Key Points

- Very few people wait to take Social Security at age 70 or later.

- Retirees with a decent amount of investments probably should wait until that age.

- Social Security might be thought of as the safest annuity you can buy--and already have bought.

We recently came across this statistic via the Motley Fool: "only 4% of women and 2% of men claim [Social Security benefits] at 70 or later, according to a report from the Center for Retirement Research at Boston College. The most popular age to claim, the study found, was age 62, with 48% of women and 42% of men claiming at this age."

We can't let this go without a few comments.

If you absolutely need the money, then by all means, take the benefits early.

First, ask yourself: Do you really need the money as soon as you're eligible? The answer to that question might be a little complicated. If you don't have any investment assets, then yes, you probably need it right away (if you don't have a pension); if you have lots of investment assets, then no, you probably don't.

But a lot of us are somewhere in the middle. We have investment assets, but we're not entirely confident they're going to be enough to carry us through retirement. Or we might have concerns about selling assets we've spent decades accumulating. Those concerns might have to do with realizing capital gains and paying taxes on those gains. But they might have to do with the idea of reversing course after all those years. Good habits die hard; spending down assets just feels wrong.

It's not wrong, though. In most cases, holding off on Social Security and tapping your investment assets instead is the way to go. We'll explain why.

Case Study Using WealthTrace's Retirement Planning Software

I used the

WealthTrace Planner to look at a case study in delaying Social Security payments.

Key Assumptions:John and Jane, Married Couple, Age 60

Age of Planned Retirement: 62

Retirement Account Investments (Traditional IRAs): $800,000

Taxable Investments: $200,000

Asset Allocation: 60% Stocks, 40% Bonds

Spending Per Year: $75,000

John’s Social Security at Full Retirement Age (67): $30,000

Jane’s Social Security at Full Retirement Age (67): $20,000

Life Expectancy: 90

When to take Social Security benefits is a very important decision that most of us will have to make. Rules of thumb are not good enough for this decision though.

There are many variables at play here that determine if delaying Social Security benefits makes sense. The most important variables are life expectancy, amount of money in taxable accounts, and overall income before Social Security payments begin.

The Variables That MatterThe reason life expectancy matters is that there is a break even amount of time needed to recoup the lost payments when on delays taking Social Security payments. For every year one delays the increase in the payment is 8%.

This couple will also need sources of income or to dip into investment principal in the years where there will be no Social Security coming in. If they have to use their retirement accounts they will have to pay federal and state income tax on the withdrawals. Because of this, sometimes delay Social Security benefits is a bad idea because the tax hit from IRA withdrawals outweighs the benefit of delaying.

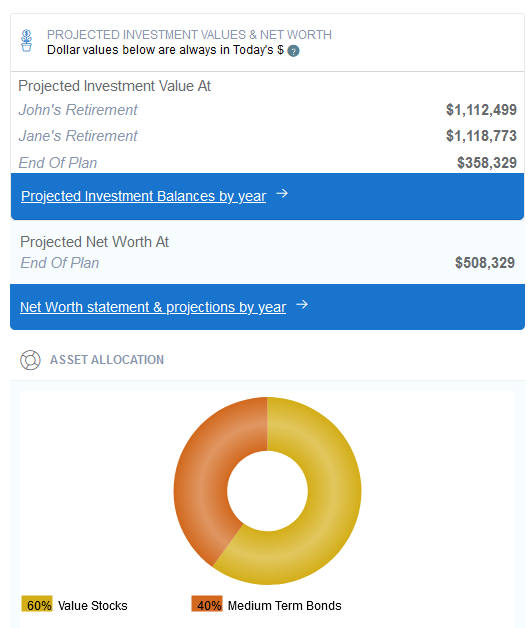

Base Case: Full Retirement AgeIn the base case they will take their Social Security benefits at age 67, which is considered their “full retirement age”. You can see how much money they are projected to have at the end of their life expectancy below.

They are projected to have a little over $358,000 at the end of their life expectancy.

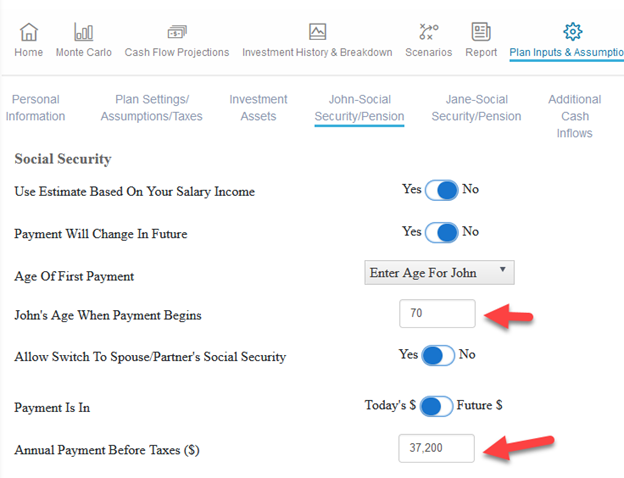

Delay Until 70It is simple in WealthTrace to change the timing and amounts of Social Security benefits.

I changed the age when payments begin to 70 and I changed to payment amount by 24% (8% extra per year for 3 years).

The WealthTrace Planner will take into account all taxes paid and withdrawals from retirement accounts that might be needed to make up for the Social Security payments that now will not be there for 3 years. The question is, do the higher payments later on make up for any losses in those 3 years? The results are below.

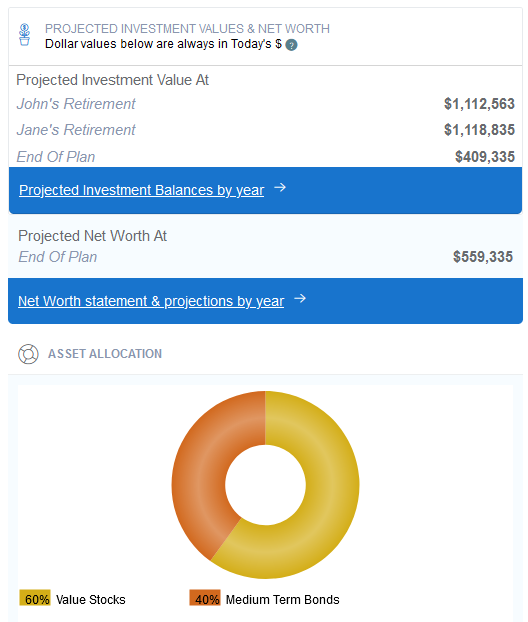

In this example the answer is a resounding yes, they should delay. It is helpful that this couple has taxable investments to help fund their expenses while they delay.

What if there are no Taxable Investments?As an interesting what-if scenario I wanted to see how things might change for them if all of their money was in traditional IRAs and they had no taxable investments at all. When I ran the two different options (no delay vs delaying) I found that it was basically a wash. If we then reduce their life expectancy, the better option for them is to take Social Security at their full retirement age.

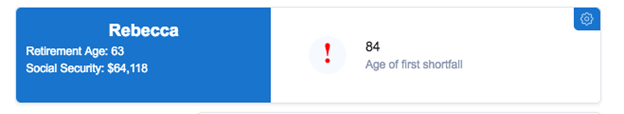

Look for ShortfallsAnother problem some people run into when delaying retirement income such as Social Security is that they simply don’t have the money to fund their expenses. Many people are very dependent on Social Security payments to pay for expenses in retirement.

It is very easy to see when there is a shortfall in WealthTrace. In the example below we have a couple that doesn’t have enough income from age 68 through 69 to fund their expenses without Social Security income.

Other Factors

Of course there are other factors involved in the decision about when to take Social Security. All of retirement planning involves a lot of moving parts, but the decision about when to take Social Security is often seen as the most fraught.

As we alluded to at the beginning of this article, there will be cases when a person will simply need the money earlier. Sometimes in WealthTrace we see plans where there's a projected shortfall, but if we move the date of Social Security up, things look a bit better. This might happen if, for example, a major expense is anticipated in the early years of retirement.

It's still not going to be ideal. In most cases where this happens, the end-of-plan value is not going to be as high as we'd like to see--there's not enough of a margin of safety. But at least the person is less likely to run out of money entirely, which was kind of the purpose of Social Security in the first place.

Another factor is political. Many fear that Social Security benefits might be cut in the future because the trust fund is projected to run out of money in 2034. But the federal government is allowed to use money from other sources to cover shortfalls. They can also raise the full retirement age for the younger generation and the cap on income that is taxable for Social Security purposes. These are more likely than benefits being cut across the board.

Even Steven

Here's a brief aside. You should be aware of the concept of the Social Security break-even age. Investopedia does a nice job of covering it, but the basic idea is this: How long do you need to live to "make up for" delaying taking your benefits?

In the image above from the calculator, the breakeven age is 83. This is basically saying you'll need to live to 83 to get to the point where you make up for having taken your benefits earlier. This can be a valuable piece of information, especially for people who feel they have a good handle on their life expectancy. In this case, if the person does not believe they'll live that long, it could make more sense to take the benefits beginning at age 66. On the other hand, if family genetics indicate that she will likely live past the break-even age, she will probably want to wait if she can.

Know Your Options

The single-digit percentages of people waiting to take Social Security until they turn 70 are somewhat alarming, but not that surprising given what we know about retirement savings rates in the United States. Regardless, taking a big-picture look at your plan--and running it through a program that can point out some things you might otherwise miss--is a must-do when considering a decision as big as when to begin taking your Social Security benefits.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.