Key Points

- Taxes can have a large impact on a person’s retirement situation.

- Retirement portfolio withdrawals and Required Minimum Distributions (RMDs) are taxed at both federal and state income tax rates.

- Predicting future taxes is not easy, but we can run some scenarios.

The recent tax law and changes to the tax code were pretty dramatic in terms of how it impacts most taxpayers. Not only did federal tax rates go down across the board, but the law regarding tax deductions changed a lot as well. Many people who used to itemize the taxes now will simply use the standard deduction of $12,000 per person, which is double what it used to be.

One problem in terms of planning for the future is that most of the tax law changes are all set to expire in 2025. The House of Representatives recently voted to make the new tax law permanent. But its passage in the Senate is very much up in the air.

How Tax Rates Can Impact Retirement

More and more people are living off of their 401(k) plans and IRAs in retirement. But one thing that comes as a nasty surprise to a lot of retirees is how much they pay in taxes on Required Minimum Distributions (RMDs). When retirees turn 71 ½ they are forced to withdraw money from their tax-deferred retirement accounts. The reasoning is that they didn’t pay taxes on the income or gains initially, so the government needs them to pay something eventually.

When the money is withdrawn the owner must pay their federal and state income tax rates on the entire amount that is withdrawn. As an example, a person with $1 million in their IRA at age 72 will need to withdraw nearly $38,000 by law that year. They will pay their full income tax rate on that amount.

Let’s put some numbers to all of this theory. I analyzed a 60 year old couple’s retirement plan in the WealthTrace Financial & Retirement Planner. This couple currently has $1 million saved in their IRAs and they save $10,000 per year. They plan on retiring in five years and they project to spend $60,000 per year in retirement. I assumed a 5.5% annual rate of return on their investments for life.

Using the old tax laws, I found the following:

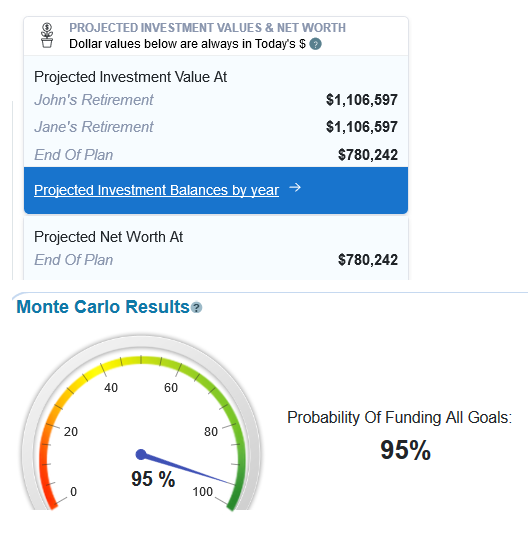

And this is with the current tax code, assuming that nothing in it expires:

The amount this couple has left at the end of their plan (when they are 85) is about $100,000 more than using the old tax rates. Also, their Monte Carlo retirement results show that their probability of never running out of money goes from up by 4% with the current tax rates. The WealthTrace Monte Carlo simulator uses 1,000 scenarios whereby the annual returns for investments move each year and in every scenario based on historical data.

Clearly the tax code impacts how much a person can spend in retirement and how comfortable they will be. But in the grand scheme of things, does it really have that large of an impact?

Other Variables In A Retirement Plan

Some people are surprised how big of an impact items such as spending and rates of return have on a plan. Let’s go back to using the old tax code for a moment. I took this couple’s plan and reduced their spending until we achieved the same results as using the new tax code. It turns out that reducing their spending by just $3,000 a year would give them the same results as the reduction in tax rates would.

I also looked at their rate of return assumptions. If their annual rate of return on their portfolio increases by just 0.4%, that is also equivalent to the tax cuts. Lastly, if they move from their current state that has a 5% income tax rate to a 0% tax state, this also gets them to the same point.

Unlike taxes, their spending is something that is in their control. So it’s nice to know that they can boost their chances of a successful retirement by cutting their spending by a reasonable amount. Their rates of return are only partially in their control. We have discussed many times how moving from treasury bonds to dividend paying stocks can improve one’s expected returns and retirement portfolio immensely.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.