Key Points

- Fidelity Investments recently released a study detailing what a person retiring in 30 years might need to save in order to cover health care costs in retirement.

- Health Savings Accounts are a great way to cover a lot of those costs.

- There's still a lot of uncertainty about what health care costs will look like down the road, so it's best to be prepared.

Fidelity Investments recently released a study (or a press release [pdf], depending on how you look at it) with some new numbers about expected health care costs in retirement.

Here's the money quote:

"According to Fidelity, a 65-year old couple retiring in 2019 can expect to spend $285,000 in health care and medical expenses throughout retirement, compared with $280,000 in 2018. For single retirees, the health care cost estimate is $150,000 for women and $135,000 for men."

The pace of increase in health care expenses is slowing for now, which is good news. But the trend is definitely still upward, and the uncertainty surrounding the topic isn't going away.

Fidelity's estimated costs are in addition to Medicare Part A and Part B, by the way (and the estimates assume that you'll be covered by it). If you're cruising along in your 30s thinking that all of your health care costs will be covered in retirement (if you've even thought about the topic at all), well, they won't be. Medicare A and B, which is basic hospital and medical insurance, probably won't cost you much (because you will have already been paying into the program throughout your working years). But you'll want more than just that. Dental care, hearing aids, glasses, and lots else are going to require additional Medicare premiums later in life--that's right, premiums, just like with a regular insurance policy.

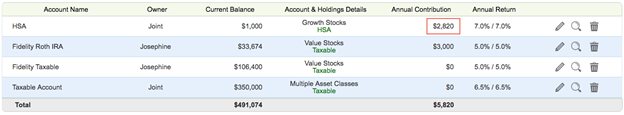

Fidelity says a 35-year-old couple saving $2,820 per year in a Health Savings Account (HSA) over 30 years (assuming 7% annual returns) can cover this expense. So, depending on where you are in your career, you may want to add that contribution to your annual accounts-to-fund list (alongside your IRA and your 401(k) accounts, at the very least).

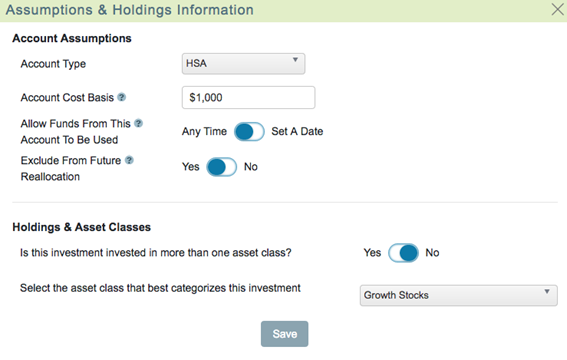

With WealthTrace, you can model contributions to Health Savings Accounts (HSAs) and other investment accounts, as well as the anticipated cost of health care in retirement.

Not Set In Stone

Don't take this study as gospel, of course. Fidelity is quick to point out that 2049 is a long way off, and that a lot could happen to the health care system between now and then. The costs could be higher or lower.

You'll definitely want to know what the risks are if the costs turn out to be higher. With WealthTrace, you're able to model that pretty quickly.

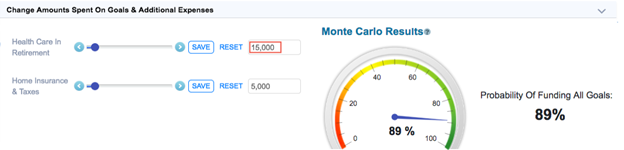

Here's a case where we assume health care costs are 50% higher than originally anticipated. Long story short, it's a couple in their 30s hoping to retire at 65. They have $875,000 in various investment accounts, are diligent about contributing to their retirement accounts, and plan to spend around $65,000 a year once they stop working full time. Below, we increase our assumption of their annual spending on health care costs from $10,000 to $15,000:

WealthTrace allows you to make changes to your plan assumptions on the fly, and then see what the effect of those changes would be on the plan.

On a probability basis, our couple's chances of funding all of their goals in retirement drops substantially, from 95% to 89%. That's not the end of the world, but it's meaningful for sure. Additional contributions to the HSA would help cover the difference (and you can model that in WealthTrace as well).

Investing In Your Health

Now, let's step back for a second. Do you have an HSA? Or, first--are you eligible for one?

You can read more about it here, but essentially, an HSA is like an IRA. Money goes in pre-tax; taxation is deferred. But there's one big difference: If you withdraw the money for qualified health care expenses, those withdrawals are tax free.

WealthTrace won't assume any taxation on withdrawals from health savings accounts.

Not everyone is eligible to have an HSA account. The main restriction is that you have to have a high-deductible health insurance plan, but there are a few other boxes to check too. If you're eligible, and have maxed out contributions to your other qualified accounts, an HSA could go a long way toward giving you peace of mind about health care costs down the road.

Fidelity has a horse in this race, obviously: They want your investment dollars. By pointing out that Medicare won't completely cover your medical needs, they hope to get some calls and emails inquiring about HSAs.

But just because it's marketing doesn't make it misleading, at least not in this case. We can't predict with 100% accuracy what medical issues we might face in retirement, but we can do a few things to prepare for those issues. Adding an HSA to your arsenal--and modeling contributions to it as well as to other qualified accounts in a program like WealthTrace--are good first steps.