Key Points

- With inflation raging it could make more sense to take a pension in a lump sum rather than in monthly payments.

- Several factors come into play when making this decision, such as risk tolerance, life expectancy, how the lump sum would be invested, and whether or not the payments pass on to a spouse if you pass away before him or her.

- It is imperative to run multiple what-if scenarios in comprehensive and accurate retirement planning software before making a decision.

As many people approach their retirement they are faced with a decision on their pension: Should they take the pension in a lump sum payment or take monthly payments for the rest of their life?

Making the right decision can save one thousands of dollars over the long run. Making the wrong decision can lead to major problems with one’s retirement planning, including having to go back to work.

How Inflation can Devalue a Pension

If you have a pension that is tied to the Consumer Price Index (CPI) or Cost Of Living Adjustment (COLA) index, congratulations! This is not typical though. Most pensions have a fixed growth rate that does not change even if inflation increases dramatically as it has over the past few months. Some pensions are fixed at a rate of 2%, but the majority are fixed at no growth rate at all. In other words, in every year where inflation is greater than 0%, the real value of the pension payments declines.

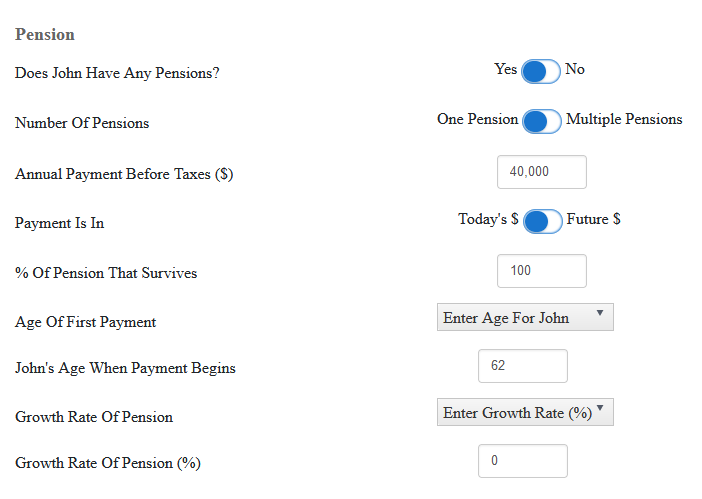

Let’s take a look at an example of this where John has a pension that is set to pay him $40,000 each year when he retires in 5 years at age 62. The pension’s payment amount is fixed for life and will not grow over time.

For John’s retirement plan I assumed an inflation rate of 2.75% per year for every year going forward. Inflation is currently at 7.9%, but is expected to eventually decline as the Federal Reserve increases interest rates.For John’s retirement plan I assumed an inflation rate of 2.75% per year for every year going forward. Inflation is currently at 7.9%, but is expected to eventually decline as the Federal Reserve increases interest rates.

For John’s retirement plan I assumed an inflation rate of 2.75% per year for every year going forward. Inflation is currently at 7.9%, but is expected to eventually decline as the Federal Reserve increases interest rates.For John’s retirement plan I assumed an inflation rate of 2.75% per year for every year going forward. Inflation is currently at 7.9%, but is expected to eventually decline as the Federal Reserve increases interest rates.

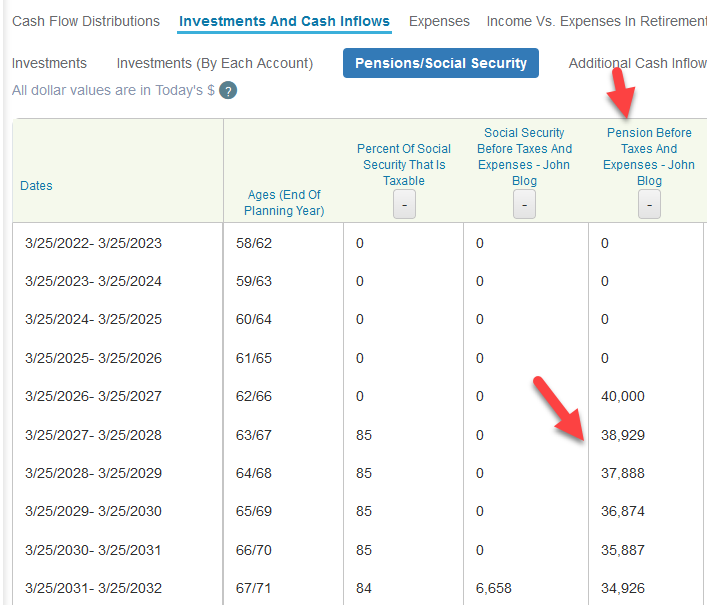

Because inflation is higher than the growth rate of the pension, the real value of the pension declines every year as you can see below.

Eight years after taking his pension, the real value of the pension has declined by 25%. By real value I mean the purchasing power of the pension payments. These payments will be able to purchase 25% less than they could eight years beforehand. This is the destructive power of inflation when income doesn’t grow with it.

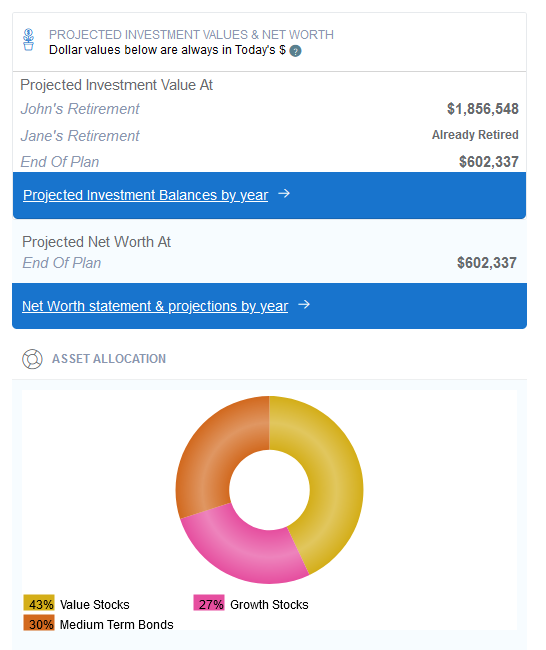

Just to reinforce this point I ran this person’s retirement plan using the WealthTrace Financial & Retirement Planner. With a growth rate of 0% on his pension John is projected to have a little over $600,000 at the end of his life expectancy.

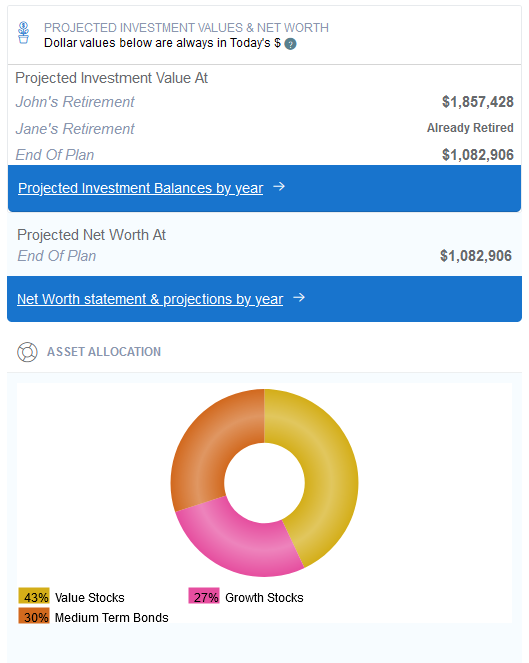

I then wanted to see how his retirement plan results would change if his pension grew with inflation. The difference at the end of John’s life expectancy is quite shocking, at over $400,000!

Most of us have heard about the power of compound interest over time and we usually only hear about it in a positive light. But the power of compounding works against us when it comes to inflation.

Should You Take The Lump Sum?

If you think inflation will stay elevated for the next ten years or more and your pension has no growth rate, you want to seriously consider taking a lump sum payout. There is also the risk of federal income taxes increasing in the near future. This should also be a consideration in the decision since future pension payments might be taxed at a higher income tax rate.

Another factor in this decision is whether or not a lump sum payout can help you keep your money in your retirement accounts longer, which would keep deferring the income taxes you would pay on the withdrawals from a 401(k) plan or traditional IRA.

What could be the most important variable in this decision is the rate of return you think you can achieve on the money that would be paid out as a lump sum. We already know that John’s pension payments won’t grow at all over time. But what if he could get a lump sum payout of $800,000 today? I ran a scenario in the WealthTrace Planner where he takes the after-tax amount of this payout and puts it into a short-term bond fund earning 1.5% per year. In this scenario he is projected to have about $490,000 at the end of his life expectancy. This is lower than $600,000 we saw where he didn’t take a lump sum payout.

It is important to point out that he eliminates or reduces three potential risks here:

1) He no longer has to worry as much about inflation eating away at the monthly payments.

2) He doesn’t have to worry about his company going bankrupt and potentially reducing the pension payment. Note that private pensions are normally covered (at least partially) by a government agency called the Pension Benefit Guarantee Corporation (PBGC).

3) If his pension doesn’t transfer to his spouse, he no longer has the risk of the pension going away if he dies first.

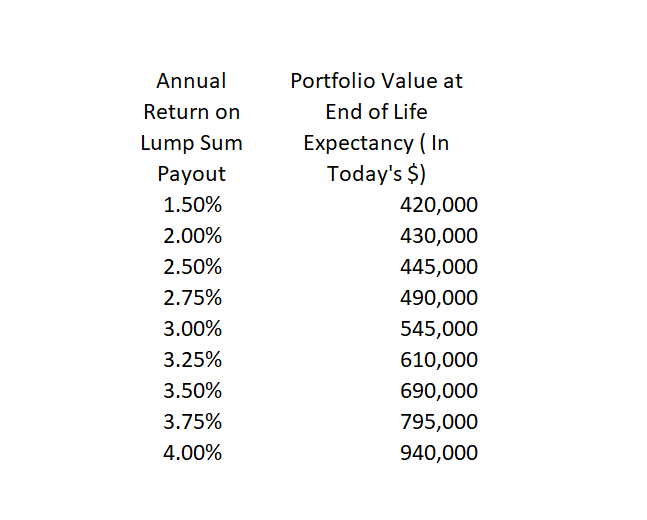

Now let’s say John is able to achieve an annual return on his lump sum payout exactly equal to the 2.75% inflation rate we used. In this scenario John is projected to have about $501,000 at the end of his life expectancy. I ran several scenarios to find the rate of return he would need to break even with the monthly payment option.

The break-even rate of return is about 3.25% per year. This seems achievable and of course does not even take into account the risks he would eliminate, as discussed earlier.

Don’t Make This Decision Too Quickly

It is clear that making the right decision when it comes to taking a lump sum pension payout can swing one’s portfolio by thousands and even hundreds of thousands of dollars. It can also mean the difference between staying at your job or retiring early. So make sure you run through as many scenarios as you can on this potentially life changing decision.

Do you want to run what-if scenarios on your pension payout? Sign up for a free trial of WealthTrace today and start running your own retirement planning scenarios.