Many people in their 40s are finally at this point beginning to save a decent amount of money every paycheck. This by itself can be a big accomplishment for many people. But a lot of those same people have yet to even begin thinking about a retirement strategy.

The questions that I believe everybody should start asking, even when they’re relatively young, are: 1) How much money do I need to retire comfortably? 2) When will my money run out in retirement? 3) What can I possibly invest in given how low interest rates are today?

Let’s first look at the overall money issue. How much money does a typical 40 year old couple really need if they retire at age 65? I took a look using our retirement planning application. I started with these assumptions: A 40 year old couple has $350,000 in investments. They are 50% in equities and 50% in fixed income. Half of their money is in taxable investment and half in IRAs. Equities return 5% per year and fixed income returns 2% per year. They save $10,000 per year. Inflation is 2% and their expenses in retirement will be $50,000 per year. They estimate they will receive a total of $35,000 (in today’s dollars) in social security payments per year starting at age 67. Here is what I found:

| Investment Value at Retirement (Today’s $) | $475,000 |

| Age When Funds Run Out | 85 |

With the assumptions we used, this couple is projected to run out of money when they are 85 years old. Is this a disastrous situation? No. Is it still stressful for them? Probably. It is best to have a very large buffer in terms of when your funds are projected to run out in retirement. For most people they should make sure their money lasts at least until age 95. So how much money would this couple need at retirement to ensure that their funds will be there until age 95? After running a few scenarios, I found that this number is $677,000.

The question is how can they get to this number by the time they are 65? The most direct way is to try and save more money before retirement. They can also postpone when they retire. I found that if they both postpone their retirement age by 2 years they will achieve the goal of not running out of money until age 95.

Another option for those who fear that they won’t have enough money in retirement is to move some funds out of low yielding fixed-income and into strong dividend paying stocks. With interest rates so low, the days of using bonds to throw off enough income to support a couple in retirement are pretty much over for most people. That leaves the option of dividend paying stocks for a solid income stream.

Solid dividend paying stocks- Still a good option

The core of my retirement portfolio is a foundation of dividend paying stocks that have had consistent dividend growth over time as well as low payout ratios and low debt. Five of the companies that make up this part of the portfolio are Johnson & Johnson (JNJ), Procter & Gamble (PG), Coca-Cola (KO), Exxon (XOM), and Sysco (SYY).

| Company | Div. Yield | 5 Yr. Annualized

Div. Growth Rate |

| JNJ | 3.4% | 9.1% |

| PG | 3.2% | 10.8% |

| KO | 2.8% | 8.7% |

| XOM | 2.5% | 7.6% |

| SYY | 3.6% | 7.7% |

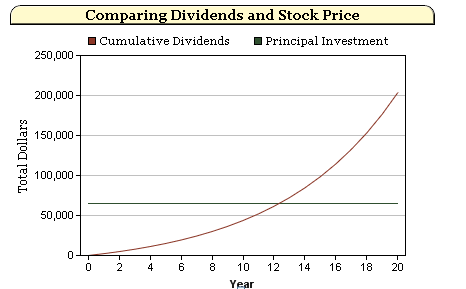

Besides having in common their relatively strong dividend yields and growth rates, these companies have also shown a commitment over long periods of time to keep growing their dividends. Over time, consistent dividend growth will lead to solid total returns even if stock prices fall during the investing period. To show this I ran an example using our publicly available calculator called Total Returns- Dividends vs. Price Appreciation. I took 1,000 shares of Johnson & Johnson (JNJ) at today’s price and assumed a growth rate of dividends of 10%. Over 20 years we see the following:

Even if the stock price doesn’t budge over the 20 year time frame, we would see a 313% total return (7.3% annual return). Like I said before, the movements in the stock price over a time period this long become nearly meaningless to those collecting the dividends.

Let’s also take a look at how this couple would fare if they moved half of their fixed income holding into to dividend payers that return 5% per year.

| Before Moving Funds | After Moving Funds |

| Investment Value at Retirement | $475,000 | $645,861 |

| Age When Funds Run Out | 85 | 95 |

By simply generating a return that is 3.5% higher than before on a portion of their portfolio, this couple has extended their funds in retirement by six years.

Before thinking about strategies on how to extend your money in retirement and retire comfortably, everybody needs to figure out their situation today. We all need to be able to project the amount of money we will have when we retire and how long that money will last. Only then can we start thinking about the different options in terms of how we can change our retirement situation.