Key Points

- You can't retire confidently without running the numbers to see if you're ready on track.

- Partners will run into certain questions and issues that individuals planning to retire will not.

- Working through those issues without a decent calculator or software package is close to impossible.

You really only need to answer two questions when planning for retirement:

1) What will I spend in retirement?

2) How much do I need to save and invest so that I can cover that first number?

Sounds simple, right? Nothing to it.

We're kidding of course. Once you start peeling those questions back, they reveal far more detailed, related questions. Such as:

- What do you mean by spending? Are you talking groceries and utility bills, or vacations and boats?

- What kind of tolerance to you have for giant swings in the stock market?

- How old are you, and how long do you expect to live?

- How much do you want to pass on to heirs?

The list goes on and on. So it can be really helpful to have a retirement calculator or retirement software such as WealthTrace that systematically runs through these more detailed questions and allows you to see some projections in a clear and concise presentation.

When There Are Two

You can find all manner of retirement calculators on the web. Be prepared to start filling out forms. It's similar to when you go see a new medical specialist: It's just a necessary hassle. Don't gloss over this step, either, because, to paraphrase what they say in software development, it's garbage-in, garbage-out. You'll get much better results if you take the time to do the inputs correctly.

A lot of questions are pretty straightforward and will be the same for individuals and partners alike. But there are going to be some data points that only (or mostly only) apply to partners.

When you're on your own, sure, you might want to plan to pass along assets to heirs one day. But you mainly just need to look out for #1. As a couple, though, life expectancy is one item that's going to be really important to try to get right. That's because you will want to make sure that assets and sources of income will be sufficient for the surviving spouse if one person passes before the other.

Being too aggressive with life expectancy (that is, underestimating how long you'll live) could lead to some unwelcome surprises. For example, if you undershoot it and say you'll only live to 85, but then end up alive and kicking for another five years--that's five extra years of living expenses for two people (instead of one) that you did not plan on.

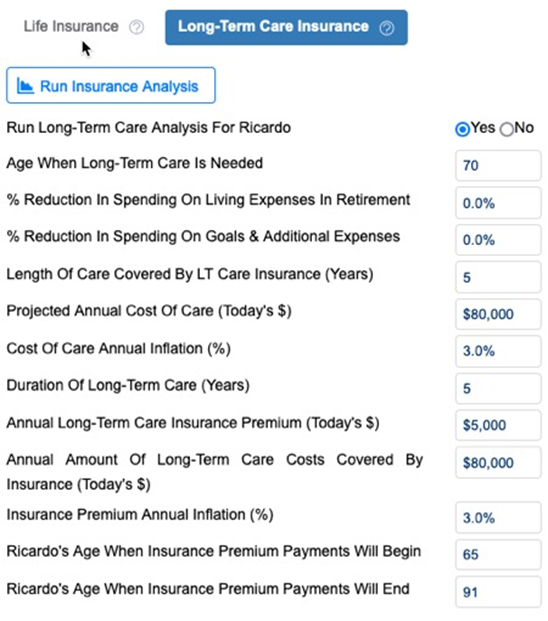

You might also need to have some hard conversations about long-term care insurance. This is one of retirement planning's biggest wildcards, and it's doubly tricky for two people.

In a near-worst-case scenario, could one person take care of the other in old age? Would that even be desirable? In most cases, the answer is no. So if you eliminate that option, you have these other options:

- Look into buying long-term care insurance. You can read the linked article above for more information about that.

- Start putting aside a separate account that is more or less earmarked for long-term care. In other words, self-insure.

- Wing it and hope that you either don't need long-term care insurance, or that you would be able to tap into other sources to cover it.

When to take Social Security should be another big topic for discussion for married partners. On your own, you could run the numbers and, based on your investment assets and other sources of income, simply determine when taking Social Security benefits would be optimal. But with two people involved, it could be more complicated. There's a process called restricted application that, while too involved to cover here, is a very real way married people can maximize their benefits.

1 + 1 = Complications

There are calculators of every stripe and scope out there. You can find everything from freebies offered by mutual fund companies to highly sophisticated software packages that are subscription based.

For the most part, as with most things, you get what you pay for. If you're single, not planning on passing anything along to heirs, and don't have much in the way of traditional investment assets, it's quite possible that a free, web-based calculator from a reputable institution will work plenty well for you in terms of figuring out if you're on track to retire or not.

But a couple with a whole lot of financial moving parts (pensions, Social Security, 401(k)s, other investment accounts) should proceed a bit differently. They don't need to turn over their whole plan to a planner necessarily, but they do need to be willing to get into the details of their finances so that they can plan to retire comfortably.

Do you want to see if you can retire stress-free? Sign up for a free trial of WealthTrace today and start running your own retirement scenarios.