Key Points:

- Deferred compensation plans can save a high earner a lot of money in the long run.

- These plans grow tax-deferred and the contributions can be deducted from taxable income. You can see projections for your retirement plan with deferred compensation by signing up for a free trial of the WealthTrace Planner for Retirement.

- There are risks to these plans, such as the company declaring bankruptcy.

How Deferred Compensation Plans Work

Deferred compensation plans are becoming more popular for higher-income earners. These types of plan are non-qualified tax-deferred plans, which means that they are allowed to grow tax-free before the money is withdrawn. When the money is withdrawn, it is taxed at the owner’s income tax rate.

These plans do not have an annual contribution limit, which makes them even more attractive for higher-earning workers. By deferring income today, when a person’s tax rate is higher, and then taking the money out when retired with presumably a lower tax rate, a lot of money can be saved.

The rules surrounding these plans can be very specific to the plan you are in. They can be very restrictive in how they let you access the money too. Some plans won’t even let you access the money at all if you quit or change jobs. Others let you take the money out if you leave early, but you would have to pay the full income tax rate on the entire distribution. This is why it’s important to understand what you are getting into before signing up for a deferred compensation plan.

The Benefits

Wealth management and wealth maximization are big parts of financial planning for most high earners. Participating in a deferred compensation plan can help a high income person’s retirement situation immensely, allowing them to potentially retire much earlier than they otherwise could have.

The contributions to the plan are tax-deductible each year. The money in the deferred compensation account will also grow tax-free until it’s withdrawn. In both of these ways, it is similar to a 401(k) plan or traditional IRA.

Another benefit comes to those who work in a high tax state currently, but plan on retiring in a low to zero tax state. In retirement when they withdraw the money from the deferred compensation account, they will reduce or completely eliminate state taxes on the deferred compensation contributions and growth.

It’s difficult to figure out exactly how much you can benefit from a deferred compensation plan without using a sophisticated and comprehensive retirement planning application. To show the benefits of one of these plans to a high earning person, I used WealthTrace's retirement planning software to run a sample case study.

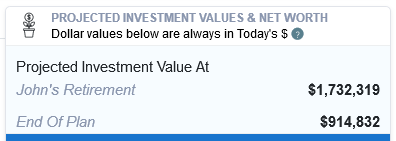

In my case study I have a high earning 50 year old man who makes $550,000 a year. He has $330,000 in taxable money saved and $330,000 in his 401(k) plan. He maxes out his 401(k) and saves an additional $55,000 a year to his taxable account. He is invested 75% in stocks and 25% in treasury bonds. He plans on retiring at age 60 and will spend $90,000 a year in retirement. I ran his financial and retirement projections and found the following:

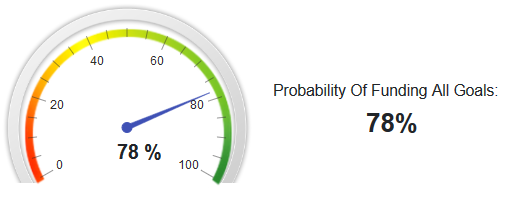

Our high-earner, John, is projected to have about $1.7 million when he retires and a little over $900,000 at the end of his life expectancy, which I entered as 85. His Monte Carlo results show a probability of never running out of money of 78%. These numbers are okay, but should be better given his high income and savings. The problem is that he is saving a lot to a taxable account that does not grow tax-deferred.

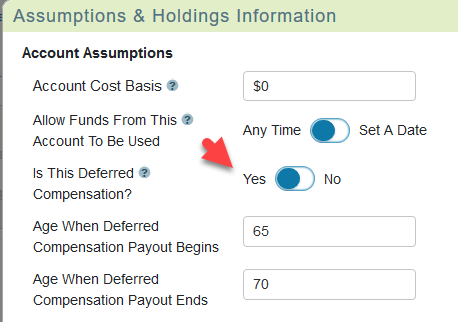

So what happens if instead of saving $55,000 a year to a taxable account he puts that money into a deferred compensation plan? I made this change in the plan.

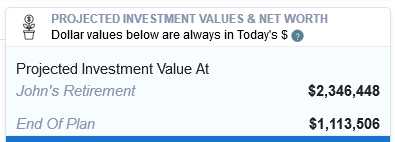

Not only will he move the $55,000 to deferred compensation savings, he will also use the tax savings to contribute even more. In this case the tax savings are about $22,000 per year. He will withdraw the deferred compensation funds over a five year period, starting at age 65. His new results are as follows:

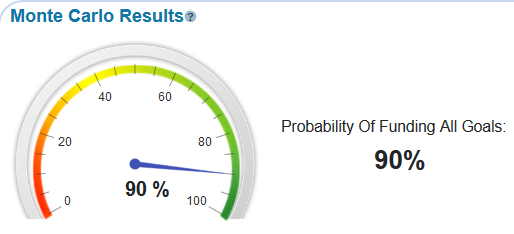

It’s no surprise that John will have more money when he retires and at the end of his plan. It’s also beneficial to his Monte Carlo results as his probability of plan success jumps to 90%.

The Risks Of Deferred Compensation Plans

As I mentioned before, most plans do not allow the participant to access the money early. If you switch jobs you might lose the entire account or you might have to take all of the money in a lump sum, which would trigger a big tax bill.

The biggest downside to most of these plans is the risk of the company declaring bankruptcy. It is surprising that most, if not all, of these plans aren’t in a trust that cannot be touched by creditors. If the plan is not in a trust, the money that you put in could be wiped out or partially wiped out in a bankruptcy. Incredibly, even if you leave the company before the company declares bankruptcy, the bankruptcy court can sometimes claw back the money you received if you were shown to have prior knowledge that your employer was close to being bankrupt.

Each plan is different and it is wise to understand exactly what you are getting into first. Many people consult attorneys before entering into a deferred compensation plan.

Do you know want to see how deferred compensation impacts your retirement situation?? Sign up for a free trial of WealthTrace to find out if your retirement plans are on track.