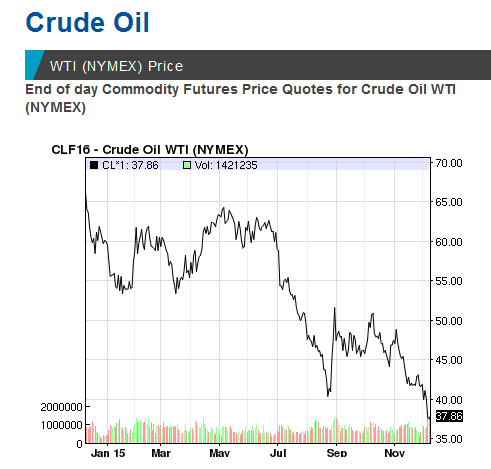

The carnage in the energy industry continues as oil has dropped below $40 per barrel, a level not seen since 2009. The biggest name of the bunch, Exxon (XOM), has not been unaffected either. Exxon's stock price is down 25% from the peak seen in mid-2014.

And now for the good news: The decline in Exxon's stock price has meant an increase in its dividend yield. Its dividend yield has increased by almost a full percentage point over the course of this year simply due to its falling stock price. Its current dividend yield stands at 3.7%.

Exxon has another dividend payment coming up in February of 2016. It will be very interesting to see if they stick to their strategy of increasing their dividends. In May of this year Exxon raised its dividend payment to shareholders — something no other major oil company has done since the downturn began, analysts say. “Exxon likes to go against the grain. They pride themselves on being a cut above the rest,” said Fadel Gheit, a managing director with the investment house Oppenheimer & Co. “Exxon is usually late to the party going in and going out. In a way it’s kind of a maturity. They don’t want to have a knee-jerk reaction to anything.”

Exxon is a dividend champion. When I look to add dividend paying stocks to my retirement portfolio I always look for companies that have a long history of paying dividends as well as a history of solid growth in those dividends. It's even better if the company has shown it can weather recessions by not cutting its dividend when the economy goes south.

Exxon has averaged nearly 10% growth in its dividend over the past 5 years. The average annual growth rate over the past 10 years has been right around 10% as well.

Exxon also has a relatively low payout ratio of 50% (which I discussed recently here) and has over $50 billion of cash on hand. This means it would not be much trouble for Exxon to continue paying out its nice dividend, even if conditions get tougher for them.

This article is not going to recommend that people invest heavily in stock funds or ETFs for the rest of their lives. This strategy has gotten too many people into way too much trouble over the past 15 years. What I want to discuss today is how carefully selecting and investing in dividend paying stocks that will have solid dividend growth for the next 20 years, such as Exxon, can pay off big time in the long-run and reduce stress immensely as movements in the stock price eventually barely matter.

Although I will focus on Exxon in this discussion, the strategy here applies to many companies that have a solid history of increasing (or at least not cutting) their dividends over time, even during recessions. Other companies that fit this mold are Johnson & Johnson (JNJ), Coca-Cola (KO), 3M (MMM), Procter & Gamble (PG), and Wal-Mart (WMT).

With its dividend yield at such a high level now, Exxon is potentially as enticing as it has been in years in terms of investing for its dividends for retirement. I thought it would be interesting to see how one would fare with the new dividend yield, but a lower dividend growth rate, compared with the old dividend yield and a higher dividend growth rate.

I started this analysis by looking at our free calculator named Dividend Yield & Growth. I compared the dividend yield seen last year, which was 2.7%, with the latest yield. To start the analysis I assumed that as things stood last year, Exxon could increase their dividend by 8% per year and now they can only increase it by 5% per year. The results over a 20 year time period are below:

Even though the assumed dividend growth rate is lower today, over a 20 year time period the higher dividend yield offsets this and the compounded return is actually higher than the older situation. This of course brings up the question, "what is the break-even dividend growth rate?" The answer is 4.3%. If Exxon's dividend growth falls to 4.3%, the compounded return over 20 years will be the same as if it had a yield of 2.7% and dividend growth of 8%.

I also ran some scenarios using our publicly available Financial Planning Software and found that Exxon's new situation, assuming they can at least increase dividends by 5%, means a typical couple can increase the time that funds last in retirement by more than three years. The dividend growth assumption is key of course, but Exxon has a long, rich history of dividend growth and I for one am willing to bet that they keep it going.

It is important not to panic with a company like Exxon. It is possible to lock in a yield of 3.7% today. Exxon has weathered many storms before. During the recession in 2008/2009, Exxon actually increased its dividend by 20%, which is amazing given that it is considered a cyclical company that moves with general economic conditions.