Key Points:

- Rental property can be a good source of passive income in retirement.

- Investing in rental property is a fair amount more complicated than investing in stocks or bonds.

- Accurately accounting for rental property inflows and outflows is critical to gauging the potential success of a retirement plan.

At or near retirement, the search for passive income is on. Stock dividends are a great solution, as we have written about many times, like here and here and here. As of this writing, even with the run-up in the markets, it's still possible to put together a well-diversified portfolio of large-cap stocks yielding 4.5% or even 5%.

For the more adventurous, real estate income is another way. Investing in rental property can be a compelling option for those who have the time, the handyman abilities, and the willingness to find and work with tenants.

Sometimes people happen into a landlord role. Maybe they have moved to another town and rent out their former primary residence while waiting for the market to improve, but then decide to keep renting it out because they like the cash flow and the diversification rental income provides.

Regardless of how you become a landlord, you'll want to go in with your eyes open. Your ability to handle the risks, your required return on investment, the vagaries of the real estate market where you might purchase a rental property--all of that is beyond the scope of this article, but very important.

Real estate income--and the eventual sale of an income-generating property--can be a significant part of a retirement plan. But if you're going to go that route, you'll want to account for the cash flows as accurately as possible. Here are some of the big-picture considerations--and how to handle them when doing your cash flow calculations.

Rental Income

Obviously, this is the big one. In planning for what this income will look like, you'll want to account for:

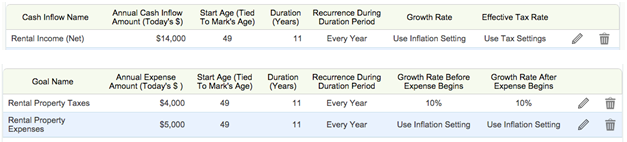

- What the rental income, net of expenses, will look like. What kind of maintenance expenses or management fees do you expect to be paying? Be sure to back that out of your expected rental income figure. Alternatively, you could enter the figure as an additional expense, and see how changes to that rate will affect your plan.

- Property taxes. Ditto for property taxes. You could net property taxes out of your rental income number. But for greater accuracy and the ability to modify the growth (or, less likely, decline) in the tax rate, enter the figure as an additional expense, and see how changes to that rate will affect your plan.

- At what rate you estimate that income will grow annually. Is it a hot market? Or do you expect rent increases will just keep up with inflation?

Get your projected income and expense numbers--and their growth rates--entered into WealthTrace as separate items for maximum control and accuracy.

The Sale of the Property

You will most likely want to sell the property eventually. When forecasting what that sale will look like, important things to consider include:

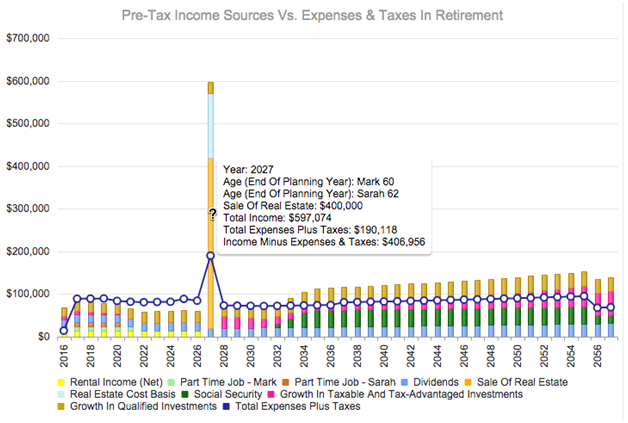

- The timing of the sale. The sale of a property normally involves a cash windfall. That could bump you into a different tax bracket, at least temporarily. Also, what happens to that cash influx after taking taxes into consideration? A good retirement planning program like WealthTrace can make assumptions about where that cash goes (such as into certain asset allocations), and allow you to see how those assumptions and the timing of the inflow affect the probability of success of your plan.

One of these years is not like the other! In this case, our property is sold in 2027. WealthTrace accounts for the cost basis and the capital gains--and handles the allocation of the cash inflow (which is assumed to go into an existing brokerage account, where it will continue to compound).

- Capital gains on the property. Of course you hope the property will increase in value over time. You'll want to make a (likely conservative) estimate of what those capital gains will be, and account for them in your plan.

- The cost basis of the property. If you do sell at a gain, you don't need to pay taxes on what you paid for the place. You'll want to account for this when running your numbers.

No need to account for taxes on the cost basis--and with WealthTrace, you don't have to. Note the effective tax rate above.

Rules and Regulations

Might you live in the property for some of the time leading up to the sale? If so, rules on capital gains could be different. And what about depreciation expenses on improvements you have made to the place, and then recapturing that depreciation at sale? These rules and laws are again beyond the scope of this post, but once you know what they are, WealthTrace can account for them in a plan.

Running Scenarios

Using the WealthTrace Planner you can run several scenarios that show the differences in your retirement situation using different strategies. One strategy could be leaving a big chunk of money in bonds. The other strategy could be taking that same money, buying a rental property, and renting it out over a 20 year time frame. You can then see if the rental property will pay off in the long run.

Whether you're an accidental landlord or an intentional one, there are a lot of moving parts to owning rental property. Making sure you understand them is important--and making sure you account for them in your financial planning is just as important.

Does rental real estate have a place in your retirement plan? Use WealthTrace to model rental property income and expenses accurately. Sign up for a free trial of WealthTrace to find out more.