Key Points

- A good retirement plan always starts with saving money.

- Monitoring your plan via planning software--and adjusting the plan’s trajectory as needed--is critical to a plan’s success.

- Having some understanding of the basic concepts of investment planning can help motivate you to put a plan into action.

A solid plan for any project, not just retirement, needs strategies to make it happen. Here are some essential building blocks for a retirement plan.

Saving

Saving money is like the adult version of eating our vegetables when we were children. Not only is it something we resist at every turn, and something we know is good for us but just can’t bring ourselves to do more of. It’s also similarly critical for a longer, healthier, and happier life down the road.

You really can't even think about retiring unless you save money. It's easy to procrastinate and tough to stick with, requiring discipline many of us do not have.

Saving simply has to be a top priority--perhaps the top priority--when it comes to your money. It means that if, for example, putting a down payment on a new car means you won't be able make your savings goal for the month or the quarter or the year, then you need to be able to tell yourself no, and not make the purchase.

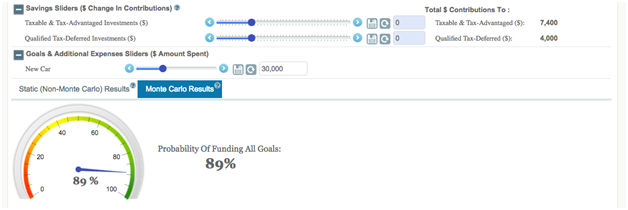

Seeing is believing WealthTrace can run through some what-ifs so you can immediately see the effect on a plan of increasing savings or decreasing spending.

Try to picture a big “Keep Out” sign on what you’re saving. It's arguably a bit too easy to withdraw from your retirement savings before you actually retire. Resist the temptation.

Investing

Once you get the savings part down, you can’t just put the money in the bank. A large portion of whatever you’re managing to sock away needs to be invested in stocks or mutual funds.

A few of our previous articles have touched on where to invest what you’ve saved. We are big fans of dividend-paying stocks and index funds. Everyone’s situation is different, but it often comes down to assessing your time frame, goals, and tolerance for market volatility, and going from there.

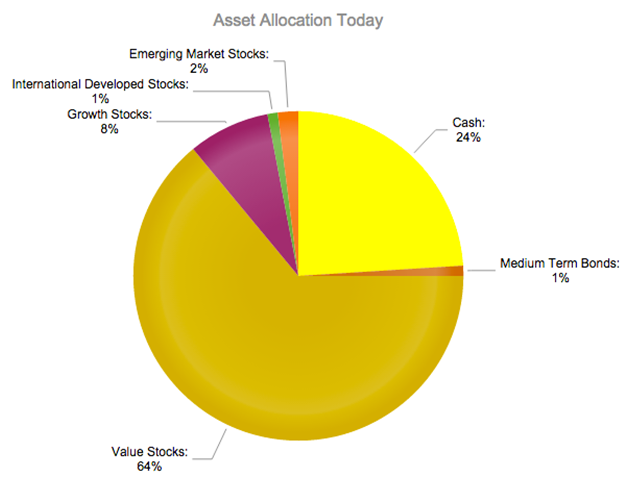

Where’s all my stuff? WealthTrace will show you where you’ve invested your money by asset class.

Budgeting

We have written before about how more people should create and maintain a household budget than actually do. While creating a budget before you retire is not absolutely necessary to strategize for a successful retirement, it certainly helps. Once you retire, some expenses will increase, and some will decrease. If you know what your spending is like before retirement, you'll get a sense for what spending will look like after retirement. It's a solid bet that you'll need to replace 80% of pre-retirement income, possibly even more.

Where does it go? WealthTrace can help you with your budgeting.

Understanding

Are you following what we’re talking about in this article? You don't need to become a financial planning expert. But it would be best if you understood a few of the basics, such as:

- Inflation. People understand the concept of inflation generally as “prices go up,” but sometimes miss the corollary: What you save now will buy less in the future. It helps to understand how inflation can chip away at your savings.

- Diversification. How well do you grasp the whole not-all-your-eggs-in-one-basket thing as it relates to investments?

- Return Versus Risk. Generally, the riskier the investable asset, the better the potential for a high return on it.

- Volatility. Investments go up and down in value. That very basic concept is scary to a lot of people. But having some understanding of it makes it less frightening.

- Your Social Security benefits. They should be projected to be around 40% of what you earn before retirement, but make sure you have an idea of what they should be--and plan your other savings and investing accordingly.

Getting some strategies together and checking in on your plan regularly should help lead to better saving and spending habits and a successful, stress-free retirement.

Small changes to savings and spending can have a big effect on a plan. Sign up for a free trial of WealthTrace to find out more.