Take It To The Limit: Max Out Your 401(k) Contribution

We'll just get this out of the way right up front. You need to start contributing more to your 401(k). And you should consider trying to max out your 401(k) contributions eventually. Maxing out your 401(k) will help you get to your retirement number much more easily.

Yes, we know--we can hear the excuses. But, my car payment. But, my cable bill. But, but, but.

Don't worry, this will only hurt a little bit.

Meet Your Match

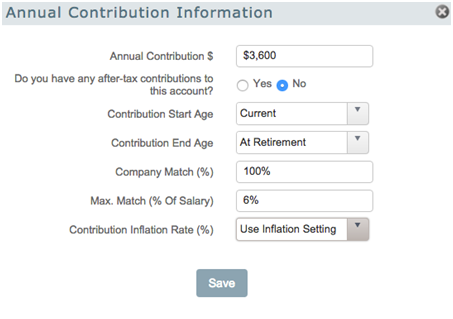

Let's set the scene. We'll use an example of a 40-year-old with a $60,000 annual salary. Her employer matches her contributions to her 401(k) dollar for dollar up to 6% of that salary. So as long as she contributes at least $3,600, her employer will match it, thereby doubling her contribution. (This is a fairly common matching scenario, but employers vary widely on what they contribute.)

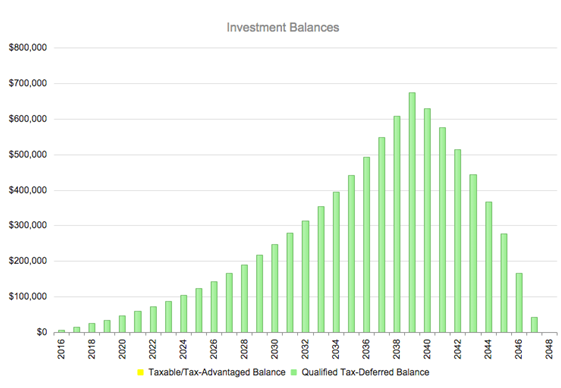

Also assuming a 3% annual raise just beating inflation at 2.9%, annual contributions increasing at the rate of inflation, and the whole shebang invested in growth stocks returning 8.5% annually, here's what the results could look like:

By 2039, when she retires, the account could top out at about $675,000.

Not bad, right? She contributes less than $15 per day for 24 years for a total of about $126,000, and ends up with $675,000. Magic!

But it could be even better. What happens if she maxes out her 401(k) contributions?

Mad Max: Road To Retirement

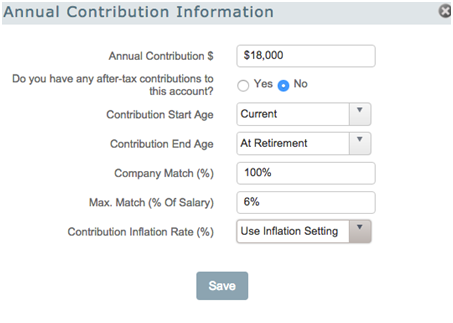

To max out 401(k) contributions is going to be a tall order for most people. But let's have a look at what the effect would be in this case.

The maximum amount a person under 50 can contribute to a 401(k) is currently $18,000 annually, and the employer match does not count toward the $20,500. We'll assume our subject is able to do the full $18,000, and that she will not be contributing the extra $6,000 she is allowed to contribute once she hits 50 (sometimes known as the catch-up amount, which, as we shall see, she will not need). The employer match will stay the same as in the previous example at $3,600 that first year, ramping up only to match her annual raises.

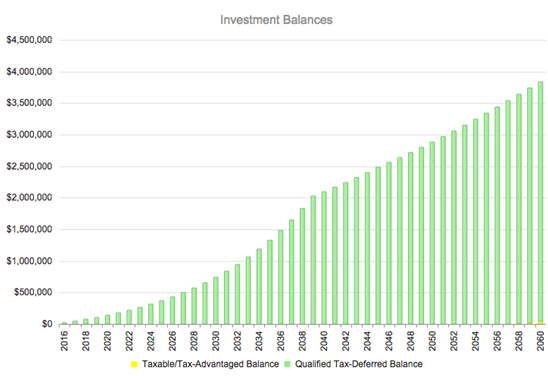

How does that look after 24 years?

Now we're talking! An investment account worth more than $2 million at retirement. (Not only that, but in this case, the investment balance after retirement actually grows in value, because our frugal retiree is spending less in retirement than the account is returning in investment value.)

If these graphs are something of a surprise to you, you may not fully understand the power of compounding. In this latter case, it takes about 17 years to go from zero to the $1 million mark, but then only another 6 years to get to $2 million. That's compounding at work.

Don't underestimate the power of procrastination, though. Procrastination creates a compounding effect of its own: The longer you wait to take action, the longer you will likely keep waiting. You don't want to be in a position where you get to 50 and need that catch-up amount above. Ideally, you use the catch-up because you want to, not because you have to.

What effect might maxing out your 401(k) have on your retirement plan? WealthTrace can help you find out. See how making small changes to savings can have a big effect on the probability of your plan succeeding. Use a free trial of WealthTrace to find out more.