Key Points

- Persistently low interest rates are not retirees' friends, but there can be positives to them.

- Investments still need to be funded even if debt is paid down.

- Refinancing is about more than just improving your monthly cash flows.

Low interest rates cut both ways. If you're an investor in search of income, bonds probably haven't been doing much for you in recent years, forcing you to look elsewhere. If you're a homeowner, though, dropping rates could give you a chance to recoup some of what you've been missing in the fixed-income markets via refinancing your mortgage.

Your first decision is going to be whether to refinance at all. With rates having come down so much, it may be worth it, but it may not. It will depend on a lot of factors, including how much time is left on the mortgage, the interest rate on the mortgage, and how much longer you plan to own the home.

If you decide refinancing is worth the effort and cost, the next question is what the terms should be. 30-year and 15-year fixed are the most popular mortgages (though there are others), so we'll focus on those here. You owe it to yourself to give this decision careful consideration, and WealthTrace can help.

According to Bankrate.com, a 30-year $300K-$400K refi in Denver can be had for 3.125% at FirstBank with no points. Change that to a 15-year refi, and it's 2.875%. (Mortgage refinancing calculators are cheap and plentiful on the web.)

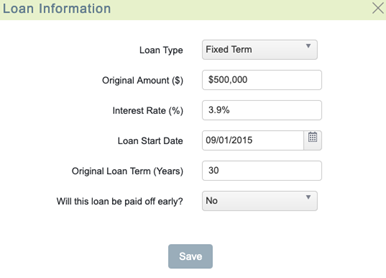

Let's consider the case of a couple with $400K left on their mortgage, which was initially a 30-year, $500K, 3.9% loan taken out five years ago.

WealthTrace can amortize your loan and factor its payments into your retirement plan.

WealthTrace can amortize your loan and factor its payments into your retirement plan.

According to WealthTrace, by refinancing to a new 30-year mortgage, the couple can get their monthly payment down from about $2,358 currently to about $2,142. If they refinance to a 15-year mortgage, on the other hand, the monthly payments will go up to about $3,422 a month, but they'll save a ton in interest payments versus their current 30-year mortgage.

Most people will grasp that refinancing would be desirable here. Mortgage rates are down substantially since when this loan was first taken out. Even though there are fees associated with refinancing (estimated to be $850 in this case), the difference in interest rates is large enough that those fees will be more than covered after a few months of mortgage payments at the new rate.

Conventional wisdom is that a 50 basis point reduction in the interest rate nearly always makes refinancing worth considering; depending on the loan terms and length, sometimes even a 25 basis point reduction can make it worth doing. In this case, with the rate dropping close to a full percentage point, the choice is pretty clear.

The more interesting question, though, is whether to go with a 15-year term on the new mortgage, or a 30-year term.

The retirement-oriented homeowner is going to at least consider switching to the shorter-term mortgage. Yes, the monthly payment would go up about 45%--a tough pill to swallow for most people. But the giant drop in interest payments and elimination of mortgage debt 10 years earlier than planned (a new 15-year mortgage versus the 25 years remaining on the existing mortgage) at least put this strategy in play.

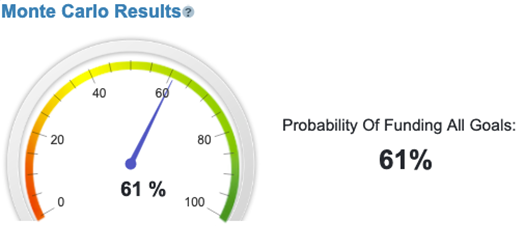

We ran all three mortgage scenarios through WealthTrace on a plan for a couple in their early 40s who contribute $12,000 annually to their tax-deferred accounts and are hoping to retire at 65. In the case of moving them to a new 30-year mortgage, we ran two different versions: one where they invest the money they save on their mortgage payment in a tax deferred account, and one where they do not.

In our base case, where the couple is paying 3.9% with 25 years to go on a 30-year mortgage, they've got a 61% chance of funding all of their goals in retirement. That could use some work; additional contributions to tax-deferred accounts would help a lot here.

Refinancing to a new 30-year mortgage brings that up to 62% if they contribute the difference in monthly mortgage payments to their tax-deferred accounts, and drops to 60% if they don't.

Refinancing to a new 30-year mortgage brings that up to 62% if they contribute the difference in monthly mortgage payments to their tax-deferred accounts, and drops to 60% if they don't.

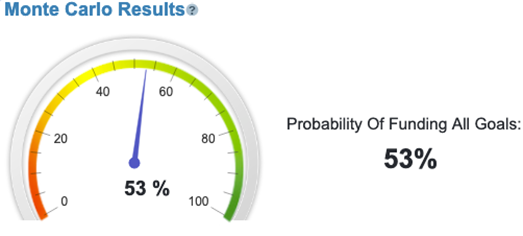

The move to a 15-year mortgage is more dramatic. We assume the couple has to cut back on their retirement contributions by the amount their mortgage has gone up. That's a $7,000 difference, so now they're only contributing $5,000 toward retirement each year. And with that happening . . .

Good Intentions, Bad Outcomes

You generally don't want to rush to eliminate your mortgage at the expense of contributing to investment accounts. This is a mistake frugal households sometimes make. The intentions are admirable: They want to get rid of debt.

But there's debt, and then there's debt.

Carrying a credit card balance is a big no-no, as most people reading this article would know. The interest rates are just too high. If you are paying 15% or 20% interest on a credit card while investing in stocks, you're doing it wrong. Your credit card debt is an emergency; pay it down before investing. On the other hand, stocks are going to have higher returns over time than whatever your mortgage rate is going to be. Don't get yourself in a position where your monthly mortgage payment is bigger than you can manage, but don't skimp on investment account contributions in the service of paying down low-interest debt, either.

With Monte Carlo results in the low 60s in the base case, a bigger issue for this couple might be the conservative nature of their investments in addition to how much is being contributed, but that's a topic for another time.

Meet Me In The Middle

There's a middle ground here to keep in mind. The couple could take another 30-year mortgage with the lower rate and simply make additional payments on the new mortgage now and then to keep them on the 25-year pace, or maybe even a little faster. A lot of people try to make an extra mortgage payment each year to speed up the process of paying it down whether they're refinancing or not. That requires some discipline, however, as nobody will be sending out a bill for that extra mortgage payment.

The urge to be debt free can be strong, but it rarely makes sense to pay down low-interest debt if it means short changing yourself on higher-interest investing.

Should you pay off your mortgage? Does a 15 year mortgage make sense for you? Sign up for a free trial of WealthTrace to find out.