Key Points

- There's a generally accepted way of withdrawing from investment accounts in retirement.

- Sometimes there are reasons to handle those withdrawals differently, such as when using a bucket strategy.

- WealthTrace allows you to adjust the order in which accounts are drawn down.

We like stocks for retirement portfolios--we have made no secret about that. And we like them in retirement in addition to the years leading up to retirement. That is, there's a place for stocks in almost any portfolio, including in retirees' portfolios--and sometimes a good chunk of them.

But there's one thing you usually can't count on stocks for: using your principal for the lion's share of retirement expenses. Heading into retirement with a large investment portfolio is advisable, but you want to make sure you have the asset classes right. A portfolio largely made up of equities could be cut in half in short order by a bear market. If you had a $2 million portfolio that turned into $1 million in less than a year, mostly due to market gyrations, would your retirement plan still be viable?

WealthTrace has a bear market scenario you can run that will show you what could happen. If you're equity heavy, you should try it out. The results may shock you.

Your Other Bucket List

By the time most people are at or near retirement age, they have a number of investment accounts they can use as sources of income. That 401(k) you contributed to all those years has been rolled into an IRA; your taxable brokerage accounts have (hopefully) seen considerable growth in value; maybe you've got a Roth IRA too if you've been diligent.

Conventional wisdom says to take from the taxable and tax-advantaged (like that Roth) accounts first, then go for the qualified tax-deferred (like that traditional IRA) accounts. And if you happen to have annuities or other non-qualified tax-deferred accounts, those should be used in the middle of those other two.

But there are always exceptions to convention. A lot of retirees want to hold on to their Roth IRA and pass it on to heirs if possible. Or maybe there's an account you want earmarked for some other use besides day-to-day living expenses in retirement. Or maybe you have big unrealized capital gains in a taxable account, and don't want to take the tax hit (by realizing those gains) until you absolutely have to.

A bucket strategy sometimes means going against convention. For example, if you have certain accounts that are heavier on sure-thing assets (not stocks), you might want to draw down on those first, even if they're in qualified accounts.

What's a bucket strategy? There's no single way to describe it, but it effectively means you have different accounts--or buckets--that you'll be using to cover expenses in retirement, and that those buckets are sorted mainly by when they will be used.

A basic bucket strategy might look something like this:

First bucket: Cash or cash equivalents. The idea here is that you want the most liquid of assets to cover near-term living expenses. What "near-term" means will vary from person to person, but depending on your risk tolerance, it's likely going to be one to five years' worth of living expenses.

In times of low interest rates (like now), this can be a tough pill to swallow for some people. Potentially years' worth of living expenses just sitting there, earning next to nothing! But it might be the prudent thing to do if you are counting on a certain amount of money to live on and want to avoid going back to work.

Second bucket: Fixed income and solid dividend payers. In this bucket, we'll take on a bit more risk with some high-quality bond funds, dividend-paying stocks, master limited partnerships, and real estate investment trusts. Income from this bucket will flow to the first bucket as needed.

Third bucket: The stocks--or at least the growth stocks. This will be the most aggressive bucket of the three, and thus the most prone to potential losses. But as you've learned over the course of your investing career, the longer the time horizon, the greater potential for recovery and capital appreciation.

That's a basic outline for a bucket strategy. Here's how WealthTrace can be used to implement it.

Setting It Up

If you're going with a bucket approach, the first thing to do in WealthTrace is to make sure the program withdraws from your accounts in the order they are listed.

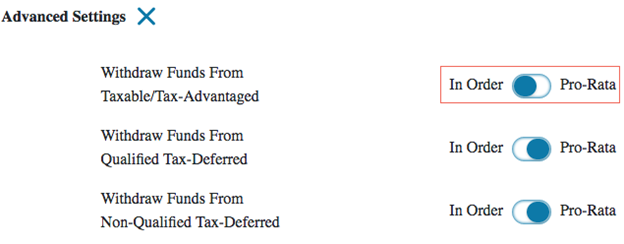

By default, the program will pull from each account on a pro-rata basis--meaning the withdrawals will come from the accounts in proportion to their balances. That's generally the best practice, but a bucket strategy more or less requires you not to do this, and to withdraw from accounts one at a time.

In WealthTrace, go to Plan Inputs & Assumptions-->Plan Settings/Assumptions/Taxes-->Settings and Assumptions-->Advanced Settings to change how the program handles withdrawals.

With that out of the way, you can now get to labeling and ordering your accounts to make implementing a bucket strategy a little easier.

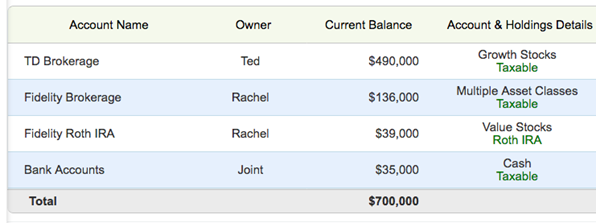

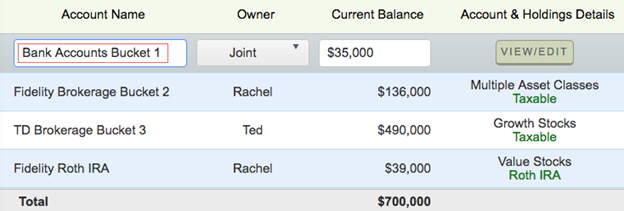

Here's the "Before" view of one couple's taxable and tax-advantaged accounts.

They've got brokerage accounts, a Roth IRA, and bank accounts. The bank accounts are an obvious choice for Bucket 1, since they're made up of cash. The Fidelity brokerage account can be Bucket 2, as it's in multiple asset classes already. That TD Brokerage account has a lot of unrealized capital gains in it, so the couple would like to hold off on using it. Besides, it's in growth stocks, so it's a great candidate for Bucket 3 anyway. And the couple would like to hold off on tapping that Roth for as long as they can, and possibly leave it to their heirs (which would be a tax-free transaction, incidentally, and with no required minimum distributions for the heirs, unlike with a traditional inherited IRA).

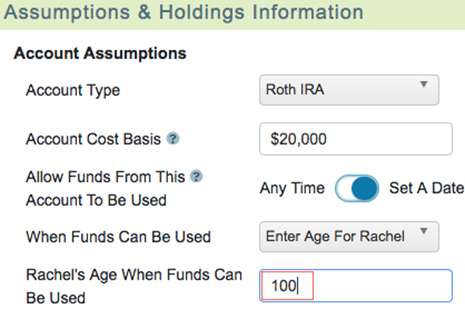

The first thing the couple does is "lock out" the Roth by telling the program not to touch it until Rachel reaches 100 years old. This ensures WealthTrace will assume the account continues to grow in value and is passed on as part of the couple's estate (unless Rachel makes it to 100).

WealthTrace allows you to specify when an account can be used to fund retirement.

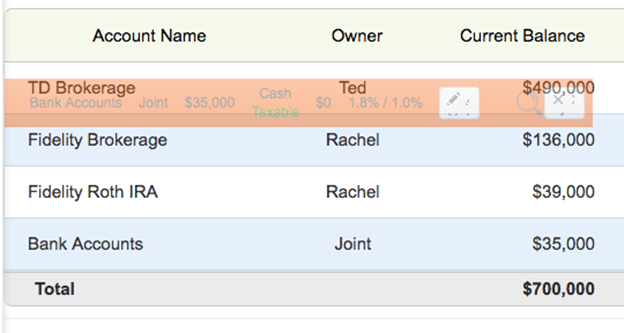

Next, they list the accounts in the order in which they expect the funds will be used.

You can drag and drop the rows representing your investment accounts. In this case, we've moved the bank accounts (in orange) to the top of the list.

Finally, to help them keep it all straight, they rename the accounts that will be part of the bucket strategy.

Name your accounts as you want to see them in WealthTrace.

Now it should be easier to keep track of the buckets. If the couple links their accounts in WealthTrace to their various brokerage and bank accounts, the program will reflect the balances and the flows between the buckets almost in real time.

Many Permutations

This is a fairly simplified example of how a bucket strategy can be set up. We didn't even touch on qualified tax-deferred investments and how those might be worked into the strategy. The main point, though, is that if you have a non-conventional way in which you plan to use your investments, you need a tool that is flexible enough to handle modeling it.

Do you want to maximize your retirement portfolio’s value? Sign up for a free trial of WealthTrace to find out how.