Key Points

- In certain circumstances it makes sense to withdraw from an IRA or 401(k) before it’s required.

- There needs to be a combination of variables for early withdrawal to make sense.

- The only way to figure out if early withdrawal from qualified retirement accounts makes sense is to run withdrawal scenarios in a detailed retirement planning application.

A general rule of thumb when it comes to taking money out of qualified tax-deferred retirement accounts, such as regular IRAs and 401(k) plans, is this: Postpone withdrawing from them as long as you can. In other words, if you have other sources of retirement income or investment principal you can use, you should almost always use that first.

The main reason that most people should hold off on taking any money from their qualified retirement accounts is simply that we are taxed at our full marginal federal and state tax rates for all withdrawals. Postponing the tax hit means the money in the accounts gets to grow tax-deferred just a bit longer.

Withdrawing From An IRA Early: Analysis

Let’s take a look at what happens when a couple decides to withdraw from their IRA before their Required Minimum Distributions (RMDs) begin at age 70 ½. I set up a couple’s retirement plan in the WealthTrace Financial and Retirement Planner. This couple is 60 years old. They have $300,000 in taxable investments and $1 million in their IRAs. Their asset allocation is 60% in U.S. stocks and 40% in medium term treasury bonds. They are currently retired and will not take their Social Security benefits until they are 67 years old. Their Social Security payments will be a combined $45,000 at that point. They also plan to spend $70,000 per year in retirement until they reach their life expectancy of 85 years old.

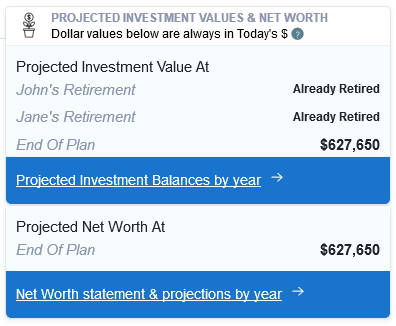

Because they won’t be receiving their Social Security payments for another seven years, they need a way to fund their retirement expenses until that point. In the WealthTrace planning software, the default setting is to take from taxable accounts first before touching any IRAs. This is what I used. It is important to also note that in this example the cost basis of their taxable account is the same as the current balance. I found the following results for their retirement plan:

At the end of their plan they are projected to have a little over $627,000. This can be considered their safety buffer for emergency spending or market downturns.

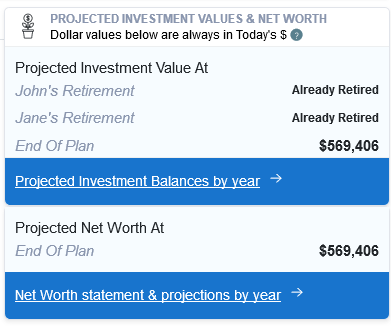

What if they decided to withdraw from their IRA instead of their taxable account? We know they will pay the full income tax rate on these withdrawals, but there are certain circumstances where this makes sense. We have discussed this “tax torpedo” effect before. Basically large RMDs combined with large Social Security payments can abruptly push a person’s Social Security tax rates into a much higher bracket. Sometimes it can make sense to take at least some IRA money before RMDs begin. But in this couple’s case, this does not hold true as you can see below:

In this scenario I locked out the taxable funds until their Social Security payments begin. You can see that they lose over $58,000 by pursuing this strategy.

The Impact Of Capital Gains

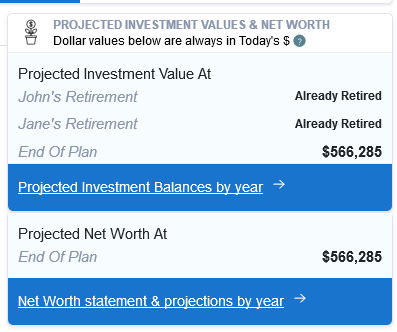

Remember that I previously mentioned their cost basis on their taxable account was equal to the current balance. This means they pay no capital gains taxes when they withdraw from their taxable account. Let’s change that assumption and see how this impacts the results. I set their cost basis to $100,000, which means they will pay capital gains on $200,000 of withdrawals. If they withdraw from taxable accounts first, we see the following:

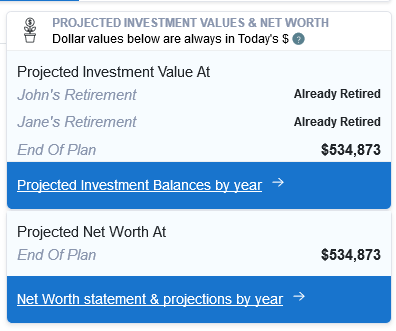

If we lock out their taxable withdrawals until age 67, we see this:

It’s still a losing strategy to withdraw from the IRA early, but the gap is not as large this time. The reason is that this couple is now paying capital gains taxes on the taxable money.

Does It Ever Pay To Withdraw From Qualified Retirement Accounts Early?

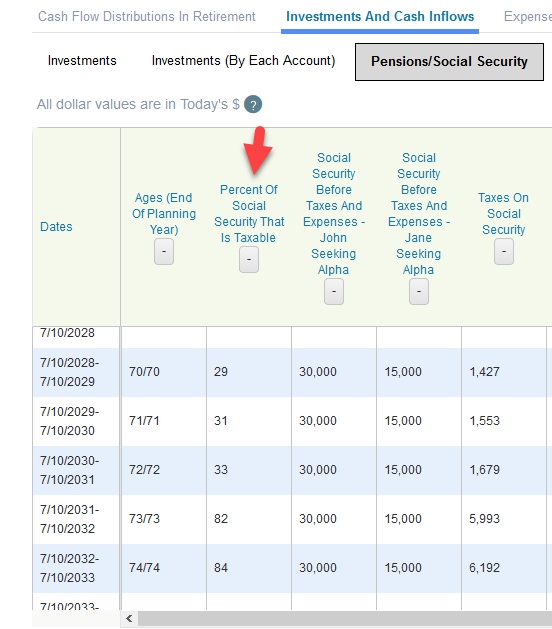

The simple answer to this is yes, but not very often. I ran several more plans and scenarios and I find that in general, the higher the capital gains taxes to be paid and the larger the overall income and future RMDS will be, the more likely it becomes that withdrawing from retirement accounts before taxable accounts makes sense. Large RMDs combined with other income can push a person’s Social Security taxes up very quickly. Social Security taxes are more complex than most taxes in that the rules are such that a person or couple can see the amount of their Social Security that can be taxed jump from 15% to 85% just due to having only a few more thousand dollars in income. This is an example of what economists are referring to when they discuss marginal tax rates above 100%. It usually happens when a couple loses lots of tax write-offs and benefits as they cross an income threshold. It can also happen with Social Security payments when there is a large jump in the percent of these payments that is taxable. In the plan I am running, I added an additional source of income when this couple turns 73 to show how Social Security taxation can take a large jump.

In this case, you can see that the percent of their Social Security that is taxable goes from 33% to 82% in just one year. This happens because they received an additional $25,000 in taxable income that year.

One more variable that can impact tax withdrawal strategies is the state tax rate on capital gains. The higher the rate, the more likely it can become that early withdrawal from qualified accounts makes sense.

Let’s go back to our previous example. This time I increased their state tax rate from 5% to 8%. I also added in pension income of $25,000 a year. I found that in this case it makes sense for this couple to withdraw from their IRAs early rather than using their taxable money. They save about $20,000 in the long run using this strategy.

Withdrawing From Qualified Accounts Early Is Usually A Bad Idea

It is not very often when it makes sense to withdraw from an IRA or 401(k) early. It takes a certain combination of Social Security payouts, income, and taxes that only a detailed retirement planning tool like WealthTrace can calculate for you. But it’s worth the time for many people to run these scenarios to see if it makes sense for them and their situation.

Do you want to see how to maximize your retirement portfolio’s value? Sign up for a free trial of WealthTrace to find out.