Key Points

- Having a $2 million nest egg (or war chest, depending on how you think about what you'll be doing in retirement) gives you a lot of flexibility heading into retirement. In this article we use the WealthTrace Retirement Planner, which is available to the public as well, to look at retirement scenarios. You can sign up for a free trial of WealthTrace and create your own accurate retirement plan.

- Everyone's situation will be different. How long $2 million will last in retirement depends on what your goals are for retirement.

- Running a Monte Carlo simulation is a great way to stress test any long-term investment return scenario.

Believe it or not, $2 million in retirement might not be enough. With inflation at 40+ year highs and the stock market down substantially, a lot has changed for both retirees and those approaching retirement.

When people start thinking about retirement, they come at it from a number of different angles. They might wonder if they can retire at a certain age; we've written about how to retire at 50 and at other ages. Or they might simply wonder at what age they can retire given their current savings and spending habits.

There's another way into the conversation about how long $2 million will last in retirement. As people who have been thinking about and planning for retirement for a while get closer to their anticipated retirement date, they start to have a decent idea about what their investment balances at retirement might look like. And it's natural to wonder how long that balance might last.

Running the Numbers

So how long will $2 million last in retirement?

Let's consider a hypothetical couple that is 60 years old and hoping to retire as soon as possible. They have $2 million saved and think they are probably ready, but want to be as certain as they can be. Their investments are roughly made up of 60% stocks (averaging around 7% annual returns) and 40% bonds (averaging 3% annually). Three quarters of their investments are in IRAs. They're hoping not to take Social Security--a combined amount of $65,000--until full retirement age. We also assumed they will live until age 90.

On the expense side of things, their home is paid off, and they think a conservative (high) estimate of spending will be $95,000 annually, pre-tax.

We ran these numbers, along with an assumed annual inflation rate of 3%, which has gone up dramatically over the past year. Although inflation is currently above 8%, we don't think it will stay there for long and will eventually settle around 3%. Using the WealthTrace Retirement Planner, which you can use by signing up for a free trial of WealthTrace's retirement planning software, we ran some scenarios to see how long $2 million will last in retirement for this couple Let's see how things look for them:

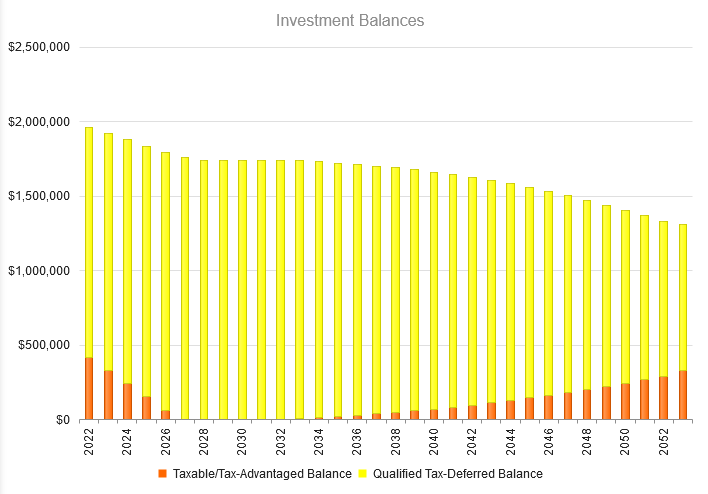

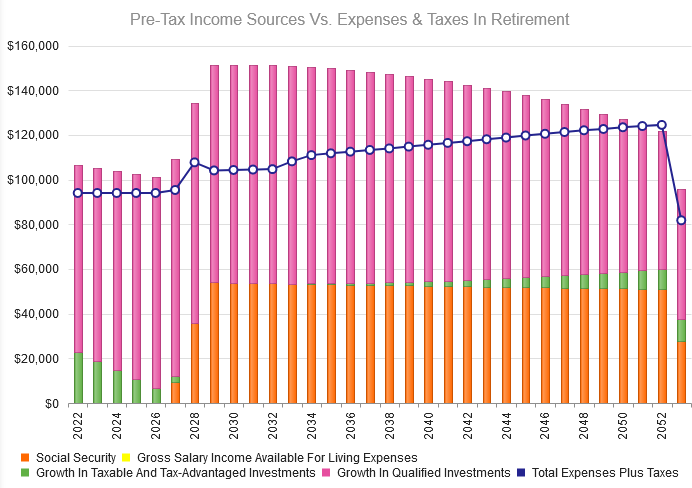

It looks pretty good for them so far. Their total investment balance in inflation-adjusted dollars does decrease slightly as retirement goes on, but not in an alarming way. Similarly, here's what their income sources versus expenses are projected to look like:

It looks pretty good for them so far. Their total investment balance in inflation-adjusted dollars does decrease slightly as retirement goes on, but not in an alarming way. Similarly, here's what their income sources versus expenses are projected to look like:

This is another good sign for them. Their retirement income is above their expenses in every year, which is key to having a comfortable retirement. It might come as a surprise that their income is always above their expenses, yet their investment balances are declining over time. How can this be? The answer is inflation. Inflation is eroding part of the portfolio each year and WealthTrace shows the values in inflation-adjusted terms so people can understand how much they really have in terms of purchasing power.

Stress Tested

OK, it may not exactly be news that a debt-free couple with $2 million should be able to live on $95,000 a year for 30 or so years. Let's push on this a bit and see what happens.

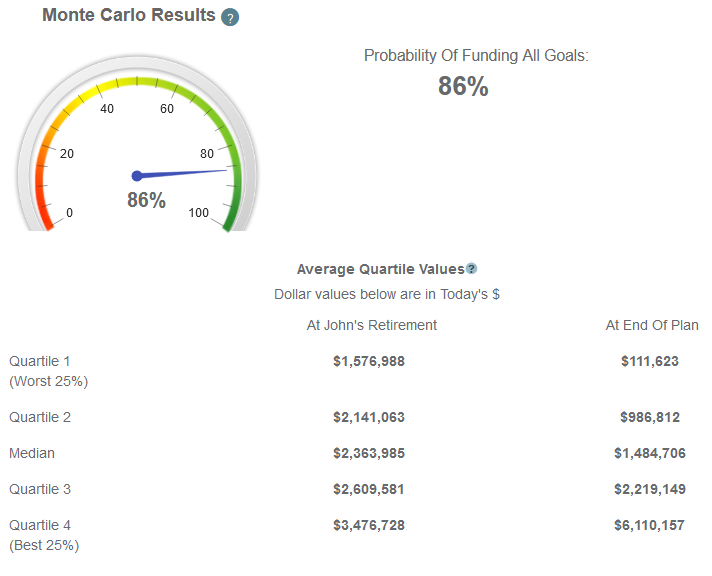

First, to really stress test their plan, we'll want to see at least an 80% probability of success when running a Monte Carlo simulation for retirement. We can do this with WealthTrace, and when we do, things are looking pretty good:

The Monte Carlo simulation runs through 1,000 potential scenarios. In 14% of these scenarios they run out of money. The scenarios where they run out of money occurs because of the riskiness of stocks, as we are seeing happening so far in 2022.

Finding More Retirement Income

If this couple can boost their retirement income they will in turn boost their Monte Carlo results and decrease their level of stress. Increasing retirement income is easier said than done, but for many people the easiest route is to delay taking Social Security benefits until age 70.

When a person delays taking Social Security, the payment increase by 8% per year delayed. There is normally a break-even time that the person must live for this to make sense. That number is right around 78 years old. Given this, it is no surprise that delaying Social Security is the right move for this couple since their life expectancy is 90. Their Monte Carlo probability of meeting all of their goals increases by 4% due to having higher, more stable income in retirement.

Another way retirement income can go up is an increase in interest rates, which is of course beyond the control of the retiree. However, when interest rates do increase, like they have this year, retirees can change their asset allocation to take advantage of this and generate more income from interest.

I found that if interest rates increase by 1%, with no increase in inflation, and this couple switches their asset allocation by 10% more to bonds, their Monte Carlo probability increases by 10%! This just shows how detrimental low interest rates have been for retirees and how higher interest income can help.

Making It Last

A couple in this position has options--far more options than we could cover in one article. For example, if their tolerance for market volatility is low (what would they do in case of another 2008?), they could invert the percentage of their funds invested in stocks and bonds, making the numbers something like 40% and 60%, respectively, and they would be fine, especially if they delay taking Social Security and are able to get just a bit more interest income out of their bonds.

It's an ideal case, really, where the main questions are not how to cover expenses in retirement or worrying about whether they money will run out, but how best to enjoy retirement.

It's a great problem to have. Be sure your retirement planning software program can cover all the bases.

WealthTrace covers all the bases. Small changes to savings and spending can have a big effect on a plan. Sign up for a free trial to find out how you can retire comfortably.