The power of growing dividends over time continues to be underestimated by many investors. Many are concerned with another decade of slow growth and low to negative equity returns. However, one way to prepare for another decade of slow economic growth is to invest in high dividend yield stocks that have shown they can weather tough economic times and even increase their dividends while it happens.

One such company is Walmart. With a dividend yield of 2.2% and a history of increasing dividends over time, Walmart is one of my favorite high dividend stocks.

| Walmart: |

| Div Yield | 1 Yr Div

Growth Rate | Annualized 3 Yr Div

Growth Rate |

| 2.2% | 11.0% | 11.2% |

| Annualized 5 Yr Div

Growth Rate | Payout Ratio | Last Year in Which

Div Did Not Increase |

| 15.1% | 28.0% | 1981 |

Walmart has a solid history of growing dividends over time. The last year in which the company did not increase its dividend was 1981. The growth rate of the dividend over the past 5 years has also been stellar at over 15%, although it has slowed to 11% in the last year.

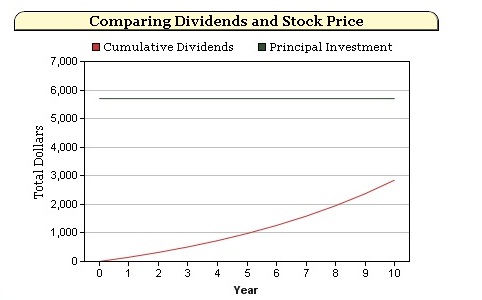

It is not necessarily obvious how investors will fare if they hold onto Walmart for the next 10 years, receiving not only the dividend, but a growing dividend over time. It’s important to analyze scenarios for such a company where we look at the dividend yield and growing dividends. If we buy 100 shares today, apply the 1 year growth rate of 11% over the next 10 years, reinvest dividends, and assume the price of the stock does not change, we get the following:

| Inputs: |

| Investment | Dividend Yield | Growth of

Dividend (Annual) |

| $5,700 | 2.20% | 11% |

| Outputs: |

| Total Return | Annual Return | FV Dividends | FV Investment |

| 45% | 4.0% | $2,850 | $5,700 |

An annual return of over 4% when the stock price hasn’t moved is definitely a victory. I also included the future value of the dividend income stream compared to the future value of the initial investment. The dividends accumulated to more than $2,850 over the 10 year period. Looked at another way, the price of this stock could fall by 50% during this period and the investor would still break even. Now let’s take a look at what happens over 20 years:

| Total Return | Annual Return | FV Dividends | FV Investment |

| 234% | 6.20% | $13,310 | $5,700 |

The annual return jumps to more than 6% even with no growth in the stock price. Again, the key here is the growing dividend payments over time. Also notice that the total dollar value of the dividend payments is nearly four times the value of the initial investment. That is the beauty of high dividend paying stocks over time. The initial investment becomes less and less important.

It is also important to run scenarios that are more pessimistic when it comes to growing dividends over time. So let’s take a look at what happens with a more conservative 6% growth rate over 20 years.

| Total Return | Annual Return | FV Dividends | FV Investment |

| 129% | 4.20% | $7,377 | $5,700 |

We still see an annual return of 4.2% even with no change in the price of the stock. Also, the total stream of dividend income still swamps the initial $5,700 investment.

Scenarios such as the ones I’ve run here can help investors understand the power of dividends over time, especially when those dividends are growing. Readers can perform the same analysis I’ve discussed by going to our free Planning Tools page and clicking on the link for Total Returns- Dividends vs. Price Appreciation.