Key Points

- It's possible--and sometimes desirable--to convert a traditional IRA to a Roth IRA.

- For most people, converting is not necessary. But there are exceptions.

- The free Roth IRA conversion calculators available on the web do not give you enough detail to make an informed decision about whether to convert or not.

Does it make sense to convert your traditional IRA to a Roth IRA? If so, when, and over what period of time? Should you use the Roth conversion ladder strategy or convert all at once?

You can use WealthTrace, which we do in this article to run Roth IRA conversion scenarios. Sign up for a free trial and see if a Roth IRA conversion saves you money. WealthTrace is more comprehensive than any free Roth conversion calculator and will allow you to run accurate Roth conversion scenarios.

The topic has gotten a lot of press in recent years. The question really comes down to the best way to minimize one's taxes. With a traditional IRA, you contribute pre-tax dollars, and only pay taxes on the (presumably) gains years later when you start withdrawing from the account. With a Roth IRA, you pay the taxes up front, so gains are not taxed later.

The conventional recommendation for most savers over the years has been to fund the traditional IRA. The reason? Traditional IRA contributions serve to reduce your taxable income at a time when that income is most likely at its highest--your working years. Later in life, when you're retired and drawing down on the account, your tax bracket will likely be lower, so the proceeds from the IRA will be taxed at a lower rate.

The result of the conventional wisdom, combined with the fact that the Roth IRA is a relatively new investment type (created less than 20 years ago), means that balances in traditional IRAs far outweigh those in Roth IRAs.

In my view, there's generally no need to be a contrarian with this particular piece of conventional wisdom. For most people, sticking with the traditional IRA and taking your tax lumps when you start the withdrawals makes perfect sense.

Checking Out Early?

But there are exceptions to every rule. Perhaps you're pretty sure you'll actually be in a higher tax bracket when it comes time to withdraw the funds for some reason. Or maybe you are confident that you won't need the money at all, and you want to leave an income-tax-free Roth IRA to heirs.

Perhaps the most common reason to consider converting a traditional IRA to a Roth is the lure of early retirement. Say you have been diligent about saving and investing over the years, and you have built up a pretty nice cache of investments in your traditional IRA. You have run the numbers every which way through WealthTrace, and you are confident that early retirement could be on the horizon for you.

There's just one problem. You can't get to that IRA money until you're age 59.5 without paying a 10% penalty on the withdrawal (in addition to the taxes you'll be hit with). Retiring at 59.5 counts as early retirement to be sure, but you're in a position to retire even earlier than that--if you can get to that money without paying a lot in penalties and taxes.

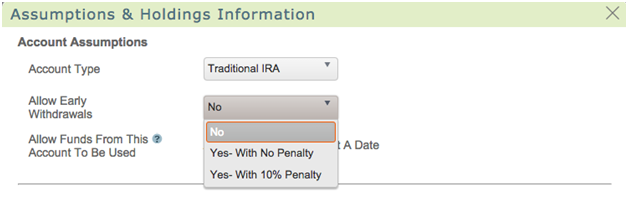

WealthTrace allows you to be as detailed as possible about how and when your tax-deferred investments can be used. Learn more.

This is where a Roth conversion can come in handy. Say you're 40, and think you are on track to retire at 50 with that IRA's help. To make it happen, you could take these steps:

1. Withdraw money from the traditional IRA.

2. Pay the income taxes on that withdrawal--remember, you didn't pay any taxes on it when you first contributed it--but pay the taxes from a different source than the IRA if possible.

3. Move the money to a Roth IRA (and put it into some investments).

4. Withdraw the money from the Roth at least five years later, tax and penalty free.

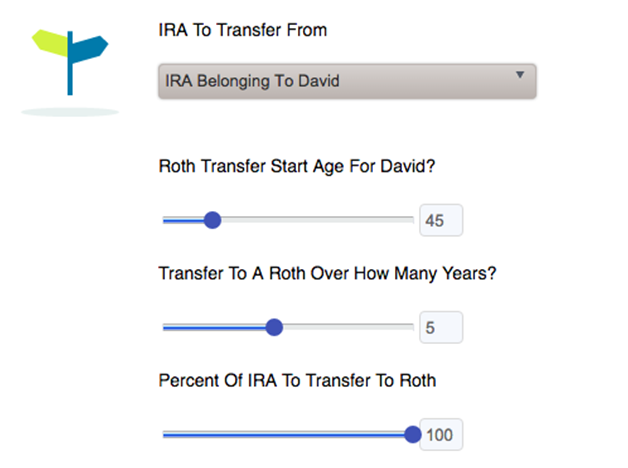

Some people utilizing this strategy will do something called a Roth IRA conversion ladder, where they convert a portion of their traditional IRA to a Roth IRA each year over a number of years. One reason to do this is to keep from bumping yourself into a higher income tax bracket, which could easily happen if you converted the whole pile at once.

In addition to tax strategizing and optimization, you have to wait five years after the conversion before withdrawing from the Roth to avoid the 10% penalty. This could be another reason to do the ladder. If withdrawing a certain portion of your IRA each year after the five-year waiting period gets you to retirement sooner (versus converting everything at once), laddering could be worth the work. In addition to tax strategizing and optimization, you have to wait five years after the conversion before withdrawing from the Roth to avoid the 10% penalty. This could be another reason to do the ladder. If withdrawing a certain portion of your IRA each year after the five-year waiting period gets you to retirement sooner (versus converting everything at once), laddering could be worth the work.

In addition to tax strategizing and optimization, you have to wait five years after the conversion before withdrawing from the Roth to avoid the 10% penalty. This could be another reason to do the ladder. If withdrawing a certain portion of your IRA each year after the five-year waiting period gets you to retirement sooner (versus converting everything at once), laddering could be worth the work.

But what is the best way to test such a strategy?

Hey, This Is Kind Of Complicated

As you can probably see by now, converting to a Roth takes a bit of planning and forethought. There's a lot to consider: income, taxes, projected investment returns, avoiding penalties, even estate planning.

That's where WealthTrace comes in. There are a lot of conversion calculators out there, but (in my not-so-unbiased opinion), none come close to what WealthTrace can do for you. Sometimes these calculators get bundled in on a site with other calculators that do much simpler calculations, such as a required minimum distribution (RMD) calculator, or a calculator of how long it might take to pay off a loan. So a person might think that an IRA conversion is along the lines of those things in terms of complexity.

But it's actually a lot more complicated.

One Way Too Early Retirement

Julie and David are only in their mid-thirties and thinking about retiring when they are 50 or so. They've been diligent about saving, and have amassed an impressive $750,000 so far--with $550,000 of that in qualified tax-deferred investments, such as IRAs and 401(k)s.

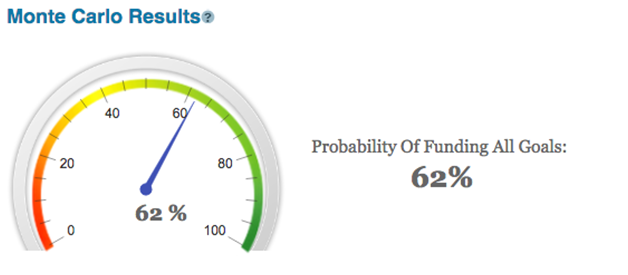

At their current saving, investing, and spending levels, they have a 62% chance of hitting their goal of retiring at 50, according to our Monte Carlo simulation:

That's not bad, given their age. But they are interested in finding out if there's anything they can do to bump it up.

The WealthTrace Roth Conversion Scenario allows the couple to see what the effect of doing a transfer to a Roth might have on the probability of their plan's success. They can try different start ages for the transfer; specify the number of years over which to do the transfer (the laddering mentioned above); see if it makes sense to transfer all or part of the Roth; and then--and this is a feature unique to WealthTrace--run the new numbers through a Monte Carlo simulation.

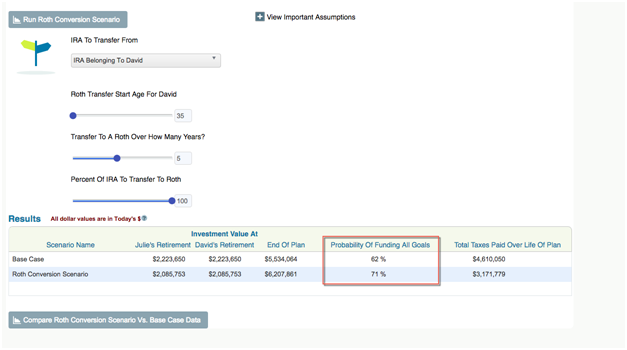

Take a look at what happens if Julie and David start the transfer over a five-year period when David turns 35:

The probability of success of their retirement plan jumps from 62% to 71%, not least because they end up reducing their anticipated tax burden by about 30% (see last column in the table above).

(There are a number of factors to consider before taking this step. We always recommend a one-on-one expert planning session for those thinking about doing an IRA conversion.)

The High Cost Of Free

Some of the free Roth IRA conversion calculators out there are fine as far as they go. But they don't go far enough. For something as important as retirement, make sure you have the details you need to make an informed decision.

WealthTrace covers all the bases including Roth IRA conversion scenarios. Sign up for a free trial of WealthTrace to find out if a Roth IR conversion makes sense for you.