Key Points

- Most people can no longer live off of interest in retirement due to low interest rates.

- Interest-paying bonds still have a place in retirement portfolios, but having neother income sources is key.

- Comparing expenses vs. interest paid each year in retirement is not enough. Taxes and inflation must also be taken into account.

How much money you need to live off interest in retirement of course depends on many things that are different for each person. It is of utmost importance to use comprehensive retirement planning software such as WealthTrace to figure out how much money you need to save before you retire. You can sign up for a free trial to quickly see your retirement projections. If you don’t have a retirement plan in place you risk running out of money in retirement and having to go back to work.

Overlooked Items That Impact if You Can Live Off Interest in Retirement

Life expectancy in retirement is one major variable that too many people get wrong. For most people, the longer they live the more money they need saved for retirement. But many retirees have assumed they won’t live past age 80. This can be a dangerous assumption given that more people than ever are living into their 90s thanks to better medical care and nutrition. In fact a 65 year old woman has a 34% chance of living until 90 and a 65 year old man has a 22% chance.

Taxes are another item that many people don’t take into account or don’t accurately project for retirement. What will your taxes be in retirement? A lot of this depends on what type of investment accounts you have. If you are mostly in a traditional IRA, get ready to pay lots of income taxes on Required Minimum Distributions.

If you mostly have money in a Roth IRA then this can be a major step towards living off interest income in retirement since you won’t pay taxes on withdrawals from a Roth IRA. In fact it is always a good idea to see if you should convert to a Roth IRA right as you transition to retirement and before retirement income such as Social Security begins to drive up your income tax rate. Many people see the lowest income tax rates of their adult lives in the first few years in which they retire, which means a Roth IRA conversion can make a lot of sense.

Calculating if You Can Live Off Interest

Living off of interest means only using interest paid from bonds for your retirement expenses and not using any of your investment principal.

The bottom line is that you need to have a retirement plan built to see if you can live just using interest income from bonds. Guessing, using free calculators, or trying to figure it all out with a spreadsheet won’t cut it.

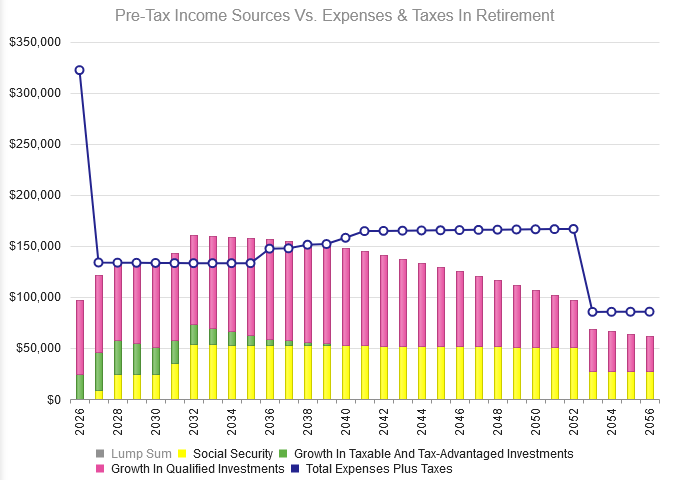

With good retirement planning software you can easily visualize your interest income vs. your expenses in retirement and see where any shortfalls are.

In the example above you can see that in most years this person cannot live off interest in retirement. They would have to come up with more types of income to make their retirement plan work.

Most People Cannot Live Off Interest When They Retire

Unfortunately for most people using just interest from bonds won’t be enough. Interest rates are just too low compared to inflation. As a simple calculation assume you have $80,000 a year in annual expenses in retirement. You have saved consistently for retirement and are wondering if you can retire on $3 million.

In today’s low interest rate world you would be lucky to get a 3.5% interest rate on your bond investments. If you can get an interest rate of 3.5% and inflation is 2.5%, you are still only making 1% on your money before taxes and after inflation. Too many people (including some financial advisors) do not take into account inflation when making this calculation. This is a mistake and can lead to bad decisions all around. After inflation, the interest generated is only $30,000 per year compared with $80,000 in spending. Even if you delay taking Social Security in order to get the maximum Social Security payment, there would not be enough income to cover these expenses.

The painful truth is that with $80,000 in spending one would need over $8 million in retirement to live off interest alone. Since most people don’t have that kind of money saved for retirement there needs to be an alternative plan.

How You Can Make Your Retirement Plan Work

It is not the end of the world if you cannot live off interest in retirement. You just have to make sure you have other stable sources of income set up from your investments. Dividend paying stocks could be the perfect solution. There are many great companies out there that have been paying a growing dividend over decades and have never cut their dividends, even in a recession.

This type of stable income is exactly what most people are looking for when they are attempting to not use any investment principal. There are even Exchange Traded Funds (ETFs) that invest in these companies.

It is also a good idea to implement a bucket strategy in retirement. This entails bucketing your retirement accounts by liquidity and risk. Your least risky assets are used first and the most risky are bucketed into accounts for much later use. That way you can keep more money invested in stocks for the long-run while withdrawing money for expenses from less volatile accounts.

Diversify Your Retirement Portfolio

It is also extremely important that your investments are diversified in retirement so a bad recession doesn’t knock you off course. This means a good mix of stocks, bonds, international investments, and potentially even real estate. A diversified portfolio is much more able to withstand market downturns as some investments normally go up as others go down. Again, this is another reason it is important to have a retirement plan in place where you can view your overall asset allocation and see if it needs to be changed.

The Bottom Line

Twenty years ago many retirees lived off of interest with no problems. That is not the world we live in today unfortunately. For most people it is nearly impossible to only live off interest income once they retire. But there are other ways to ensure you have a stress-free retirement and meet all of your financial goals. Just make sure you have a retirement plan set up so you can see exactly what you need to do

Are you worried you might run out of money in retirement? Start your free retirement plan today to help alleviate your stress and anxiety.