Key Points

- In general, investments with higher projected returns should be in more tax-friendly accounts.

- Moving stocks and bonds to different account types can make a big difference over time.

- Simple moves in asset location can save you thousands of dollars over time.

There is a lot written about investment withdrawal strategies that can help people save money on taxes. This can get complicated quickly and usually centers on trying to minimize capital gains. Surprisingly though, very little is written about a simpler concept called an “asset location strategy”.

Where You Put Your Money Makes A Difference

The concept of choosing where to put your money is not new. But with today’s do-it-yourself technology tools, it has become easier to calculate just how much you can save by implementing a better asset location strategy.

Let’s take a look at a simple example that will show how big of a difference asset location can make. I used our WealthTrace Financial Planner, which can be used by consumers who want to do their own financial and retirement planning. I took a 60 year old couple that plans on retiring in five years. They have $1 million in investment assets. Currently, 50% of their money is in an S&P 500 stock index fund and is in their traditional IRA.

They also have a Roth IRA, and 50% of their money is located there and is invested in ten year treasury bonds. Their projected spending in retirement is $45,000 a year.

The big difference here between the two accounts is that the traditional IRA will be taxed when the money is withdrawn. The Roth IRA won’t be taxed at all when the money is withdrawn because they already paid income taxes on this money before they deposited it.

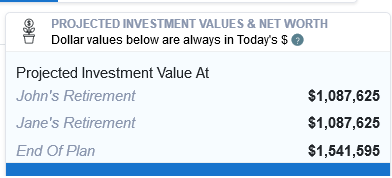

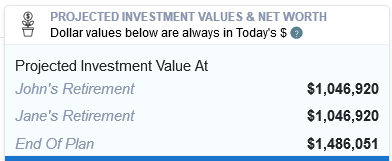

The results for their plan for this first strategy are below.

In this scenario they will have slightly over $1 million at retirement and a little over $1.5 million at the end of their life expectancy. This analysis takes into account all taxes they will pay on retirement income, including the taxes on withdrawals from their Roth IRA and traditional IRA. The program also takes into account Required Minimum Distributions and assumes that this couple will withdraw from the Roth IRA before the traditional IRA in order to minimize taxes.

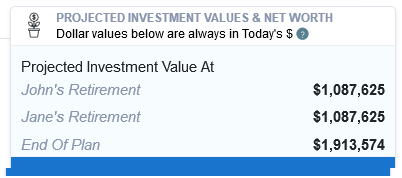

Let’s now look at a different location strategy for this couple. What happens if they put their stock index fund in their Roth IRA and the bonds in their traditional IRA? It turns out, the impact is pretty big.

At the end of this couple’s life expectancy, they will have nearly $400,000 more in today’s dollar terms. This is solely due to how these two accounts are taxed differently. The Roth IRA withdrawals are not taxed at all, but this couple must pay their full income tax rate on any traditional IRA withdrawals. By moving their higher-performing investments (stocks) to the Roth IRA, they significantly reduced the overall taxes they will pay because all of those higher gains on their stocks won’t be taxed at all.

Taxable And Tax-Deferred Location Strategies

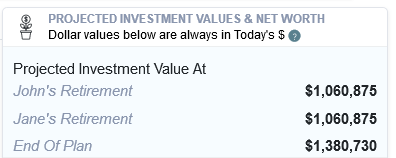

This idea also works, but not nearly as significantly, when deciding where to place investments between a taxable account and a tax-deferred retirement account. Let’s take the same couple, but this time instead of a Roth they have a taxable brokerage account. If they place all of their bonds in their traditional IRA and the stocks in their taxable account we see the following:

If they place their bonds into their taxable account and the stocks in their traditional IRA we see these results:

You can see the same idea as before takes place here. It is better to place the riskier (and therefore higher performing) assets into the account that has a tax advantage or is tax-deferred.

Retirement Accounts Should Have The Riskier Assets

The tax savings is just one reason why riskier assets should almost always be in tax-deferred accounts rather than taxable accounts, especially when you’re younger. The other reason to keep riskier assets in retirement accounts vs. taxable accounts is because, presumably, you won’t be using the retirement money for a longer time period. The longer the time horizon to use investment funds, the more risk one should take.

Find your best asset location strategy. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.