated rules for retirement, such as the 100 minus age rule and the 4% rule, they have a comprehensive retirement plan built where they can see exactly how much they need to save for retirement, when they can retire, and how much they can spend once they do retire.

Software to Help with Financial Empowerment

There are a lot of great software applications that can help with financial literacy and financial empowerment. Mint.com and other budgeting applications allow users to import and link credit and debit cards in order to track a budget. Millions have been helped with their budgeting using web-based budgeting software.

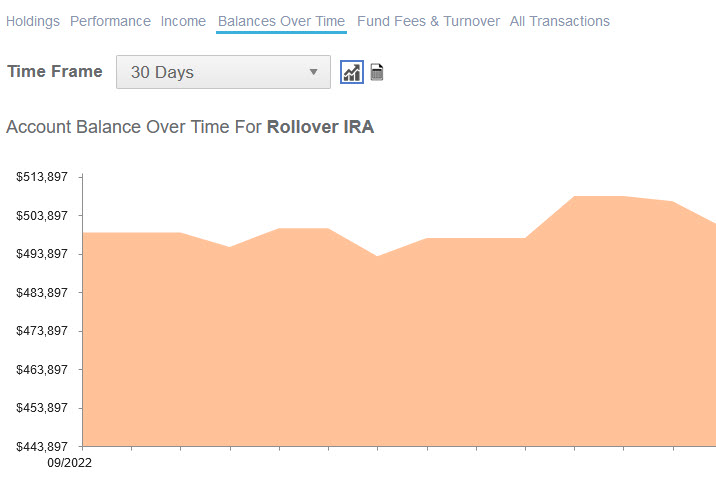

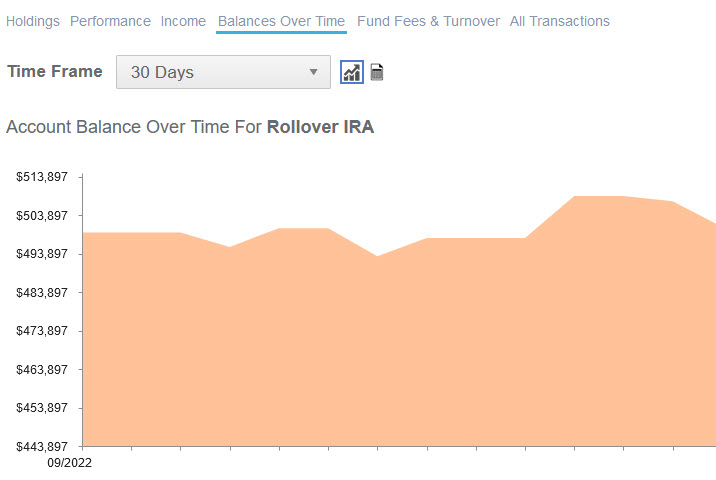

For retirement planning, WealthTrace is the best retirement planning software there is for consumers. It not only provides detailed and comprehensive financial and retirement planning, it also allows users to track their investment account balances, holdings, performance, and transactions over time. You can get started with a 7 day free trial.

Being able to track account balances for every account in one location helps with your financial empowerment.

It is not an overstatement to say that fear of running out of money in retirement is one of the biggest fears that people have. This is a very good example of not having financial empowerment. The fear of running out of money causes stress, anxiety, and can lead to sleepless nights. This is why it is so important to have a retirement plan in place. It can reduce stress and anxiety and let you know when you can retire comfortably.

Getting to the goal of financial empowerment takes practice and some work. But when you create a financial and retirement plan and, ultimately, a financial cushion for yourself, then you will have the ability to power through financial mistakes or sudden changes in your life.

Use WealthTrace’s retirement planning software to find out what you need to do in order to retire comfortably and without stress.

Educate Yourself and Become More Financially Literate

If you are serious about wrapping your arms around your financial situation and you want to become more empowered with your finances, you should start educating yourself right away. You don’t even have to spend money to do it. There are thousands of financial blogs and websites that have helped millions of people, such as bogleheads.org.

You can also sign up for online personal finance classes to help you learn more. The more you learn about personal finance, the more confident and empowered you will be. This will then help you make confident and solid decisions around your finances and retirement.

The time to start is now. The sooner you know where you stand financially the better. When you become financially literate you will be ready to make sound financial decisions that will compound over time for the better.

Do you want to start down the path of financial empowerment? Sign up for a free trial of WealthTrace to run your own comprehensive and accurate retirement plan.