When looking to build a long-term portfolio of stocks that pay high dividends, investors usually come up with a mix of stocks that either have high dividend yields or high dividend growth rates. It is difficult to find good companies that have both. This means that there is often a choice to be made. All else equal, should one invest in the company that has that enticing high dividend yield, but a low dividend growth rate, or does one exude patience and invest in the company with a relatively low yield, but a high dividend growth rate? To help answer this question I looked at two companies that offer these different alternatives: Wal-Mart (WMT) and Merck (MRK)

| WMT: | | Div Yield | 1 Yr Div

Growth Rate | 5 Yr Div

Growth Rate | Payout Ratio | | 2.4% | 9.0% | 16.2% | 32.0% | | | | MRK: | | Div Yield | 1 Yr Div

Growth Rate | 5 Yr Div

Growth Rate | Payout Ratio | | 4.2% | 10.5% | 2.1% | 71.0% | |

There are clear differences in the two companies’ dividend yields as well as the growth rates. This presents a great case study in which company will give the investor a greater return due to dividends over time. More specifically, I want to measure the Yield on Cost (YOC) and how it changes over time as well as the compounded annual return due to dividends. The YOC simply measures the annual dividend divided by the original investment in the company’s stock.

The five year growth rate of dividends for Wal-Mart far exceeds that of Merck. However, I do not expect the growth rate to remain that high going forward, especially over a long time frame. To be more realistic, I will assume that Wal-Mart’s dividend grows at the one year rate of 9% and Merck maintains a growth rate of 2.1%. I ran the following results in our free calculator called Dividend Yield And Growth.

It takes 9 years for the YOC for Wal-Mart to break even with the YOC for Merck. Of course, due to compounding we see the YOC for Wal-Mart explode upward eventually. But this assumes that the company can continue its relatively high rate of dividend growth going forward.

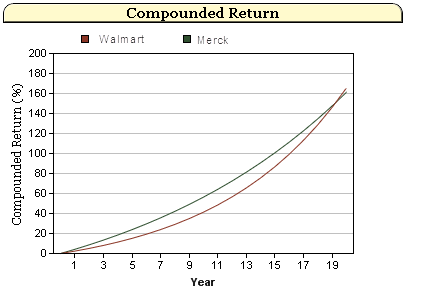

Although the yield on cost breaks even after nine years, it takes much longer for the compounded total returns to break even. In fact, it takes 20 years for the returns to break even. It is also important to note that I do not consider any price appreciation in these calculations and compounded returns are due solely to dividends.

This is an interesting case study in dividend investing because we can see that by investing in Wal-Mart for its dividends, one would be betting on the company maintaining a high level of dividend growth. If this doesn’t happen, there are better alternatives out there for dividend investors.

When constructing a dividend portfolio for the long-run, it is important to keep in mind just how long it might take for a lower dividend yield to catch up with a stock that pays a higher yield. That low yield stock that you think will have stellar dividend growth rates might still not be worth putting in your portfolio until the dividend yield has risen enough to make it worthwhile.

Retirement Planning Software | Financial Planning Software