Key Points

- The amount of risk to take with your portfolio in retirement depends on a lot of different factors.

- Be careful of rules of thumb about asset allocation when you’re older.

- The amount of risk you can take in retirement depends heavily on your retirement income vs. your expenses.

When interest rates were above 6% a little over 20 years ago many retirees put most of the retirement savings into treasury bonds and lived off of that income. They weren’t worried about the ups and downs of the stock market and they were able to generate enough income to pay for their retirement expenses.

But with interest rates falling dramatically over the past 15 years, most people in retirement could not live off of bonds alone. In fact, most had to increase their exposure to more volatile stocks in order to attempt to make ends meets.

Be Careful of Rules of Thumb

We have discussed the dangers of using rules of thumb for retirement planning before. Both the 100 minus age rule and the 4% rule are pretty outdated at this point and can be dangerous to use.

These rules of thumb were based on the ability to generate enough income from bonds in retirement. With interest rates below the rate of inflation currently, it simply is not possible to generate enough income from bonds to meet expenses.

This doesn’t mean there isn’t a place for bonds in retirement portfolios. There definitely is. When recessions hit, bonds almost always produce positive returns when stocks decline. This diversification is key to not running out of money in retirement.

Risk Level Can Depend on Retirement Income

I have run a lot of different retirement planning scenarios on this topic using the WealthTrace retirement planner. You can sign up for a free trial and generate your own comprehensive retirement plan as well.

I have found time and time again that those with a substantial amount of secure retirement income can afford to take more risk with their retirement portfolio. This makes intuitive sense because if you don’t need the money in the portfolio, the time horizon to use it is longer (perhaps forever) and therefore it can be invested for the long run.

Let’s look at two examples. Our first couple is 65 years old and they have $1 million saved. $800,000 of this is in an IRA and the rest is in a taxable brokerage account. They have a combined $40,000 in Social Security payments per year and they are projecting they will spend $70,000 per year in retirement.

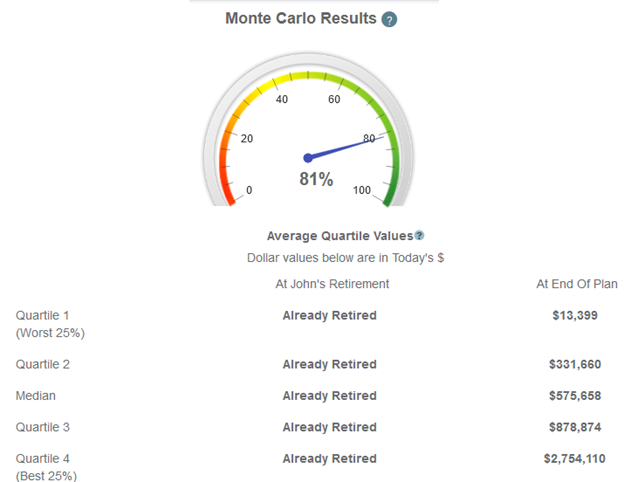

Because their retirement income is less than their annual spending they will have to dip into their investment balances. This means they should not be taking too much risk with their portfolio. To show this I set their asset allocation to be 90% in a mix of domestic stocks and international stocks. The other 10% is in Treasury bonds. I ran Monte Carlo simulations on their portfolio to determine the probability of them never running out of money.

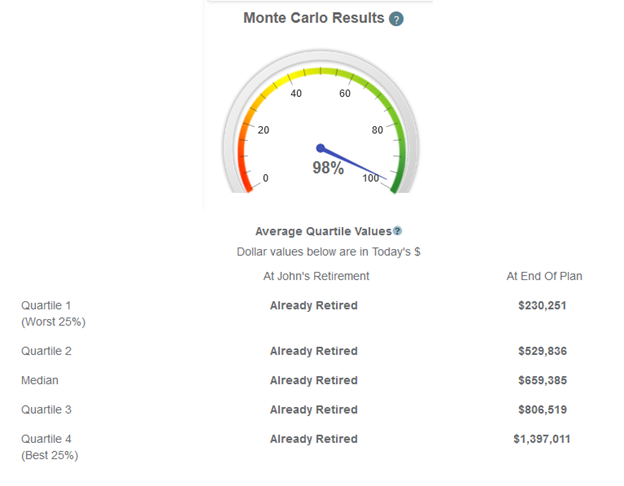

Monte Carlo shows that they would run out of money in 19% of the simulations run. I then set their portfolio to a more conservative mix of 50% in stocks and 50% in bonds.

Not only does their Monte Carlo probability of success increase dramatically, but the volatility of their investment values decreases. You can see this by looking at the value of their investments in the worst quartile and the best quartile of Monte Carlo simulations.

This is solid evidence that taking too much risk in retirement when you need to access your investment principal can be devastating if there is a bear market.

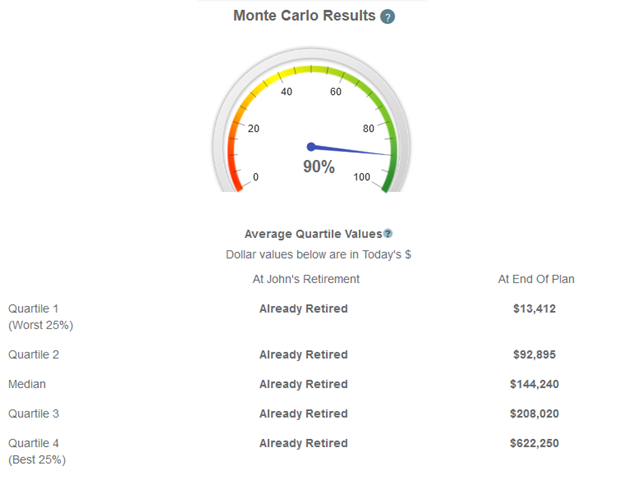

Now let’s look at a couple that has almost enough after-tax income to cover expenses in retirement, but has less saved to their investments. In this example the couple is the same as the previous one except they have a pension of $30,000 per year that grows with inflation. Their total investment value is only $250,000, with $200,000 in an IRA and $50,000 in taxable investments. If they are 90% in stocks and 10% in bonds I found the following with Monte Carlo.

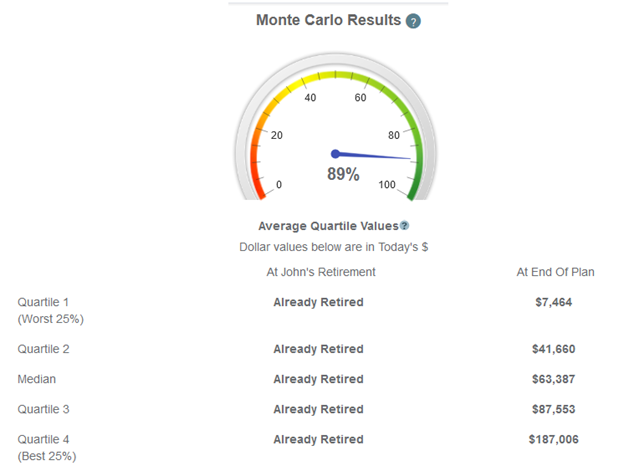

If we move them to a more conservative 50/50 mix of stocks and bonds I found the following Monte Carlo results.

The Monte Carlo probability of success went down slightly. But more interestingly, the median investment value declined by over $80,000. This makes sense because the more aggressive portfolio gets to grow over time without being touched for the most part. The longer the time horizon for investments, the more likely the stocks are to outperform bonds and Monte Carlo simulations reflect this.

No One Size Fits All Approach

It is so important to get all of your financial information into a retirement plan so you can run retirement planning scenarios like we ran for this article. Everybody’s retirement plan is different and requires more than a simple rule of thumb when making important decisions like what the asset allocation should be in retirement. Although most people should be in a relatively conservative mix of investments when retired, this isn’t the case for everybody, especially those who have enough retirement income to cover most or all of their expenses in retirement.

Do you have the right asset mix for your retirement portfolio? Sign up for a free trial of WealthTrace to build your own comprehensive retirement plan and run scenarios to find your optimal asset allocation.