Key Points

- A home is often a big chunk of a family's net worth, so it is important to consider what to do with it as retirement approaches.

- Renting is not necessarily just throwing money down the drain.

- There's more to the decision than financial concerns, but those should be considered carefully.

My grandparents retired to Florida. They loved where they lived, and called it the best move they ever made. But from the perspective of a financial professional, they arguably made a couple of poor choices. First, they bought a mobile home. Unlike a brick-and-mortar home, that's a depreciating asset, like a car.

They did not have much in the way of other assets--just incomes from pensions and Social Security, mostly--so if they wanted to buy something, their options were few. The bigger issue, though, was that they had to pay rent on the land on which the manufactured home sat.

Early on, the mobile home park owners recognized that many of their retiree tenants were on fixed incomes, and could not afford big rent increases. But as mobile home park operators consolidated over time via mergers and buy-outs, that changed. Demand for places to live in Pinellas county, with its beaches and easy access to Tampa, grew quickly. The landlords, who once restricted the rentals to seniors only, were eager to open up to the growing population of younger, working people who could pay more.

My grandparents were fortunate enough to be able to make it work, but a number of their neighbors could not, and had to move. Moving a manufactured home is rarely worth the cost, so they sold, probably for far less than they paid, and probably moved to apartments.

We generally can't predict the future. But we owe it to ourselves to run through some probable scenarios when making big decisions like this one. I doubt my grandparents did so.

Home Is Where The Money Is

A home is often a huge piece of a family's net worth, as long as they've played their cards right and not withdrawn too much equity out of it over the years. In retirement, or even earlier when the kids are out of the house, it can be decision time: Do mom and dad stay in the house, or do they downsize?

This is more than a financial decision, though that is the part we'll be focusing on in this article. It's often an emotional decision as well. After all, it's your home. It's probably the site of many fond memories; you know your way around it with your eyes closed; you love your neighborhood and know all the routes and shortcuts and local hangouts.

If you're planning to retire to somewhere warmer or closer to children who have moved away, one choice is probably clear: You'll sell the home. But should your next abode be a rental, or a purchase?

On the Other Other Hand

Let's briefly run through some pros and cons on both sides. We'll start with the pros and cons of buying in retirement.

On the positive side, well, you own it. That means you can do what you want with it, and that's important to a lot of people. Related to that is the satisfaction that comes with owning a home. Although rent isn't necessarily 'wasted,' that's how a lot of people think about it, and it pains them to pay it. On a mortgage, you're kind of paying yourself--it's enforced savings. Also, as of this writing, money is cheap--that is, interest rates are historically low, so you won't be paying a lot in interest.

On the negative side, you have to maintain it, and that costs and costs. As an early retiree who rents says in this article, "We don't get blindsided with roof repairs." That's the landlord's problem, as is nearly everything in most cases, like appliance repairs and yard work. (Incidentally, there are some great hypotheticals in that article linked above regarding renting versus buying that you can run for yourself in WealthTrace.)

Another negative, particularly in retirement, is that your house can't generate income the way dividend-paying stocks can. That is, if you have the money sunk into the home, yes, you'll likely get it out someday, probably with some appreciation over what you paid. But if you're a retiree, there's a decent chance you'd rather have it now instead of someday; you won't live forever.

Let's move on to the pros and cons of renting in retirement.

The biggest pro, as in the pre-retirement years, is probably the freedom of knowing you can pick up and go relatively easily. This is important for a few reasons. First, you might want to be near your kids and grandkids, so you move. Great. But what if you don't like where you move to? Or what if your kids decide to move, and you want to follow? It's a lot easier to do that if you rent instead of buy.

Second, there's a very real possibility that assisted living in some form is in our futures. If you've been in a home that you have owned for a long time when the time comes to move, OK, you'll sell--and bring in some cash to help cover that expense. But if you purchased your home relatively recently, maybe at a market peak, and are more or less forced to sell during a lull or a crash because you have to move, you might be in for some financial hardship.

The cons of renting are pretty straightforward, pre- or post-retirement. You can't usually do a lot of customization to make it yours. There's always the chance you'll be forced to move because of a property sale. And of course you're not building any equity if you're renting.

The Financial Aspect

Although finances won't be the only consideration in a decision like this, they should be thought through carefully. WealthTrace can help.

We won't run through all the possible permutations--there are so many--but we'll give you an example of one fairly common scenario.

Say you own your home, and you're considering downsizing at retirement and buying another place.

This probably means:

- You have a mortgage now that you'll pay off at retirement

- You'll get cash from the sale of your home

- You'll make a down payment on a new place and take on another mortgage

- Your property taxes will change

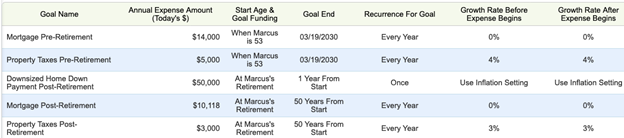

WealthTrace can handle all of that. In fact, here's what it might look like:

See what's going on there? One mortgage (which WealthTrace will amortize for you automatically) ends, and another starts; property taxes drop by 40% at the same time; and $50K is put toward a down payment.

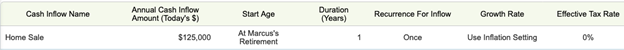

Oh, and here's the inflow from the original home sale:

Note that we put a 0% tax rate on that sale. If you have a home that's more valuable than that, you might enter two line items here: One that covers the portion that's excluded from capital gains taxes, and one that's not.

Once you get started, you can try out all kinds of permutations and see how it affects your Monte Carlo results. Get rid of the down payment, mortgage, and property taxes post-retirement, for example, and drop in a rent expense instead:

We're increasing the rent 3.5% per year here, but you could enter any figure you want. Play around with that rent number: What kind of rent could you afford on the high end?

There's much else you could run through the program too. What would happen if you kept your first home and rented it out? What kind of rent could you get? And could that rent offset your rent, or your new mortgage? Knowledge like this truly is power when it comes to helping you make some important decisions.

So Many Options

We hate to break it to you, but there's no pat answer to this riddle. There are a lot of variables, including, as we mentioned, many that aren't financial in nature. We can't help you with those, but for the money part, be sure to put your ideas to the test--and make sure you're satisfied with the projected outcome.

How will your investments and retirement plan hold up under various scenarios? Sign up for a free trial of WealthTrace to find out.