Key Points

- January is a good time to revisit your finances and investments, and to make sure you are doing all you can to ensure you are saving enough for retirement.

- There are small things you can do, even habits you can form, that could make a dramatic difference to how much you save, and when you can retire.

- If you're already retired, making a few changes to your spending and saving habits could mean less worry about your finances.

We're a little late to the new-year's-resolution-article party this year, but better late than never. And anyway, good advice is good advice, regardless of when it's offered. Following are a few ideas that

WealthTrace

can help you with if you're trying to get (or keep) your financial house in order.

Pay Yourself First--And Then Some

One of the first things a planner will often tell a new client is that they need to pay themselves first. This usually means making sure a portion of each paycheck is put toward savings or investments. This is easily done via an automatic paycheck transfer. Diverting the money to your retirement savings before you get your hands on it is much easier psychologically than taking the money out of your checking account after it's already there.

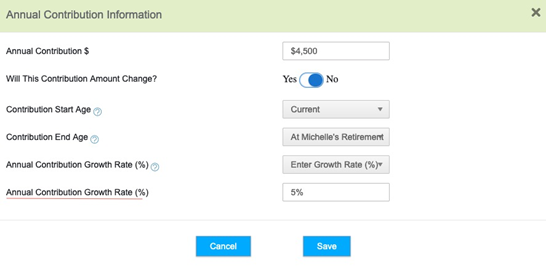

That's a great resolution in and of itself if you're not doing it already, but take it a step further: Automatically increase contributions to your 401(k) or other retirement savings account by a certain percentage each year. Many qualified plans offer this option. If yours doesn't, set an alert on your calendar to remind you to bump it up each December. Either way, you can use WealthTrace to incorporate the annual growth rate into your plan.

P

ay Down That Mortgage More Quickly

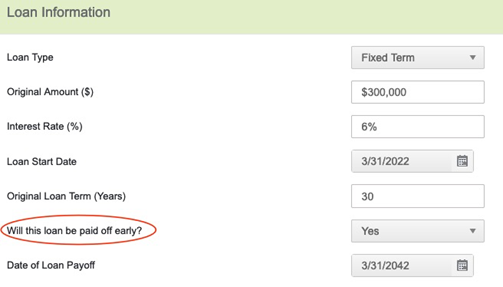

If you bought a house in 2022, you could be paying twice as much in interest as if you had bought the year before. When interest rates were more like 3%, it did not make much sense to make extra principal payments: That money would have been put to better use invested in stocks. But with 30-year mortgage rates in the 6%-7% range, the calculation has changed.

If you're paying your monthly mortgage via automatic drafts from your bank (and you should be), simply add an additional amount to those payments. Even $50 or $100 per month can really add up over time,

shorten the duration of the mortgage

, and reduce the amount of interest you end up paying. Virtually all mortgages allow this now without penalty, and many mortgage banks allow you to model what-ifs on their web sites, so you can see how much quicker you would pay off your mortgage by topping up your payment each month--and how much less in interest you would pay over the life of the loan. It's an easy resolution to make stick, too: Similar to automatic retirement account contributions, if it comes out of your bank account automatically, you won't miss the money. WealthTrace can help you model it.

Did We Budget For This?

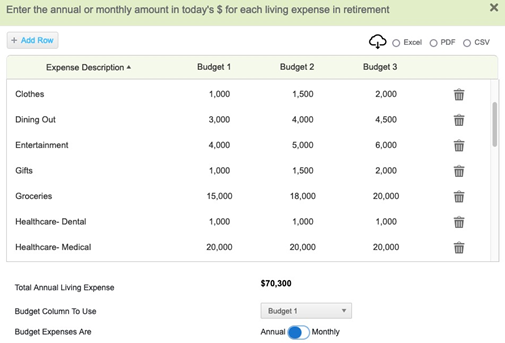

Nobody likes budgeting, but getting your spending needs in retirement dialed in as accurately as possible should be the first step in any retirement plan. WealthTrace allows you to build three different retirement spending budgets. You can toggle amongst them to gauge what different spending habits would do to your retirement plan.

Outside of WealthTrace, there are a number of things you can consider doing to keep your retirement plan on track and to

empower yourself financially

. Here are just a few.

Knock Down Your Grocery Bill

Most of us fall into certain habits when it comes to grocery shopping. We stop at stores that are on the route home from work. We get to know layouts of stores and know where most items are after a while, making us loathe to switch.

But what if the grocery store a few blocks out of the way is substantially cheaper? Try taking a receipt from a recent grocery trip to another store or two, and spend some time comparing prices. You might find that it would be worth your time to start going to a different place.

Making that resolution stick should be easy. After all, who doesn't like saving money?

Give Yourself a Cooling Off Period

Amazon and other sites make commerce frictionless. But that's not necessarily a good thing. Throwing a bit of sand in the gears might keep you from buying things you don't need or even really want.

Here's what you do. If you're considering a purchase, add the item to the 'saved for later' list. Then, set an alert on your calendar for a day or two later. If you still feel like you want the item, OK. But you might just as often wonder what you were thinking when you thought you needed the item in the first place.

Fix Your Credit

Don't let bills pile up and possibly go unpaid, thereby hurting your credit score. Autopay is your friend: Set up autopay on all of your utility bills and credit card bills. That way, you won't even have a chance to think about not paying them.

And are there credit cards around that you don't even use? Sometimes people open retail cards (like Macy's, or Gap) to get discounts and then forget they even have those cards. Close those accounts, especially newer ones. (Credit agencies like to see older accounts.) Why? Because they add to your available credit, which can make the credit agencies nervous.

Making this resolution stick is fairly simple: Check your credit rating each quarter. One or more of the banks or credit card companies you have accounts with might offer credit reports for free, or you can get them for free from annualcreditreport.com. If the number is on the rise, you're on the right track; if it's not moving or if it's dropping, it could be time time for more drastic measures.

Don't Get Too Comfortable

It is sometimes said that complacency is the enemy of progress. When it comes to retirement planning, we could not agree more. Being diligent about existing good habits and creating new ones takes work. The turning of the calendar from one year to the next is a good time to evaluate how you're doing, and if you need to make any modifications.

Do you know if you are prepared for retirement? Sign up for a free trial of WealthTrace to find out.