Key Points

- Living to 100 is quite possible for a lot of people.

- If your genetics indicate you might be one of these people, you want to be prepared financially.

- Having enough money to live to 100 is easier said than done.

Are you blessed with good health and good genes and hoping to live to 100? If so, do you have the means to get you there?

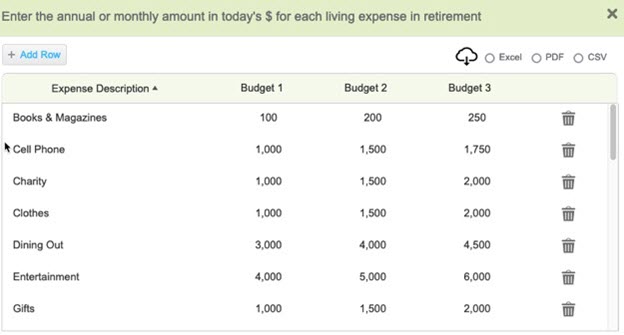

The process of answering the question of how much money you need to have saved really doesn't vary that much, regardless of life expectancy. It should start with your spending needs.

You can approach estimating your retirement spending needs in a couple of ways. You used to see this tackled on the income side of things: There's the so-called 80% Rule that says you should try to figure out a way to generate 80% of your pre-retirement income once you retire. But that looks at the problem backwards, in our opinion, because it starts with income instead of spending.

A better way to go about this is simply to make a solid attempt at figuring out what your spending needs will be. This is best accomplished by good old fashioned spending tracking: Simply watch where the money goes, make a note of it, and then back out things that you won't be spending money on in retirement. It's best to do this for at least a year, so you capture all the things that come up that you might otherwise forget about. (You don't want a surprise such as, "Oh, right, we have to pay property taxes" to derail your plans.)

Whether you're Retired or Not

If you're already retired, you should be able to get a good sense of your spending habits after a while, and plan accordingly. Just be sure to factor in surprise expenses every year or two--and by "surprise," we really do mean surprise, as in things you're not counting on happening. Also be sure to take into consideration late-in-life care costs, which you should count on happening. These can be substantial.

Now, if you're not retired yet, it's a little trickier to estimate what you'll be spending once you do retire. You might currently be paying kids' expenses and (hopefully) contributing to retirement accounts, or putting money toward other things that you won't be putting money toward in retirement.

Once you've got spending dialed in, you can turn to the income side of things. It might be easiest to start with sources of income outside of what you expect to garner from investments. That's going to be Social Security and pension benefits in most cases, but there could other sources as well, such as rental income from properties you might own.

The March to Age 100 Goes Through the Stock Market

That gives us two of the three pieces of the equation, and brings us to the big question: What do you need to have saved and invested so you can live to age 100 without running out of money?

Like we mentioned, the process really is the same regardless of life expectancy, but of course the longer you expect to live, the more you're going to need, all else equal. So let's try a case study.

A fit, active, genetically gifted, and retired 60-year-old couple with about $1.9 million in investments wants to know if they have the resources to get them to 100. They don't have any pension income, but plan to start taking Social Security at Full Retirement Age, currently 67. They estimate that will be about $40,000 between them. They have also structured their portfolio such that it generates around $50,000 in dividends each year. Setting things up this way, with solid dividend-paying companies as a large part of their investment portfolio, allows them to have more of their assets invested in stocks than they might otherwise have at their age.

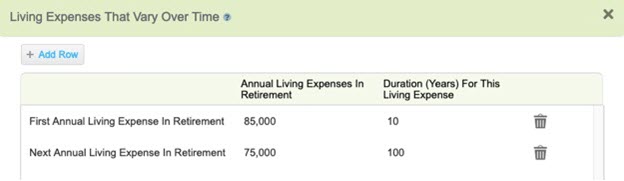

They expect to spend around $85,000 on living expenses annually for the next 10 years, and then drop that down to around $75,000 after that.

There's more to their spending than that, however. On top of their living expenses, they budget $5,000 annually for the unexpected expenses we mentioned above, plus about $15,000 annually for health insurance (on top of basic Medicare), $5,000 for property taxes, and $4,000 for homeowners' insurance. Their mortgage of $10,000 annually will be paid off in 10 years.

Their baseline plan has them living to 90, which is a reasonably conservative (high) life expectancy for most people.

Care for The Long Haul

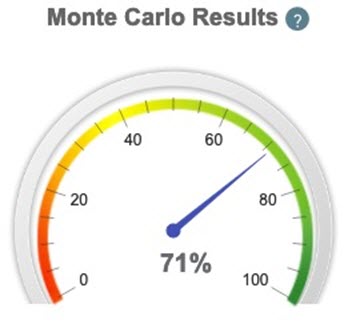

As it stands now, things look pretty decent for our couple on a Monte Carlo basis: We found they have an 85% chance of funding all of their goals using the WealthTrace Retirement Planner. If we bump their life expectancy up to 100, though, that drops considerably:

What's missing here, whether they'll live to 100 or not, is some way to account for late-in-life care. That could be long-term care insurance, or it could be covering it out of pocket, but it should be handled somehow.

This is a huge wildcard in retirement planning. You may need virtually no extra care at all, or you might need quite a bit.

Let's hypothesize a bit here regarding how our couple might be able to cover their care needs. Buying long-term care insurance is one way to go, but it's no cure-all: In the past, premiums were mispriced, leading to unexpected increases in those premiums. Few reputable companies write such policies at all anymore.

Another option is selling their residence and moving to a community that allows them to live independently for as long as they can, and then switch to assisted living after that. If we assume their home is paid off in 10 years on the above-mentioned schedule, and that their home is worth $500,000, this plan could work out very well. They would have an infusion of cash just when they need to make the transition.

More and more, though, people don't like to hear the word 'facility,' and want to stay in their home for the duration of their lives. That traps an asset that might otherwise be liquidated and used to cover expenses, but, well, it's home. This could mean in-home care, which is rarely covered by regular insurance.

In that case, our couple is going to have to start thinking about it now, and they may need to get creative.

Flexibility Is Key

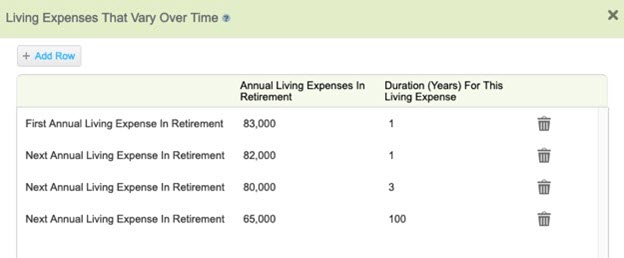

One option that is often overlooked in financial planning is to vary spending a bit more than planned. In years with a bear market or recessions, they could tighten their belts a bit more than they'd like, for example. People don't like to think about doing this because it introduces uncertainty into a time of life when uncertainty is unwelcome. But it can be effective.

Here's what our couple's spending projections look like now:

They can't know when bear markets will hit, of course. But they can modify their spending a bit. If they go with something more like this...

. . . then they have a lot more breathing room:

Finally, it's beyond the scope of this article, but a reverse mortgage should at least be on the table for discussion. That would generate a bit more income for them, though of course their heirs would not get their home in that case.

It's Complicated

Hopefully it's becoming clear how difficult planning for late-in-life care really is. How much money you need to live to 100 depends on a lot of different factors. The key for the non-independently-wealthy is largely going to come down to what we talked about at the beginning: Spending, and, yes, being flexible with it. If our couple really thinks they could get to 100, they would be wise to start making at least some minor modifications (that is, reductions) to their outflows now.

Do you want to run scenarios on your retirement situation? Sign up for a free trial of WealthTrace's retirement planning software to build your own comprehensive and accurate retirement plan.