Key Points:

- You owe it to yourself--and your retirement--to do better than basing it on a simple spreadsheet. Using planning software such as our WealthTrace financial planner gives you the full picture.

- Tax rates and one-time or irregularly occurring items can have a big effect on a plan.

- Details matter, and often can't be captured using a spreadsheet or a simple short-form retirement calculator.

On the heels of our recent article about using a retirement budget planner, we wanted to point out that a budget, while important, is not enough on its own. It's really just a start.

The basic theme of that recent article was that, even if you don't feel like you need a budget before retirement, it's a useful exercise to track spending so that you'll have a sense of what you'll need during retirement.

As important as projecting that spending is--and in fact it's sometimes overlooked, in our view, as people tend to focus their efforts on saving and investing--a really comprehensive retirement plan is going to go a lot further.

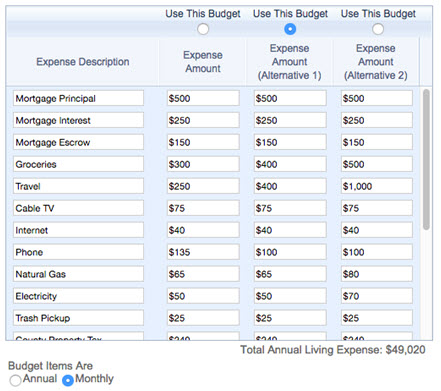

In our last post, here's what a portion of the worksheet looked like:

WealthTrace allows you to have three variations on a budget, and to toggle among them to see what the effect of changing things up would be on a plan.

WealthTrace allows you to have three variations on a budget, and to toggle among them to see what the effect of changing things up would be on a plan.

It's pretty standard stuff. But once you have the spending estimated, what's next? Quite a bit, actually.

Details, Details

To get the most accurate results possible, you have to be very detailed with your inputs. This is a big problem with a lot of retirement calculators on the web: They can't give you detailed, accurate results without accounting for things such as:

- Tax rates on various sources of income

- Various account types, such as taxable or tax-deferred (such as 401(k)s or IRAs)

- Varying total return rates for those accounts

- Inflation

- Social Security benefits

To account for those items (and others) properly, a calculator or program needs specifics.

Take The Time To Get It Right

While it would be great if, as some calculators seem to indicate, you could find out after answering five simple questions whether you're on track for retirement or not, it's simply more complicated than that. And you owe it to yourself, and your future, to take the time--and it does take a bit of time--to get it right.

WealthTrace has you covered in this regard. Here are just a few of the things WealthTrace allows you to account for.

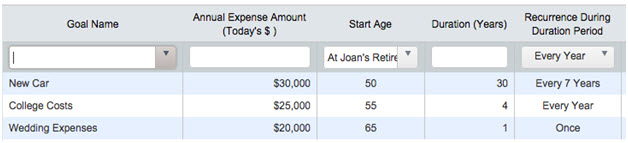

The Rest Of The Spending

The worksheet in the first picture above is for somewhat predictable spending that happens on a regular basis. You need somewhere to put the non-day-to-day spending as well--bigger things that you want to do or plan for.

WealthTrace allows you to enter one-time items, and with a high degree of detail that you won't find everywhere.

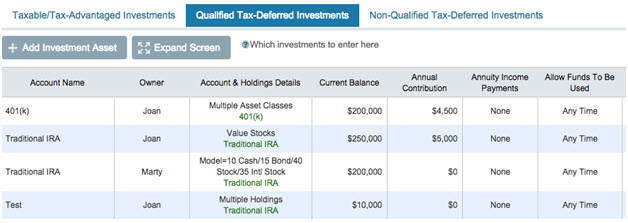

Investments and Inflows

Where are your investments? Not just how much do you have invested, and not just in what asset classes, but in what type of accounts is the money invested?

This matters, mainly due to the effects of taxes: Tax deferral (not paying taxes on any gains until later, usually after retirement) can make a huge difference in a retirement plan.

WealthTrace handles projected IRA and 401(k) contribution amounts, taxes when you start taking distributions, and more.

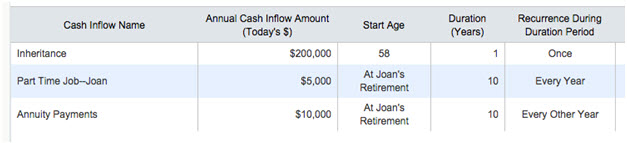

What about one-time or irregular cash inflows? Similar to non-day-to-day spending, these also need to be accounted for when trying to put together an accurate retirement plan.

You can't always know what the future holds. But if you do, WealthTrace can take that information and make your plan forecast that much more accurate.

Where Did These Total Returns Come From?

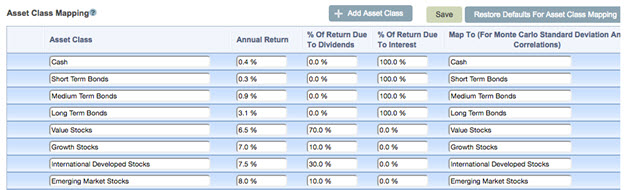

A lot of retirement planning calculators will default to certain annual rates of return based on the historical rates of return on an asset class. But what's going on behind the scenes? Taxes, as indicated earlier, matter. Qualified dividends, for example, are generally taxed at a much lower rate than ordinary income (such as interest income). So when you're talking about the total returns on a specific asset class, you need to have an idea of the components of that total return figure to calculate taxes properly.

WealthTrace not only breaks those components down, it allows you to modify them. If you want to see how changes in assumptions to the components of total return will affect your plan, you can make those changes (and you can always go back to the defaults with the click of a button).

Breaking down the components of total return is another way WealthTrace can your plan forecast more accurate.

We're not saying don't use a retirement planning worksheet. (By all means, do so, if you're comfortable with spreadsheets!) We're just saying that that's only be the place to begin. Piecing it all together is best handled by a comprehensive piece of software like WealthTrace.

Let WealthTrace can handle retirement planning for you. Sign up for a free trial of WealthTrace to find out more.