Key Points

- This analysis runs thousands of scenarios and gives you the probability of a certain event occurring or not occurring. You can sign up for a free trial of WealthTrace, which has the most accurate Monte Carlo retirement simulations for consumers on the market, to calculate your probability of never running out of money.

- Applied properly to retirement plans, the WealthTrace Monte Carlo retirement calculator is a powerful tool to help you figure out when you can retire comfortably.

- Models like Monte Carlo are garbage in, garbage out. The assumptions must be based on reality and history.

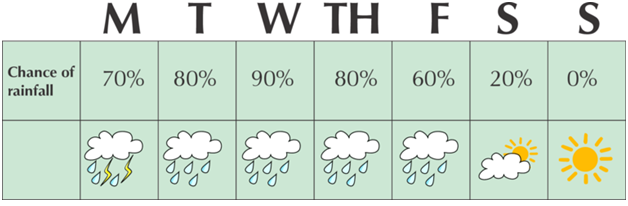

We all look at the weather forecast from time to time. Some of us look every day. But how many of us ask the question, "Will it rain tomorrow or not?"

That is not the question most of us are asking. We almost instinctively ask, "What is the probability of rain tomorrow?"

Monte Carlo Calculator For Weather

We almost take for granted what goes into a weather forecast that says there is a 10% chance of rain tomorrow. But behind the scenes there are very powerful computers running Monte Carlo simulations, using hundreds of variables that impact the weather.

These weather models are run using thousands of scenarios. The number of times it rains in these scenarios is then divided by the number of scenarios run. This gives us the probability that it will rain.

Monte Carlo Simulation For Retirement

The analogy for retirement is this: Do you really want to ask "Will I outlive my money in retirement or not?" You can ask that, but what you also need to be asking is "What is the probability that I do not outlive my money in retirement?"

Just like any modeling process, Monte Carlo retirement simulations are garbage in-garbage out. There are a few Monte Carlo retirement calculators out there that take in a few basic assumptions and spit out the probability of success, which usually means you do not run out of money at any point.

Most of these calculators do not dig deep into your own personal situation and information. But if the Monte Carlo retirement calculator doesn't take into account you actual assets, correct tax rates, historical volatility of your investments, the correlations among your investment types, and all of your other retirement income sources, the answer it gives won't be worth much.

Holistic Monte Carlo Retirement Simulations

In order to get an accurate assessment of your probability of never running out of money, you need accurate retirement planning software. Our customers use the WealthTrace Financial & Retirement Planner to get an accurate view of their retirement situation, including their probability of plan success. You can use our software for free by starting here.

In our retirement planning software we take into account the following:

- Historical volatility of all major investment types

- Historical correlation among the investments

- Historical rates of return for investments

- Changing taxes over time using up to date tax laws

- Other income sources such as social security and pensions

- Different account types such as Traditional IRAs, Roth IRAs, 401(k)s, 529 plans, tax-free accounts, and many other variables that impact your financial plan.

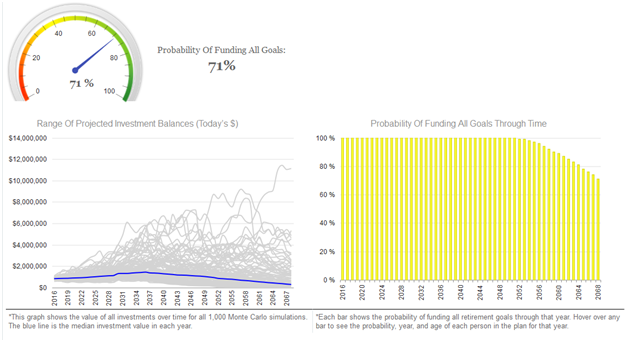

An example of what we show for Monte Carlo retirement simulations is below:

Our Monte Carlo retirement calculator runs 1,000 scenarios where the rates of return for every investment changes in each year. We take the number of scenarios where money never runs out in retirement and divide it by 1,000 to find the probability of success (never running out of money).

In this example this person has a 71% chance of never running out of money. Also unique to WealthTrace is the graph on the right, which shows the probability through any given year. This is nice to have as it shows the probability of never running out of money as your life expectancy increases. Notice how the probability declines as this person's life expectancy increases, which is what we would expect.

The Bottom Line

Using quick and easy calculators can be completely fine for a first pass at retirement and financial planning questions. But it's very important not to make serious decisions about your retirement plan based on simple calculators. You want to use a Monte Carlo retirement calculator that is powerful, accurate, and assesses your actual situation and investments.

What is your probability of never outliving your money? WealthTrace can give you that answer. Use a free trial of WealthTrace to calculate your probability of retirement success.