Key Points:

- Traditional IRAs allow you to defer taxes on their income, but the tax bill comes due eventually.

- By withdrawing from your investments in a planned way using financial planning software for retirement, you can minimize taxes on your Required Minimum Distributions (RMDs)

- Reducing taxes is of course desirable, but don't let the tail wag the dog.

Defer, defer, defer. That's the name of the game with traditional IRAs. Although you can start taking withdrawals at age 59 1/2, you don’t want to do this if you are trying to minimize taxes on RMDs. Generally you want to wait as long as you can before taking distributions so you delay paying taxes on the income.

Once you get to 72 (recently bumped up from 70 1/2 for most people), you can't wait any longer. RMDs come due, and taxes along with them. You can view your projected RMDs and run tax-related scenarios by signing up for a free trial of WealthTrace's financial planning software for personal use.

But there are other methods that can be combined with financial planning software for retirement to get your RMD tax burden down as well. Some require action in advance to minimize the RMDs coming due, and some do not.

Get Converted

The one that gets the most ink is probably converting a traditional IRA to a Roth IRA. We have written about this before; that link contains a useful Roth conversion case study and is well worth a read. The short version: If a conversion is under consideration, it's normally best to do it when your income tax rate is low. That could mean when one or both plan participants retire and Social Security has not kicked in yet. Income obviously drops when salaries disappear.

The reason you would want to wait to do this until your income tax rate is anticipated to be lower is that traditional IRA conversions are taxable in the year the conversion happens. You wouldn't want to add to your tax burden unnecessarily (unless you have reason to think your taxable will income will go up after retirement, which can happen in rare cases). Once the money is in a Roth, of course, you're home free--no further taxes will be due.

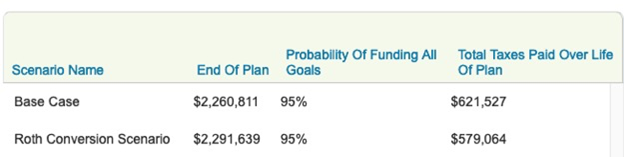

The WealthTrace Planner can run such scenarios and give you useful information about what kind of conversion, if any, would make the most sense in terms of taxes paid. You can start the conversion within the retirement software in different years, specifying over what period of time the conversion should take place, and more.

WealthTrace's financial planning software for individuals streamlines conversions for users.

Roth conversions are probably as good as it gets for minimizing taxes on RMDs for most people, but there are lesser-known methods (of varying practicality for most people) that are worth noting as well.

If It QLACs Like A Duck

We're not generally fans of annuities, but here goes: Qualified Longevity Annuity Contracts (QLACs) are annuities that can be funded by IRAs. They offer monthly payments guaranteed until the end of the purchaser's life, allowing the annuitant to ignore stock market fluctuations. The kicker: Regular RMD rules do not apply.

With a QLAC, you buy (via regular payments or a lump sum) an annuity, usually from an insurance company, out of your qualified funds, such as an IRA. At the start date (specified in the contract), the payouts begin for some set number of years (also specified in the contract), possibly until the end of the annuitant's life.

The amount from the qualified account that has been used to purchase the QLAC has no RMD requirements until the payouts start. And that start age can be as high as 85.

To us, buying an annuity sure sounds like an extreme measure just to defer taxes even further. However, it could make sense for people with other assets and sources of income. That is, if a retiree can get by (and then some) on Social Security benefits, pension income, and investment accounts that are not traditional IRAs, it could be worth looking into a QLAC if further tax deferral is an important goal.

Keep on Punching the Clock

Working after you turn 72 would also be an extreme thing to do just to further defer taxes due. But it is an obvious thing that can be overlooked: If you work past 72 and have an active 401(k) through your employer, there's a decent chance (subject to the 401(k)'s terms) that you can hold off on taking RMDs from it.

Now, you'll still need to take distributions from any traditional IRAs you may have. But the 401(k) could be exempt as long as you keep working.

Give It Away

Charitable giving strategies could fill a book, and probably have. Such strategies are often employed by the wealthy to donate money while minimizing taxes. We'll touch on just one here: Qualified Charitable Distributions (QCDs) mean retirees can donate up to $100,000 of their RMDs annually to charities and not be taxed on them. It's another thing where it's not something to do just to reduce your taxes, but if you're planning to give away some of your assets anyway, it's definitely something to look into.

Keep Your Eyes on the Big Picture

It's worth keeping in mind that, in the end, you mainly just want to meet all of your retirement goals. Minimizing taxes, while desirable, shouldn't drive the decision-making process. But if you can meet those goals while also reducing the tax load using financial planning software for retirement combined with other methods, that's even better.

Do you want to minimize your taxes in retirement? Sign up for a free trial of WealthTrace's comprehensive retirement planning software to build your retirement plan and run tax planning scenarios.